You use this program to add and maintain static (descriptive) information for your assets. Once you have defined this information, you use the Asset Acquisition program to enter the financial information for each asset.

Amendment journals are created if required (Asset Register Setup - General tab).

The Assets program does not generate any General Ledger entries.

If you used the Asset Templates program to define templates, then the values for the fields you defined are displayed by default, but can be changed.

- Toolbar and menu

- Asset Details

- Book Value Details

- Tax Details

- Purchasing Details

- Alt Valuations

- Additional Fields

- Notes and warnings

| Field | Value | Description | ||||

|---|---|---|---|---|---|---|

| Functions | These functions are only enabled after you enter and accept an asset code in the Asset field. | |||||

| Acquisition | Select this to use the Asset Acquisition program to enter the financial information for the asset. | |||||

| Disposal | Select this to use the Asset Disposal program to dispose of the asset. | |||||

| Revaluation | Select this to use the Asset Revaluation program to revalue the asset. | |||||

| Transfer | Select this to use the Asset Transfer program to transfer assets to another asset branch, cost centers or group. | |||||

| Depreciation Adjustment | Select this to use the Asset Depreciation Adjustment program to adjust the accumulated depreciation for any depreciation book defined against an asset. | |||||

| Depreciation Adjustment EUL | Select this to use the Asset Depreciation Adjustment Recalc program to adjust the accumulated depreciation for an asset whose depreciation method is based on Statistical EUL or Fixed EUL and where the EUL (Estimated Useful Life) criteria have changed. | |||||

| Transactions | Select this to use the Asset Transactions program to post transactions of costs incurred against the asset. | |||||

| New | Select this to add a new asset. You will be unable to add an asset with the same asset code as a capex asset that exists in suspense (Assets in Suspense). |

|||||

| Delete | Select this to delete the asset currently displayed.

|

|||||

| Save | Select this to save the details you entered or

changed.

|

|||||

| Asset | Enter the code of the asset you want to add or

maintain. This field is only enabled if your Asset numbering method is set to Manual (Asset Register Setup - Numbering tab). When your asset numbering is not set to Manual you can, however, use the Browse icon to select an asset to maintain. When asset numbering is set to Automatic, the system allocates the next asset code number according to the current entry in the Next asset number field of the Asset Register Setup program when you add a new asset. |

|||||

| Play | Select this to use the Multimedia program to view multimedia objects defined against the asset. | |||||

| Edit | Select this to use the Multimedia program to define multimedia objects against the asset. | |||||

| Field | Value | Description | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Asset information | ||||||||||

| Asset |

This indicates the code of the asset you are currently adding or maintaining. |

|||||||||

| Description | This indicates the description of the asset. | |||||||||

| Asset branch |

This indicates the branch to which the asset belongs and must be defined against each asset. This field is used to accumulate month-to-date and year-to-date expenses. It is also the default branch used for the asset in Asset Transactions and Asset Labor Time Sheet Posting programs, but can be overridden at the time of entry. Additionally, the Assets Register can be integrated to the General Ledger at branch level (General Ledger Integration - Assets tab - Maintain Assets Interfaces function). Asset branch codes are maintained using the Asset Branches program. |

|||||||||

| Asset cost center |

This indicates the cost center to which the asset is allocated and must be defined against each asset. Asset transactions may be integrated to the General Ledger by Cost Center (General Ledger Integration). Cost centers can be defined within Branches for integration purposes. Cost centers are maintained using the Asset Cost Centers program. |

|||||||||

| Asset group |

Enter a valid group code to be assigned to the asset. A valid group code (Asset Group Maintenance) must be defined against each asset. The group can be used for ledger integration purposes to establish the correct ledger codes for the various depreciation codes (General Ledger Integration). The asset group can be changed when:

Asset groups are also used as a subtotaling criterion when printing reports. Items that you wish to attach using the Asset Master Sub-assets program must belong to the same group. |

|||||||||

| Asset location |

This enables you to specify the location of the asset, which is used as a subtotalling criterion when printing reports. Items that you want to attach using the Asset Master Sub-assets program must be in the same location. Asset locations are maintained using the Asset Locations program. |

|||||||||

| Asset type |

You use the asset type to classify the asset. An asset type must be defined against each asset. It is can be used as a selection criterion when printing asset details using the Asset Full Enquiry Listing program. Asset types are maintained using the Asset Types program. |

|||||||||

| Depreciate by asset |

Select this if you want to define the General Ledger code that must be used for the expense side of depreciation transactions for this asset. This option is only available if you selected the Assets setup option Book value depreciation posted to G/L code by Integration setup (Asset Register Setup). If you select this option, then you must enter a valid General Ledger code in the Ledger code field. The depreciation code defined against the Depreciation field on the Assets tab of the General Ledger Integration program is then ignored for this asset. |

|||||||||

| Ledger code |

You use this field to indicate the ledger account to which the expense side of depreciation entries must be distributed for General Ledger integration purposes. The ledger account entered here cannot be defined as either a Statistical or a Template type of account. The accumulated depreciation entries for all assets are posted to the ledger according to the integration method defined in the General Ledger Integration program. If you selected the setup option Book value depreciation posted to G/L code by Individual asset (Asset Register Setup), then this field is automatically enabled and you must enter a valid general ledger code. If you selected the setup option Book value depreciation posted to G/L code by Integration setup (Asset Register Setup), then you can enable this field by selecting the option Depreciate by asset. You must then enter a valid General Ledger code for the depreciation transactions for this asset. In this case, the code you enter here is used for depreciation transactions for this asset and the code defined on the Assets tab of the General Ledger Integration program is ignored. Ledger codes are maintained using the General Ledger Codes program. |

|||||||||

| Purchase date |

You use this field to enter the purchase date of the asset.

If your number of accounting periods per year is set to 12 (Company Maintenance - General tab), then you must enter this purchase date. However, you need not specify the Purchase period and Purchase year as the system calculates these based on the purchase date. If your number of accounting periods per year is set to 13 (Company Maintenance - General tab), then you must enter this purchase date as well as the Purchase period and Purchase year as the system cannot calculate these for 13 accounting periods. In this case, the purchase date is merely a memo date and the purchase period and year are used for calculations.

|

|||||||||

| Purchase period | You use this field to indicate the financial period in which the asset was purchased. When your number of accounting periods per year is set to 12 (Company Maintenance - General tab), you cannot enter this as the system calculates it from the Purchase date entered. However, when your number of accounting periods per year is set to 13, you must enter the purchase period as the system cannot calculate it based on the Purchase date. The Purchase period together with the Purchase year govern most date manipulations, so you need to ensure that these are correct. The current assets period is displayed on the Current month tab of theAsset Register Setup program. |

|||||||||

| Purchase year | You use this field to indicate the financial year in which the asset was purchased. When your number of accounting periods per year is set to 12 (Company Maintenance - General tab), you cannot enter this as the system calculates it from the Purchase date entered. However, when your number of accounting periods per year is set to 13, you must enter the purchase year as the system cannot calculate it based on the Purchase date. The Purchase year together with the Purchase period govern most date manipulations, so you need to ensure that these are correct. The current assets year is displayed on the Current month tab of theAsset Register Setup program. |

|||||||||

| Deposit paid | This indicates the amount of the deposit paid for the asset, if any. | |||||||||

| Total tax paid |

The value you enter here is purely for notational purposes. It indicates the amount of tax (if any) paid on the asset. |

|||||||||

| Asset status |

You use this to indicate the status of the asset. It could be used to indicate the whereabouts or the condition of an asset at a particular time. For example, if the asset is being refurbished, is in storage or temporarily out of commission. The Asset status code is used for information purposes only and does not have to be defined against an asset. Asset status codes are maintained using the Asset Statuses program. |

|||||||||

|

Capex item |

This indicates the capital expenditure reference number attached to the capex item, if the requisition line for the asset was generated using the Assets in Suspense program. You will be unable to change this number if the Capex line number is greater than zero as this indicates that the asset was created using the Assets in Suspense program. You can browse on capex items using the Browse on Asset Capex Items program. |

|||||||||

| Capex line | This indicates the line number allocated to a capex requisition line generated by the Asset Capex Items program. | |||||||||

| Resp user |

This indicates the person responsible for the asset. For example, for a vehicle it could be the name of the driver. This field is not mandatory and is used for information purposes only. |

|||||||||

| Asset owner |

You can use this field to indicate the person responsible for the safe-keeping and/or the maintenance of an asset, or the person responsible for authorizing any costs spent on the asset. For example the Fleet Manager could be the responsible owner for all vehicles in the organization. Although this field is used for information purposes only, an owner must be defined against each asset. Owners are maintained using the Asset Owners program. |

|||||||||

| Cycle |

This field indicates the number of times per annum that the asset must be counted. This is only an information field and can be used to perform asset count selections using the Asset Count Extract-Cancel program. |

|||||||||

| Original cost/value |

This displays the cost value entered when the asset was acquired (see Asset Acquisition). |

|||||||||

| Original quantity | This displays the asset quantity entered when the asset was acquired (see Asset Acquisition). | |||||||||

| Original start depr date |

This displays the original start depreciation date entered when the asset was acquired (see Asset Acquisition). |

|||||||||

| Original start depr period no | This displays the original start depreciation period entered when the asset was acquired (see Asset Acquisition). | |||||||||

| Original start depr year no | This displays the original start depreciation year entered when the asset was acquired (see Asset Acquisition). | |||||||||

| User defined field 1 -4 | These fields can be used to enter any information of your choice for the asset. User defined field 4 is a date field. | |||||||||

| Memo date | You can use this field to enter date information of your choice. | |||||||||

| Alternate valuation flags | ||||||||||

| Alternate valuation 1 - 10 | This enables you to indicate which alternate valuation

books you want to retain against the asset. Up to 10 alternate

valuation books can be selected. The wording displayed for these books defaults to Alt valuation 1, Alt valuation 2,etc., but is replaced by whatever wording you assigned to these user-defined fields (Asset Register Setup - User defined tab). |

|||||||||

![[Note]](images/note.png)

|

|

|

The information entered in this pane applies only to the asset's Book value depreciation book. |

|

| Field | Value | Description | ||||

|---|---|---|---|---|---|---|

| Depreciation book value information | The following options enable you to specify Book value depreciation information. | |||||

| Depreciation code |

You use this field to enter a valid depreciation code. Depreciation for the asset is calculated based on the depreciation type defined against the depreciation code (see Asset Depreciation Codes). If you have already specified a Group code for this asset, then the Book value depreciation code assigned to the group is displayed here, but can be changed. |

|||||

| Suspend depreciation |

Select this if you want the system to stop calculating Book value depreciation for this asset.

|

|||||

| Residual value |

This indicates the residual value (if any) for Book value purposes. By default, book value depreciation is calculated on the Cost/value of the asset, unless a residual value is defined and the option: Exclude residual from depreciation for - Book value (Asset Register Setup - General tab) is selected. In this case, the residual value is deducted from the cost of the asset before calculating book value depreciation. An asset is depreciated until the residual value entered here is reached (i.e. the accumulated value equals the difference between the cost value and the residual value. For example: You have and asset with a cost of 100 000 and a residual value of 10 000. Assume that the asset is depreciated at 20% per annum straight line with no varying depreciation.

The asset is always depreciated only until the book value residual amount entered here is reached (i.e. the accumulated depreciation equals the difference between the cost/value and the residual value).

If no residual value is entered, then the asset is depreciated until its current asset value is zero, assuming no minimum book value for the asset group is defined (Asset Group Maintenance), |

|||||

| Start depreciation date |

You use this field to indicate the date on which Book value depreciation of the asset must start.

|

|||||

| Start depreciation period no |

You use this field to indicate the financial period from which Book value depreciation for the asset must be calculated. This applies only when your number of accounting periods per year is set to 13 (Company Maintenance - General tab). You must enter the start depreciation period as the system cannot calculate it based on the Start depreciation date. The Start depreciation period no together with the Start depreciation no year govern most date manipulations, so you need to ensure that these are correct. When your number of accounting periods per year is set to 12 (Company Maintenance - General tab), you cannot enter this as the system calculates it from the Start depreciation date entered. |

|||||

| Start depreciation year no |

You use this field to indicate the financial year from which Book value depreciation for the asset must be calculated. This applies only when your number of accounting periods per year is set to 13 (Company Maintenance - General tab). You must enter the start depreciation year number as the system cannot calculate it based on the Start depreciation date. The Start depreciation period no together with the Start depreciation no year govern most date manipulations, so you need to ensure that these are correct. When your number of accounting periods per year is set to 12 (Company Maintenance - General tab), you cannot enter this as the system calculates it from the Start depreciation date entered. |

|||||

| . | Throughput EUL |

You use this field to enter the estimated throughput value for the entire life of the asset. This is used for calculating the Statistical EUL depreciation amount. For example, if you are depreciating a vehicle based on through-put of kilometers and the vehicle's estimated total life in kilometres is 300 000, then you enter 300 000 in this field. This field is only enabled if you entered a Statistical EUL depreciation code type at the Depreciation code field. EUL is an acronym for Estimated Usable Life. |

||||

| Statistical GL code |

You use this field to enter the General Ledger code to which you will process the statistical throughput value for the current period. This ledger code must have an Account type of Statistical (General Ledger Codes). The through-put value you enter in this statistical ledger code is used by the Asset Depreciation Calculation program when calculating the depreciation value for the asset for the current period. For this reason, you would create a unique statistical ledger code for each asset for which you want to calculate depreciation based on Statistical EUL. For example, if you are depreciating a vehicle based on throughput of kilometers, then for each period, you will enter the kilometres travelled for that period in the statistical ledger code you define here. This field is only enabled if you entered a Statistical EUL depreciation code type at the Depreciation code field. |

|||||

| No of periods EUL |

This defaults to the default number of periods defined against the depreciation code, but can be changed. You use this field to enter the fixed number of periods over which the asset must be depreciated. For example, if the Estimated Useful Life (EUL) of the asset is 10 periods, then you enter 10 in this field. The asset is then depreciated over 10 periods. This field is only enabled if you entered a Fixed EUL depreciation code (see Asset Depreciation Codes), for the asset. |

|||||

| No of years EUL | You use this field to enter the fixed number of years over which the asset must be depreciated. This defaults to the default number of periods defined against the depreciation code, but can be changed. This only applies of the Depreciation code is defined as Sum of year digits or Declining balance with or without switch. |

|||||

| Remaining periods EUL | This is calculated by the system and is displayed here for information purposes only. | |||||

| Total periods depr to date | This is calculated by the system and is displayed here for information purposes only. | |||||

| Varying depreciation anniversary | This option is only enabled if you entered a Depreciation code with varying depreciation. | |||||

| Fiscal year end | Select this to set the varying depreciation rate by fiscal year (i.e. the rates defined change at the start of each of your financial years). | |||||

| Start depreciation period | Select this to set the varying depreciation rate according to the depreciation start date entered (i.e. the rates defined change on the 'birthday' of the asset's start depreciation date). | |||||

![[Note]](images/note.png)

|

|

|

The information entered in this pane applies only to the asset's Tax value depreciation book. |

|

| Field | Value | Description | ||||

|---|---|---|---|---|---|---|

| Depreciation tax information |

The following options enable you to specify tax allowance (wear and tear) depreciation information. You would typically use these options where the tax depreciation rate for the asset differs from the Book value depreciation rate or the depreciation start dates for Tax and Book value depreciation differ. |

|||||

| Depreciation code |

You use this field to enter a valid depreciation code. Depreciation for the asset is calculated based on the depreciation type defined against the depreciation code (see Asset Depreciation Codes). If you already specified a Group code for this asset, then the tax depreciation code assigned to the group is displayed here, but can be changed. |

|||||

| Suspend depreciation |

Select this if you want the system to stop calculating Tax value depreciation for this asset. |

|||||

| Residual value |

This indicates the residual value (if any) for tax purposes. By default, tax value depreciation is calculated on the Tax Cost/value of the asset (Asset Acquisition), unless a residual value is defined and the option: Exclude residual from depreciation for - Tax value (Asset Register Setup - General tab) is selected. In this case, the residual value is deducted from the tax cost of the asset before calculating tax value depreciation. The asset is always depreciated only until the tax value residual amount entered here is reached (i.e. the accumulated tax depreciation equals the difference between the tax cost/value and the tax residual value).

If no residual value is entered, then the asset is depreciated until its current tax asset value is zero, assuming no minimum tax value for the asset group is defined (Asset Group Maintenance), |

|||||

| Start depreciation date |

You use this field to indicate the date from which tax allowance (wear and tear) depreciation must be calculated. This enables you to define an asset with a depreciation start date for Tax allowance (wear and tear) depreciation that differs from the depreciation start date for book value depreciation.

|

|||||

| Start depreciation period no |

You use this field to indicate the financial period from which Tax value depreciation of the asset must be calculated. This applies only when your number of accounting periods per year is set to 13 (Company Maintenance - General tab). You must enter the start depreciation period as the system cannot calculate it based on the Start depreciation date. The Start depreciation period no together with the Start depreciation no year govern most date manipulations, so you need to ensure that these are correct. When your number of accounting periods per year is set to 12 (Company Maintenance - General tab), you cannot enter this as the system calculates it from the Start depreciation date entered. |

|||||

| Start depreciation year no |

You use this field to indicate the financial year from which Tax value depreciation for the asset must be calculated. This applies only when your number of accounting periods per year is set to 13 (Company Maintenance - General tab). You must enter the start depreciation year number as the system cannot calculate it based on the Start depreciation date. The Start depreciation period no together with the Start depreciation no year govern most date manipulations, so you need to ensure that these are correct. When your number of accounting periods per year is set to 12 (Company Maintenance - General tab), you cannot enter this as the system calculates it from the Start depreciation date entered. |

|||||

| Throughput EUL |

You use this field to enter the estimated throughput value for the entire life of the asset. This is used for calculating the Statistical EUL depreciation amount. For example, if you are depreciating a vehicle based on through-put of kilometers and the vehicle's estimated total life in kilometres is 300 000, then you enter 300 000 in this field. This field is only enabled if you entered a Statistical EUL depreciation code type at the Depreciation code field. EUL is an acronym for Estimated Usable Life. |

|||||

| Statistical GL code |

You use this field to enter the General Ledger code to which you will process the statistical throughput tax value for the current period. This ledger code must have an Account type of Statistical (General Ledger Codes). The through-put value you enter in this statistical ledger code is used by the Asset Depreciation Calculation program when calculating the depreciation tax value for the asset for the current period. For this reason, you would create a unique statistical ledger code for each asset for which you want to calculate tax depreciation based on Statistical EUL. For example, if you are depreciating a vehicle based on throughput of kilometers, then for each period, you will enter the kilometres travelled for that period in the statistical ledger code you define here. This field is only enabled if you entered a Statistical EUL depreciation code type at the Depreciation code field. |

|||||

| No of periods EUL |

This defaults to the default number of periods defined against the depreciation code, but can be changed. You use this field to enter the fixed number of periods over which the asset must be depreciated. For example, if the Estimated Useful Life (EUL) of the asset is 10 periods, then you enter 10 in this field. The asset is then depreciated over 10 periods. This field is only enabled if you entered a Fixed EUL depreciation code (see Asset Depreciation Codes), for the asset. |

|||||

| No of years EUL | You use this field to enter the fixed number of years over which the asset must be depreciated. This defaults to the default number of periods defined against the depreciation code, but can be changed. This only applies of the Depreciation code is defined as Sum of year digits or Declining balance with or without switch. |

|||||

| Remaining periods EUL | This is calculated by the system and is displayed here for information purposes only. | |||||

| Total periods depr to date | This is calculated by the system and is displayed here for information purposes only. | |||||

| Varying depreciation anniversary | This option is only enabled if you entered a Depreciation code with varying depreciation. | |||||

| Fiscal year end | Select this to set the varying depreciation rate by fiscal year (i.e. the rates defined change at the start of each of your financial years). | |||||

| Start depreciation period | Select this to set the varying depreciation rate according to the depreciation start date entered (i.e. the rates defined change on the 'birthday' of the asset's start depreciation date). | |||||

| Field | Value | Description |

|---|---|---|

| Purchase information | ||

| Agreement number |

You use this field to record the agreement number of the asset if the asset is being leased or hired. This number is used for documentation purposes only. |

|

| Agreement code |

These fields allow you to indicate the manner in which the asset was purchased. They are used for documentation purposes only. |

|

| Cash | Select this if the asset was paid for in full at the time of purchase (i.e. bought cash). | |

| Lease | Select this if the asset is being leased. | |

| Hire purchase | Select this if the asset was bought on hire purchase. | |

| Other | Select this if the asset was not acquired by any of the means mentioned above. | |

| Purchase |

You use these fields to record whether the asset was purchased new or second hand. These fields are used for documentation purposes only. |

|

| New | Select this if the asset purchased was new. | |

| Second hand | Select this if the asset purchased was second hand. | |

| Total interest payable | This indicates the total interest amount payable which is added to the Cost/value amount for the monthly installment calculation. | |

| Period of lease or hp | This indicates the monthly period of the lease or hire purchase agreement, and is used to calculate the Monthly installment value. | |

| First installment date |

This indicates the first installment date of the asset. This field is used for documentation purposes only. |

|

| Monthly installment |

This indicates the monthly amount payable on the lease or hire purchase. It is calculated as: (Cost/value + Total interest payable) / Period of lease or hp. |

|

| Last installment | This indicates the final installment amount. | |

| Registration |

You use this to enter the registration number for a vehicle asset. This number is used for documentation purposes only. |

|

| Chassis number |

You use this to enter the chassis number for a vehicle asset. This number is used for documentation purposes only. |

|

| Engine number |

You use this to enter the engine number for a vehicle asset. This number is used for documentation purposes only. |

|

| ID/Serial no |

This enables you to enter an identity number or other serial number for the asset, if required. This number is used for documentation purposes only. |

|

| Supplier |

This enables you to enter the supplier from which the asset was purchased. No validation is performed on this field, so the code you enter here need not be a valid Account Payable supplier (Supplier Maintenance). |

You use these panes to enter the details of the Alternate valuations you selected to define for the asset (Asset Details pane). Only the fields for the selected Alternate valuation flags are enabled.

The details entered for each alternate valuation book are used for information purposes only. This information does not affect the General Ledger.

The information for each Alternate valuation book can be viewed using the Asset Query program and can be printed on the Asset Movement Schedule and the Asset List of Disposals by selecting the alternate valuation report options.

The wording displayed for these tabs defaults to Alt valuation 1, Alt valuation 2,etc., but is replaced by whatever wording you assigned to these user-defined fields (Asset Register Setup - User defined tab).

The same fields are available against each Alternate valuation as against the Book Value Details.

This pane can be used to add any additional fields you want to display on the Assets screen. An example could be custom fields you defined (see Custom Form Entry).

Electronic Signatures provide security access, transaction logging and event triggering. This enables you to increase control over your system changes.

Access to the following eSignature transactions within this program can be restricted at Operator, Group, Role or Company level. You configure this using the Electronic Signatures program.

| eSignature Transaction | Description |

|---|---|

| Asset Added |

Controls access to the New Asset Code function in the Assets, Asset Initial Capture and Browse on Assets programs. |

| Asset Changed |

Controls access to the maintenance of assets in the Assets and Browse on Assets programs. |

| Asset Deleted |

Controls access to the Delete Asset Code function in the Assets and Browse on Assets programs. |

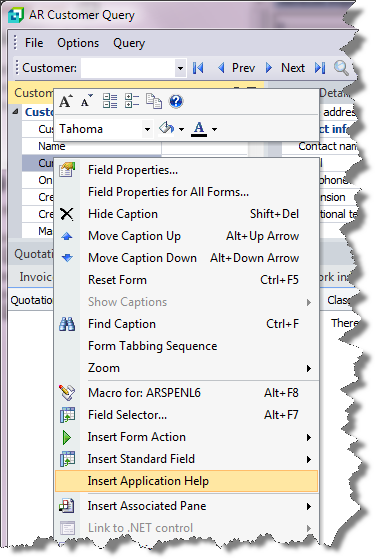

Inserting Application Help

You would typically follow this procedure to display help for the current program in a customized pane that can be pinned to the program window.

Information includes step-by-step instructions for the various functions available within the program, including a brief overview of what the program does, what setup options are required and how to personalize the program.

-

Open the program for which you want to insert application help into a customized pane.

This functionality is only available for a program that has panes.

-

Right-click any form field.

You can also click the triangle menu icon that appears in the title area of a pane.

-

Select Insert Application Help from the context-sensitive menu.

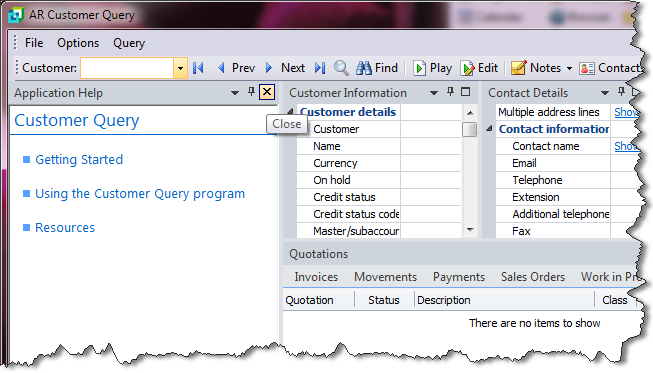

The application help appears in a pane within your program. You can reposition the pane using the docking stickers or pin it to the program window.

Removing the Application Help pane

If you no longer want to display application help in a pane for your current program, you can simply remove it.

-

Select the Close icon in the right-hand corner of the application help pane.

-

Confirm that you want to delete the pane.