You use the Asset Depreciation Codes program to maintain depreciation codes that establish the actual percentage rates of depreciation applied to an asset.

Depreciation codes can be applied to all depreciation books (i.e. Book value, Tax value and all Alternate valuations) in the Assets program.

The Browse on Asset Depreciation Codes listview displays the asset depreciation codes currently defined.

- Asset Depreciation Code Maintenance

- Asset Depreciation Code Details

- Asset Depreciation Varying Annually

- Asset Depreciation Varying by Period

- Depreciation Type Examples

| Field | Value | Description |

|---|---|---|

| File | ||

| Save | Select this to save the information you entered. | |

| Save and Close | Select this to save the information you entered and to return to the previous screen. | |

| Close | Select this to return to the previous screen. | |

| Edit | ||

| New | Select this to add a new depreciation code. | |

| Delete | Select this to delete the currently displayed depreciation code. | |

| New | Select this to add a new depreciation code. | |

| Delete | Select this to delete the currently displayed depreciation code. | |

| Save | Select this to save the details you entered for the depreciation code. | |

| Asset depreciation code | You use this field to indicate the depreciation code you want to maintain. | |

| Play | Select this to use the Multimedia program to view multimedia objects attached to the depreciation code. | |

| Edit | Select this to use the Multimedia program to maintain multimedia objects for the depreciation code. |

| Field | Value | Description | ||||

|---|---|---|---|---|---|---|

| Depreciation code | This indicates the depreciation code you are currently maintaining. | |||||

| Depreciation code information | ||||||

| Description | This indicates the depreciation of the depreciation code. | |||||

| Depreciation type | This enables you to indicate the depreciation method for

the depreciation code. Refer to Depreciation Type Examples for calculation examples of the various depreciation types. |

|||||

| No depreciation | Select this if no depreciation applies for the depreciation code. When this code is defined against a depreciation book (Assets), no depreciation is applied for that book. | |||||

| Straight line |

Select this to base the depreciation percentage on the full cost price for each monthly calculation and each year. When you select this option, you can indicate how you want to apply the straight line method at the Varying depreciation option. |

|||||

| Reducing balance |

Select this to base the depreciation percentage on the full cost price for the first year and then on the reduced book value (i.e. the net book value) at the beginning of each successive year or period. When you select this option, you can indicate how you want to apply the reducing balance at the Varying depreciation option. Note that the asset is never fully depreciated when using this method. |

|||||

| Statistical EUL |

Select this to base the depreciation value on the estimated throughput life of the asset. The Estimated Useful Life (EUL) of the asset is based on a defined throughput. This throughput could for example be mileage for a vehicle, hours of use for a machine or number of copies for a photo copier. The depreciation for each period is calculated as: Asset cost / Throughput for life of asset x Unit throughput for the period. |

|||||

| Fixed EUL |

Select this to base the depreciation value on the fixed Estimated Usable Life (EUL) of the asset in periods. If you select this option, then you must define the number of periods that make up the EUL for the asset in the Number of periods EUL field below. The depreciation for each period is calculated as: Asset cost / Number of periods in useful life. |

|||||

| Sum of year digits | Select this to base depreciation on the estimated useful

life of the asset in years. Annual depreciation is calculated by multiplying the cost by a fraction which is reduced each year. The fraction used each year is the EUL year divided by the sum of the EUL years. For example, if EUL is 5 years then the sum of the EUL years is 5+4+3+2+1 = 15. The fractions used will be 5/15 in the first year, 4/15 in the second year, 3/15 in the third year, 2/15 in the fourth year and 1/15 in the fifth year. This depreciates the asset at a greater rate than the straight line method, but a slower rate than the declining balance methods. |

|||||

| Rem value over rem life | Select this to base depreciation on the estimated useful

life of the asset in periods, reviewed at every

year. Depreciation is calculated as per the straight line method, except that changes in the estimated useful life of the asset are taken into account. Depreciation is calculated as the remaining depreciable amount divided by the asset's remaining life at the beginning of the year. |

|||||

| Declining bal with switch | Select this to base depreciation on the estimated useful

life of the asset in years. Depreciation is calculated using the declining balance and the straight line method. The system compares the two values and uses the greater of the two as the depreciation value for the asset. Initially, the declining balance depreciation exceeds the straight line depreciation value. Eventually, however, the straight line depreciation value will exceed the declining balance depreciation value. A switch is then made to the straight-line calculation in the year in which the straight-line calculation exceeds the declining balance rate calculation. |

|||||

| Declining bal without switch | Select this to base depreciation on the estimated useful

life of the asset in years. Depreciation is calculated using the declining balance only. Annual depreciation is calculated as (Original Cost - Accumulated depreciation) * (1/number of EUL years * Declining rate). |

|||||

| Varying depreciation | This option is only applicable if you selected either the Straight line or Reducing balance depreciation type. | |||||

| No | Select this if you want the depreciation percentage to remain fixed for each year of the asset's life. | |||||

| Annually | Select this if you want to indicate the depreciation percentage to use for each year of the asset's life. | |||||

| By period | Select this if you want to indicate the depreciation

percentage to use for each period of the asset's life. The total of the percentage depreciation values for all the periods must add up to 100%. For example, if you want the asset to depreciate over 30 periods, you can enter different depreciation percentages for each period, but the total for the 30 periods must add up to 100%. This is only available for Straight line depreciation. |

|||||

| By period (fixed property) | Select this if you want to indicate the depreciation percentage to use for each period of the asset's life. The total of the percentage depreciation values in each same period for each year must add up to 100%. For example, if you want to depreciate the asset over 3 years, then the total depreciation percentages for Period 1 for Years 1-3 must add up to 100% and for Period 2 for Years 1-3 must add up to 100%, etc. This is only available for Straight line depreciation. |

|||||

| Varying depreciation anniversary | This only applies if the depreciation code uses varying

depreciation. This does not apply when Varying depreciation is By period. |

|||||

| Fiscal year end | Select this to set the varying depreciation rate by fiscal year (i.e. the depreciation rates indicated change at the start of each of your financial years). | |||||

| Start depreciation period | Select this to set the varying depreciation rate according to the depreciation start date entered (i.e. the rates defined change on the 'birthday' of the asset's start depreciation date). | |||||

| Annual depreciation % |

You use this field to indicate the annual depreciation percentage to use when not using varying depreciation (i.e. when Varying depreciation is No). This only applies to Straight line, Reducing balance, Declining bal with switch and Declining bal without switch depreciation types. |

|||||

| Number of periods EUL |

You use this field to indicate the default life of the asset in periods. This only applies to Fixed EUL and Rem value over rem life depreciation types. This can be changed against the depreciation book using the Assets program. Therefore, the value you enter here is not fixed for this depreciation code. It is merely the default value displayed when you select this depreciation code for a depreciation book (Assets). |

|||||

| Number of years EUL | You use this field to enter the default fixed number of

years over which the asset must be depreciated. This only applies for o Sum of year digits and Declining balance with orwithout switch depreciation types. This can be changed against the depreciation book using the Assets program. Therefore, the value you enter here is not fixed for this depreciation code. It is merely the default value displayed when you select this depreciation code for a depreciation book (Assets). |

|||||

| Statistical G/L code |

You use this field to enter the General Ledger code to which the statistical throughput value for the current period must be posted. This ledger code must have an Account type of Statistical (General Ledger Codes). The through-put value you enter in this statistical ledger code is used by the Asset Depreciation Calculation program when calculating the depreciation value for the asset for the current period. For this reason, you would create a unique statistical ledger code for each asset for which you want to calculate depreciation based on Statistical EUL. For example, if you are depreciating a vehicle based on throughput of kilometers, then for each period, you will enter the kilometres travelled for that period in the statistical ledger code you define here. This field is only enabled if you entered a Statistical EUL depreciation code type at the Depreciation type field. This can be changed against the depreciation book using the Assets program. Therefore, the value you enter here is not fixed for this depreciation code. It is merely the default value displayed when you select this depreciation code for a depreciation book (Assets). |

|||||

| Throughput EUL |

When you select the Statistical EUL depreciation method, you use this field to indicate the throughput Estimated Useful Life of the asset. This throughput could for example be the total mileage for a vehicle or the total number of copies in the life of a photocopier. This can be changed against the depreciation book using the Assets program. Therefore, the value you enter here is not fixed for this depreciation code. It is merely the default value displayed when you select this depreciation code for a depreciation book (Assets). |

|||||

| Apply half year rule | Select this to deduct 50% of the usual depreciation rate for any depreciable asset bought after the first period of the fiscal year. The usual rate will be used to calculate depreciation for the subsequent years. This field is enabled when your nationality is set to Canada. |

|||||

| Date convention | This option only applies when your Date

conventions are set to Depreciation

code (Basis and Date Conventions).

|

|||||

| None | This is equivalent to Full month - see below. | |||||

| Full month | If you select this option then book value depreciation is

calculated as follows:

|

|||||

| Mid-month | If you select this option then book value depreciation is

calculated as follows:

|

|||||

| Half-year | If you select this option then:

|

|||||

| Modified half-year | If you select this option then:

|

|||||

| Full year | If you select this option then:

This is set as the default for Tax value depreciation when you upgrade to SYSPRO 6.1 from a prior version of the software. |

|||||

This listview enables you to indicate the annual depreciation percentages by which an asset book must be depreciated.

This listview is enabled when you select the Varying depreciation > Annually option.

| Field | Value | Description | ||||

|---|---|---|---|---|---|---|

| Year | This indicates the year number. | |||||

| Percent | You use this field to indicate the percentage by which

the asset must depreciate in the corresponding year.

|

|||||

This listview enables you to maintain the depreciation percentages by which an asset book must be depreciated in each period of the corresponding year.

This listview is enabled when you select the Varying depreciation > By period or the Varying depreciation > By period (fixed property) option.

| Field | Value | Description | ||||

|---|---|---|---|---|---|---|

| Year | This indicates the year number. | |||||

| Period 1 - 13 | You use this field to indicate the percentage by which

the asset must depreciate in the corresponding period.

|

|||||

This section includes examples of how depreciation is calculated for the various depreciation types.

![[Note]](images/note.png)

|

|

|

All examples are based on a 12 accounting periods (Company Maintenance - General tab). |

|

Asset cost = 120 000

Depreciation percentage = 10%

Years 1-10:

Annual depreciation = 120 000 * 10% = 12 000

Monthly depreciation = 12 000 / 12 = 1 000

Asset cost = 120 000

Depreciation percentage year 1 = 20%

Depreciation percentage year 1 = 40%

Depreciation percentage year 1 = 30%

Depreciation percentage year 1 = 10%

Year 1:

Annual depreciation = 120 000 * 20% = 24 000

Monthly depreciation = 24 000 / 12 = 2 000

Year 2:

Annual depreciation = 120 000 * 40% = 48 000

Monthly depreciation = 48 000 / 12 = 4 000

Year 3:

Annual depreciation = 120 000 * 30% = 36 000

Monthly depreciation = 36 000 / 12 = 3 000

Year 4:

Annual depreciation = 120 000 * 10% = 12 000

Monthly depreciation = 12 000 / 12 = 1 000

Asset cost = 120 000

Depreciation percentage per period per annum:

| Periods | Year 1 | Year2 |

|---|---|---|

| 1 | 1% | 1% |

| 2 | 2% | 2% |

| 3 | 2% | 3% |

| 4 | 2% | 4% |

| 5 | 2% | 5% |

| 6 | 2% | 6% |

| 7 | 2% | 7% |

| 8 | 2% | 8% |

| 9 | 2% | 9% |

| 10 | 2% | 10% |

| 11 | 2% | 11% |

| 12 | 1% | 12% |

Year 1:

Monthly depreciation:

This is calculated as Asset cost * depreciation percentage for each period.

I.e. Period 1: 120 000 * 1% = 1 200, Period 2: 120 000 * 2% = 2 400, etc.

The resulting monthly depreciation is as follows:

| Periods | Year 1 |

|---|---|

| 1 | 1 200 |

| 2 | 2 400 |

| 3 | 2 400 |

| 4 | 2 400 |

| 5 | 2 400 |

| 6 | 2 400 |

| 7 | 2 400 |

| 8 | 2 400 |

| 9 | 2 400 |

| 10 | 2 400 |

| 11 | 2 400 |

| 12 | 1 200 |

Annual depreciation:

This is the sum of all monthly depreciation values for year 1 = 26 400

Year 2:

This is calculated as Asset cost * depreciation percentage for each period.

I.e. Period 1: 120 000 * 1% = 1 200, Period 2: 120 000 * 2% - 2 400, Period 3: 120 000 * 3% = 3 600, Period 4: 120 000 * 4% = 4 800, etc.

The resulting monthly depreciation is as follows:

| Periods | Year 2 |

|---|---|

| 1 | 1 200 |

| 2 | 2 400 |

| 3 | 3 600 |

| 4 | 4 800 |

| 5 | 6 000 |

| 6 | 7 200 |

| 7 | 8 400 |

| 8 | 9 600 |

| 9 | 10 800 |

| 10 | 12 000 |

| 11 | 13 200 |

| 12 | 14 400 |

Annual depreciation:

This is the sum of all monthly depreciation values for year 2 = 93 600

Asset cost = 120 000

Depreciation percentage = 40%

Year 1:

Annual depreciation: 120 000 * 40% = 48 000

Monthly depreciation: 48 000 / 12 = 4 000

Year 2:

Annual depreciation: (120 000 - 48 000) * 40% = 28 800

Monthly depreciation: 28 800 / 12 = 2 400

Year 3:

Annual depreciation: (120 000 - 48 000 - 28 800) * 40% = 17 280

Monthly depreciation: 17 280 / 12 = 1 440

Year 4:

Annual depreciation: (120 000 - 48 000 - 28 800 - 17 280) * 40% = 10 368

Monthly depreciation: 10 368 / 12 = 864

Year 5:

Annual depreciation: (120 000 - 48 000 - 28 800 - 17 280 - 10368) * 40% = 6 221

Monthly depreciation: 6 221 / 12 = 518.42

The asset continues to depreciate each year at 40% of its net book value at the start of that year.

Asset cost = 120 000

Depreciation percentage year 1 = 50%

Depreciation percentage year 2 = 60%

Depreciation percentage year 3 = 70%

Depreciation percentage year 4 = 80%

Depreciation percentage year 5 and subsequent years = 90%

Year 1:

Annual depreciation: 120 000 * 50% = 60 000

Monthly depreciation: 60 000 / 12 = 5 000

Year 2:

Annual depreciation: (120 000 - 60 000) * 60% = 36 000

Monthly depreciation: 36 000 / 12 = 3 000

Year 3:

Annual depreciation: (120 000 - 60 000 - 36 000) * 70% = 16 800

Monthly depreciation: 16 800 / 12 = 1 400

Year 4:

Annual depreciation: (120 000 - 60 000 - 36 000 - 16 800) * 80% = 5 760

Monthly depreciation: 5 760 / 12 = 480

Year 5:

Annual depreciation: (120 000 - 60 000 - 36 000 - 16 800 - 5 760) * 90% = 1 296

Monthly depreciation: 1 296 / 12 = 108

The asset continues to depreciate each year at 90% of its net book value at the start of that year.

Asset cost = 120 000

Number of periods EUL = 60

Monthly depreciation: 120 000 / 60 = 2 000

Annual depreciation: 2000 * 12 = 24 000

Asset cost = 120 000

Throughput EUL = 100 000 units

Statistical G/L code is 01-604090

The movements for Statistical G/L code 01-604090 are as follows:

| Periods | Year 1 | Year 2 |

|---|---|---|

| 1 | 1000 | 0 |

| 2 | 2000 | 0 |

| 3 | 3000 | 0 |

| 4 | 4000 | 0 |

| 5 | 5000 | 0 |

| 6 | 6000 | 0 |

| 7 | 7000 | 0 |

| 8 | 8000 | 0 |

| 9 | 9000 | 0 |

| 10 | 10000 | 0 |

| 11 | 11000 | 0 |

| 12 | 12000 | 22000 |

Year 1:

Monthly depreciation:

-

Period 1: 1000 / 100 000 * 120 000 = 1 200

-

Period 2: 2000 / 100 000 * 120 000 = 2 400

-

Period 3: 3000 / 100 000 * 120 000 = 3 600

-

Period 4: 4000 / 100 000 * 120 000 = 4 800

-

Period 5: 5000 / 100 000 * 120 000 = 6 000

-

Period 6: 6000 / 100 000 * 120 000 = 7 200

-

Period 7: 7000 / 100 000 * 120 000 = 8 400

-

Period 8: 8000 / 100 000 * 120 000 = 9 600

-

Period 9: 9000 / 100 000 * 120 000 = 10 800

-

Period 10: 10000 / 100 000 * 120 000 = 12 000

-

Period 11: 11000 / 100 000 * 120 000 = 13 200

-

Period 12: 12000 / 100 000 * 120 000 = 14 400

Annual depreciation: 93 600

Year 2:

Monthly depreciation:

-

Period 1 - 11: 0 / 100 000 * 120 000 = 0

-

Period 12: 22 000 / 100 000 * 120 000 = 26 400

Annual depreciation: 26 400

Asset cost = 120 000

Number of years EUL = 5

The sum of year digits is calculated as (1+2+3+4+5) = 15

Year 1:

Annual depreciation: 1 / (1+2+3+4+5) * 120 000 = 8 000

Monthly depreciation: 8 000 / 12 = 666.67

Year 2:

Annual depreciation: 2 / (1+2+3+4+5) * 120 000 = 16 000

Monthly depreciation: 16 000 / 12 = 1 333.33

Year 3:

Annual depreciation: 3 / (1+2+3+4+5) * 120 000 = 24 000

Monthly depreciation: 24 000 / 12 = 2 000.00

Year 4:

Annual depreciation: 4 / (1+2+3+4+5) * 120 000 = 32 000

Monthly depreciation: 32 000 / 12 = 2 666.67

Year 5:

Annual depreciation: 5 / (1+2+3+4+5) * 120 000 = 40 000

Monthly depreciation: 40 000 / 12 = 3 333.33

Asset cost = 120 000

At Year 1, the Number of periods EUL is 60 periods

At Year 4, the Remaining useful life is set to 36 periods (i.e. the Estimated useful life is now 72 periods and not 60 periods as it was in Year 1).

Monthly depreciation is calculated as: (cost on file - accumulated depreciation) / remaining life of asset in periods

Year 1

EUL = 60 periods, Cost = 120 000

Monthly depreciation: (120 000 - 0) / 60 = 2 000

Annual depreciation: 2000 * 12 = 24 000

Year 2

EUL = 48 periods, Depreciable Cost = 120 000 - 24 000 = 96 000

Monthly depreciation: (120 000 - 24 000) / 48 = 2 000

Annual depreciation: 2 000 * 12 = 24 000

Year 3

EUL = 36 periods, Depreciable Cost = 96 000 - 24 000 = 72 000

Monthly depreciation: (120 000 - 48 000) / 36 = 2 000

Annual depreciation: 2 000 * 12 = 24 000

Year 4:

At the beginning if Year 4, the EUL is changed from 24 periods to 36 periods. The total EUL of the asset is therefore increased to 72 periods (from the original 60 periods).

EUL = 36 periods, Depreciable Cost = 72 000 - 24 000 = 48 000

Monthly depreciation: 120 000 - (3 * 24 000) / (72 - (12 * 3) = 48 000 / 36 = 1 333.33

Annual depreciation: 12 * 1 333.33 = 15 999.96 = 16 000 rounded up

Year 5:

EUL = 24 periods, Depreciable Cost = 48 000 - 16 000 = 32 000

Monthly depreciation: 32 000 / 24 = 1 333.33

Annual depreciation: 12 * 1 333.33 = 15 999.96 = 16 000 rounded up

Year 6:

EUL = 12 periods, Depreciable Cost = 32 000 - 16 000 = 16 000

Monthly depreciation: 16 000 / 12 = 1 333.33

Annual depreciation: 12 * 1 333.33 = 16 000 (rounded up)

Depreciation is calculated using the declining balance and the straight line method. The greater depreciation value of the two methods is used.

Asset cost = 120 000

EUL = 5 years

Declining rate = 200%

Straight line rate = 20% pa (the asset's EUL is 5 years)

Year 1:

Declining balance calculation: 120 000 * (1/5 * 200%) = 48 000

Straight line calculation: 120 000 / 5 = 24 000

Annual depreciation: 48 000 (per declining balance calculation)

Monthly depreciation: 48 000 / 12 = 4 000

Year 2:

Declining balance calculation: (120 000 - 48 000) * (1/5 * 200%) = 28 800

Straight line calculation: 120 000 / 5 = 24 000

Annual depreciation: 28 800 (per declining balance calculation)

Monthly depreciation: 28 800 / 12 = 2 400

Year 3:

Declining balance calculation: (120 000 - 48 000 - 28 800) * (1/5 * 200%) = 17 280

Straight line calculation: 120 000 / 5 = 24 000

Annual depreciation: 24 000 (per straight line calculation as this is now greater than the declining balance calculation - i.e. 24 000 > 17 280)

Monthly depreciation: 24 000 / 12 = 2 000

Year 4:

Remaining book value is now 19 200 (i.e. Original cost minus all Accumulated depreciation to date)

Straight line depreciation is in use.

Annual depreciation = 19 200

Monthly depreciation: 19 200 / 12 = 1 600

Depreciation is calculated using the declining balance but no switch is made to the straight line method.

Asset cost = 120 000

EUL = 5 years

Declining rate = 200%

Year 1:

Declining balance calculation: 120 000 * (1/5 * 200%) = 48 000

Annual depreciation: 48 000

Monthly depreciation: 48 000 / 12 = 4 000

Year 2:

Declining balance calculation: (120 000 - 48 000) * (1/5 * 200%) = 28 800

Annual depreciation: 28 800

Monthly depreciation: 28 800 / 12 = 2 400

Year 3:

Declining balance calculation: (120 000 - 48 000 - 28 800) * (1/5 * 200%) = 17 280

Annual depreciation: 17 280

Monthly depreciation: 17 180 / 12 = 1 440

Year 4:

Declining balance calculation: (120 000 - 48 000 - 28 800 - 17 280) * (1/5 * 200%) = 10 368

Annual depreciation: 10 368

Monthly depreciation: 10 368 / 12 = 864

Year 5:

Declining balance calculation: (120 000 - 48 000 - 28 800 - 17 280 - 10 368) * (1/5 * 200%) = 6 220.80

Annual depreciation: 6 220.80

Monthly depreciation: 6 220.80 / 12 = 518.40

The asset continues to depreciate each year at (1/5 * 200%) of its net book value at the start of that year.

Asset cost = 1000

Half year rule calculation: 1000 * 20% / 12 / 2 = 8.34

Year 1:

Monthly depreciation from Period 2 onwards - 8.34

Year 2:

Monthly depreciation defaults to 20% - 16.67

| Periods | Year 1 | Year 2 |

|---|---|---|

| 1 | 0 | 16.67 |

| 2 | 8.34 | 16.67 |

| 3 | 8.34 | 16.67 |

| 4 | 8.34 | 16.67 |

| 5 | 8.34 | 16.67 |

| 6 | 8.34 | 16.67 |

| 7 | 8.34 | 0 |

| 8 | 8.34 | 0 |

| 9 | 8.34 | 0 |

| 10 | 8.34 | 0 |

| 11 | 8.34 | 0 |

| 12 | 8.34 | 0 |

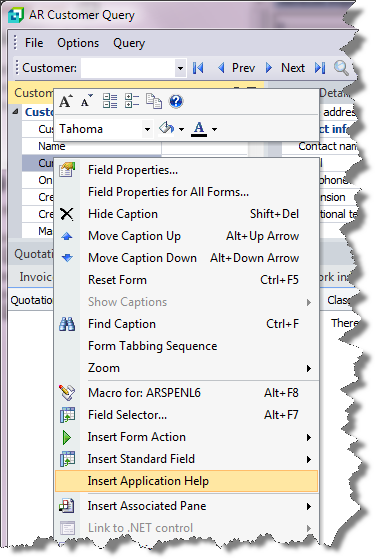

Inserting Application Help

You would typically follow this procedure to display help for the current program in a customized pane that can be pinned to the program window.

Information includes step-by-step instructions for the various functions available within the program, including a brief overview of what the program does, what setup options are required and how to personalize the program.

-

Open the program for which you want to insert application help into a customized pane.

This functionality is only available for a program that has panes.

-

Right-click any form field.

You can also click the triangle menu icon that appears in the title area of a pane.

-

Select Insert Application Help from the context-sensitive menu.

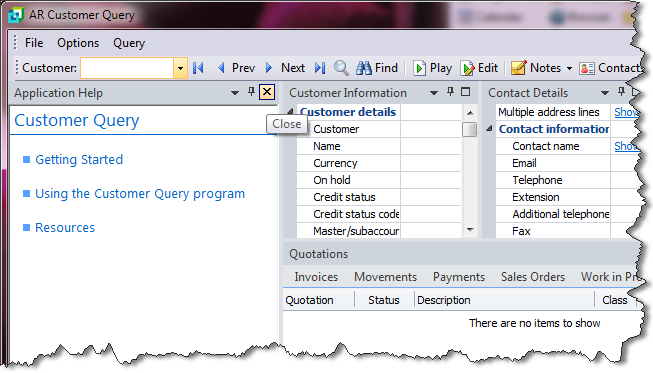

The application help appears in a pane within your program. You can reposition the pane using the docking stickers or pin it to the program window.

Removing the Application Help pane

If you no longer want to display application help in a pane for your current program, you can simply remove it.

-

Select the Close icon in the right-hand corner of the application help pane.

-

Confirm that you want to delete the pane.