You use this program to process revaluations for the book value of your assets.

You can change the cost, residual value, depreciation code, depreciation start date and varying anniversary year where applicable. In addition, you can suspend depreciation for the asset.

Assets in SYSPRO are revalued in accordance with International Accounting Standards - IAS16. A change in the estimated useful life of an asset is treated as a change in accounting estimate. Depreciation is recalculated from day 1 of ownership of the asset and the net change profit/loss is realised in the current period.

![[Note]](images/note.png)

|

|

|

|

You can use the Entries function of the Asset Query program to view the revaluation entries made against an asset. In addition, you can generate the Asset List of Revaluations report to print details of revalued assets.

| Field | Description | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Post |

Select this to process the revaluation information you entered against the asset. If your Assets Register module is integrated to the General Ledger (General Ledger Integration), then entries for Book value changes are created in the General Ledger distribution file in the current period. This is in accordance with International Accounting Standards - IAS8. All depreciation to date is reversed and the depreciation book information is changed according to your entries. The Revaluation date is used as the new Start date for depreciation. The program uses the Revaluation date to check if depreciation adjustments are required. If so, then these adjustments are only created if the Basis for Depreciation is Period or Year. No depreciation adjustment entries are created if the Basis for Depreciation is Life of asset (Asset Register Setup - Basis & Date Conventions tab). Where applicable, the following entries are created and can be viewed in the Asset Query program:

If you increased the Book value cost of the asset, then the following entries are created:

If you decreased the cost of the asset, then the following entries are created:

|

||||||||||||||||||

| Asset | You use this field to indicate the asset for which you

want to process the revaluation. The asset must have been acquired (Asset Acquisition) and cannot have been fully disposed (Asset Disposal). |

| Field | Description | ||||

|---|---|---|---|---|---|

| Asset revaluation information | |||||

| Asset code | This indicates the code of the asset you are revaluing. | ||||

| Description | This indicates the description of the asset you are revaluing. | ||||

| Revaluation date |

This defaults to the current period end date of the Assets module, but can be changed. This date cannot be:

This can be changed, providing it is within the current period. The date you enter here is written to the Start date field against the asset (Assets - Book value tab) and is used as the new start date for depreciating the asset.

|

||||

| Comment | This field enables you to enter free format comments relating to the revaluation of the asset. | ||||

| Reason | You use this to indicate the reason for the

revaluation. A reason code must be entered in this field. Revaluation reason codes are maintained using the Asset Reasons for Revaluation program. |

||||

| New asset costs |

|

||||

| Book value | You use this field to enter the revalued Book value cost of the asset. | ||||

| Tax | You use this field to enter the revalued Tax value cost of the asset. | ||||

| Alt valuation 1-10 | You use these fields to enter the revalued Alternate valuation cost of the asset. | ||||

You use this editable listview to enter the changes to the various depreciation books.

![[Note]](images/note.png)

|

|

|

Only depreciation books with a Basis of depreciation of Period (Asset Register Setup - Basis & Date Conventions tab) can be changed. The columns available to edit depend on the Depreciation code entered. |

|

| Field | Description | ||||

|---|---|---|---|---|---|

| Book | This displays the depreciation books currently defined against the asset. | ||||

| Depreciation code |

This defaults to the depreciation code for the asset book (Asset Acquisition), but can be changed. The depreciation code you enter here is immediately saved against the asset. This depreciation code is used to calculate the depreciation for the asset from this point onwards.

|

||||

| Residual value | This enables you to enter or change the residual value for the asset depreciation book. | ||||

| Throughput EUL |

You use this field to enter the estimated throughput value for the entire life of the asset. This is used for calculating the Statistical EUL depreciation amount. |

||||

| Statistical GL code | You use this field to enter the General Ledger code to which you will process the statistical throughput value for the current period. This ledger code must have an Account type of Statistical (General Ledger Codes). | ||||

| Number of periods EUL |

You use this field to enter the fixed number of periods over which the asset must be depreciated. |

||||

| Number of years EUL |

This indicates the fixed number of years over which the asset must be depreciated. |

||||

| Remaining periods EUL | This is calculated by the system. | ||||

| Varying anniversary | This option is only enabled if you entered a

Depreciation code with varying

depreciation. Select S to set the varying depreciation rate according to the depreciation start date. Select F to set the varying depreciation rate by fiscal year. |

||||

| Suspend | Select this to suspend (stop) depreciation for the asset book. | ||||

| Cost/cash price | This indicates the current cost value of the asset. This is changed by acquisitions processed (see Asset Acquisition). | ||||

| Depreciation this year | This indicates the amount depreciation for the current year to date. | ||||

| Accumulated depreciation | This indicates the total depreciation processed against the asset to date. | ||||

| Current value | This indicates the current value of the asset. This calculated as is Cost/cash price less Accumulated Depreciation. | ||||

This example of an asset revaluation uses the following values:

- Asset cost = 200 000

- Depreciation = 20% per annum - straight line no varying depreciation

- Accumulated depreciation opening balance is 120 000 (i.e. the asset is 3 years old at the beginning of the financial year)

- Depreciation for the current year is 40 000

The asset is revalued at the end of the current financial year and is increased by 20 000. The revalued cost of the asset is therefore now 220 000.

The following transactions are processed by the system:

| Dr | Asset Control | 20 000 |

| Cr | Revaluation Reserve | 20 000 |

| Dr | Accumulated Depreciation | 160 000 (120 000 + 40 000) |

| Cr | Revaluation Reserve | 160 000 |

| Dr | Depreciation Expense | 3 666.67 (i.e. 220 000 x 20% /12) |

| Cr | Accumulated Depreciation | 3 666.67 |

The asset is carried at a revalued amount, being its fair value at the date of revaluation less subsequent depreciation, provided that fair value can be measured reliably. The revaluation of an asset changes its value at the current point in time to whatever the current measured value of the asset is. This is in accordance with IAS16.

When you process the year end, the system creates the following entries:

| Dr | Retained Earnings | 43 666.67 (40 000 + 3666.67) |

| Cr | Depreciation Expense | 43 666.67 |

Electronic Signatures provide security access, transaction logging and event triggering. This enables you to increase control over your system changes.

Access to the following eSignature transactions within this program can be restricted at Operator, Group, Role or Company level. You configure this using the Electronic Signatures program.

| eSignature Transaction | Description |

|---|---|

| Asset Revalued |

Controls access to the Asset Revaluation program. |

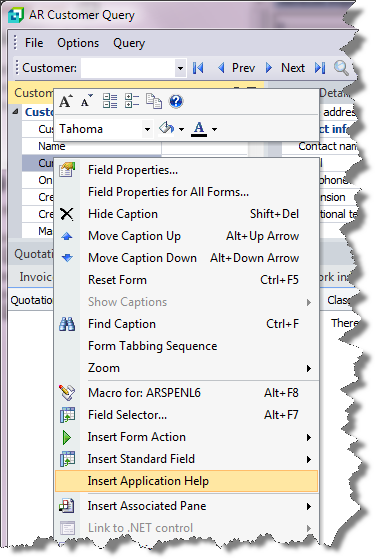

Inserting Application Help

You would typically follow this procedure to display help for the current program in a customized pane that can be pinned to the program window.

Information includes step-by-step instructions for the various functions available within the program, including a brief overview of what the program does, what setup options are required and how to personalize the program.

-

Open the program for which you want to insert application help into a customized pane.

This functionality is only available for a program that has panes.

-

Right-click any form field.

You can also click the triangle menu icon that appears in the title area of a pane.

-

Select Insert Application Help from the context-sensitive menu.

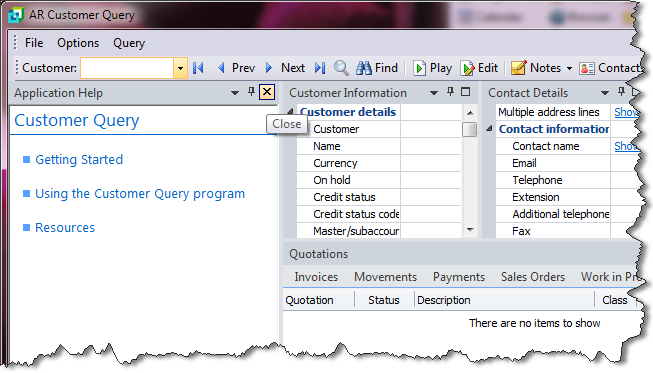

The application help appears in a pane within your program. You can reposition the pane using the docking stickers or pin it to the program window.

Removing the Application Help pane

If you no longer want to display application help in a pane for your current program, you can simply remove it.

-

Select the Close icon in the right-hand corner of the application help pane.

-

Confirm that you want to delete the pane.