You use the Asset Acquisition program to maintain the financial information for your assets.

The program enables you to:

- initially acquire assets

- process additional acquisitions on existing acquired assets

- calculate and view depreciation calculations for each depreciation book for first acquisitions before updating

Acquisitions can be processed for all depreciation books simultaneously or for individual books as required.

![[Note]](images/note.png)

|

|

|

Before using this program you need to have used the Assets program to define the static/descriptive information for the asset you want to acquire. |

|

If your Assets Register module is integrated to the General Ledger, (General Ledger Integration), then General Ledger entries are created according to your selections on the General Ledger tab of the General Ledger Integration program when you add or delete an asset using this program. Refer to Effect of automation level selected.

Amendment journals are created if required (Asset Register Setup - General tab).

| Field | Description | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Post | Select this to post the financial information for the

asset acquisition.

This function updates the relevant depreciation books with the information entered and calculated. When you do an initial asset acquisition for an asset with a depreciation start date in a prior year, then the accumulated depreciation (catch-up) is posted to the last period of the previous year. For an initial acquisition with a depreciation start date in the current year, the depreciation history is created in the relevant history files/tables and the asset entries are created for the current year. These can be viewed in the Asset Query program. Entries and history for depreciation basis Period is created as "Depreciation on addition" and for depreciation basis Year as "Depreciation". For depreciation basis Life of asset, the accumulated depreciation prior to the current year is created as "Depreciation on addition" and for the current year as "Depreciation." The reason for this is that the current year depreciation for basis Life of Asset is deleted and re-calculated each time the depreciation calculation is run. No asset entries are created for basis Life of Asset books.

|

||||||||

| Asset | You use this field to indicate the code of the asset

you want to acquire. This code must already exist. For a first acquisition, the program checks that the asset has not been sold, has no depreciation and that the Asset quantity is zero. For additional acquisitions, the program checks that the asset has not been sold and that the Asset quantity is non-zero. |

||||||||

| Calculate History | You use this function to calculate the depreciation

history for the acquisition. This calculation can be performed for all depreciation books simultaneously or individual by depreciation book. The results are displayed in the relevant History pane for the each depreciation book. This function is only available for a first acquisition. You can use the editable History listviews to change the 'catch up' depreciation values. Note that once you have posted the values, they cannot be changed using this program. This function merely performs the calculation, but does not update the asset. It enables you to view the effect of your entries and to amend them if required, before using the Post function to actually update the asset.

|

||||||||

| Field | Description | ||||

|---|---|---|---|---|---|

| Asset information | You can only enter the Acquisition quantity and the Acquisition tax. The rest of the fields are displayed for information purposes only | ||||

| Asset code | This indicates the code of the asset for which you are processing the acquisition. | ||||

| Description | This indicates the description of the asset. | ||||

| Asset quantity | This displays the current quantity defined against the

asset. When you add a new asset using the Assets program, then this value is zero until you process an acquisition against the asset. |

||||

| Tax paid | This indicates the Total tax paid value entered when the asset was added (Assets - Asset Details). | ||||

| Acquisition quantity | You use this field to indicate the quantity of the

asset you want to acquire. For example, if you purchased 10 chairs and want to treat these as a single asset, you enter 10 in this field. This quantity need not be a whole number. You could, for example, enter 0.5 or 0.1, etc. This quantity can be negative providing it does not reduce the Asset quantity to zero or less than zero.

|

||||

| Acquisition tax | You use this field to indicate the tax value applicable

to the Acquisition quantity.

|

||||

| Purchase period | This indicates the period in which the asset was purchased (Assets - Asset Details). | ||||

| Purchase year | This indicates the year in which the asset was purchased (Assets - Asset Details). | ||||

| Field | Description | ||||

|---|---|---|---|---|---|

| Book value depreciation detail | |||||

| Cost/cash price | This indicates the current cost/cash price of the asset

for Book value purposes. This is zero if no acquisitions have been processed for the asset. |

||||

| Acquisition cost/cash price | You use this field to indicate the total acquisition cost/cash price of

the Acquisition quantity for Book value

purposes.

Each Acquisition cost/cash price entered and posted adds to the cost/price of the asset. |

||||

| This year depreciation | This indicates the accumulated Book value depreciation applied to the asset for the current year to date. | ||||

| Accumulated depreciation | This indicates the total accumulated Book value depreciation for the asset. | ||||

| Last year depreciation | This indicates the total accumulated Book value depreciation for the asset for the previous year. | ||||

| Date convention start details | This is displayed for information purposes only. | ||||

| Date convention | This indicates the date convention according to which

Book value depreciation is calculated for the acquisition.

These conventions are defined for the various depreciation books in the Assets setup program - see Basis and Date Conventions. |

||||

| Start date | This indicates the date from which Book value depreciation commences. | ||||

| Start period no | This indicates the period from which Book value depreciation commences. | ||||

| Start year no | This indicates the year from which Book value depreciation commences. | ||||

| Field | Description |

|---|---|

| Tax depreciation detail | |

| Cost/cash price | This indicates the current cost/cash price of the asset

for Tax value purposes. This is zero if no acquisitions have been processed for the asset. |

| Acquisition cost/cash price | You use this field to indicate the cost or value for the asset for tax value purposes. This is the value on which the tax depreciation is based. |

| This year depreciation | This indicates the accumulated Tax value depreciation applied to the asset for the current year to date. |

| Accumulated depreciation |

This indicates the current net tax value of the asset. It is calculated as the original cost of the asset less the accumulated tax depreciation amount as at the end of the previous financial year. |

| Last year depreciation | This indicates the total accumulated Tax value depreciation for the asset for the previous year. |

| Investment allowance % |

You use this field to enter the tax allowance percentage to be used after the first year of depreciation. This field is for documentation purposes only. You can only access this field when you are adding an asset. |

| Initial allowance % |

You use this field to enter the initial tax allowance percentage to be used only for the first year of depreciation. This value refers to the percentage deducted from the full cost of the asset before tax allowance depreciation is calculated, and affects tax allowance (wear and tear) values, but not the book value. If a residual value is also defined and the option: Exclude residual from depreciation for - Tax value (Asset Register Setup - General tab) is selected, then the residual value tax value is deducted after the initial tax allowance percentage has been deducted, before calculating the tax value depreciation. You can only access this field when you are adding an asset. |

| Capital gains tax cost |

This indicates the value of the asset for Capital Gains Tax purposes. This is a notational field only. |

| Date convention start details | This is displayed for information purposes only. |

| Date convention | This indicates the date convention according to which

Tax depreciation is calculated for the acquisition.

These conventions are defined for the various depreciation books in the Assets setup program - see Basis and Date Conventions. |

| Start date | This indicates the date from which Tax value depreciation commences. |

| Start period no | This indicates the period from which Tax value depreciation commences. |

| Start year no | This indicates the year from which Tax value depreciation commences. |

You use these panes to enter the financial details of the Alternate valuations you selected to define for the asset. Only the alternate depreciation books the selected Alternate valuation flags are enabled (Assets - Asset Details pane).

The same fields are available against each Alternate valuation as against the Book Value Details.

The details entered for each alternate valuation book are used for information purposes only. This information does not affect the General Ledger.

The wording displayed for these tabs defaults to Alt valuation 1, Alt valuation 2,etc., but is replaced by whatever wording you assigned to these user-defined fields (Asset Register Setup - User defined tab).

When you select the Calculate History function, this pane displays the depreciation history for the selected depreciation book(s).

These are the 'catch up' depreciation values that are recorded against the asset when you select the Post function.

This applies only to the initial acquisition of the asset (when you process an additional acquisition, no catch-up depreciation is calculated). Subsequent depreciation will occur only at month-end when running the Asset Depreciation Calculation.

History values are not calculated for a subsequent addition as no 'catch up' depreciation applies.

![[Note]](images/note.png)

|

|

|

History values are created according to:

|

|

You use the editable listview to adjust these values if required.

![[Note]](images/note.png)

|

|

|

If you select the Calculate History function after having changed these values, then the values are reset to the values calculated by the program (i.e. your changes are lost). |

|

Once you select the Post function, you cannot change these values using this program.

Electronic Signatures provide security access, transaction logging and event triggering. This enables you to increase control over your system changes.

Access to the following eSignature transactions within this program can be restricted at Operator, Group, Role or Company level. You configure this using the Electronic Signatures program.

| eSignature Transaction | Description |

|---|---|

| Asset Acquired |

Controls access to the Asset Acquisition and Asset Initial Capture programs. |

| Asset Additional acquisition |

Controls access to the addition of acquisitions in the Asset Acquisition program. |

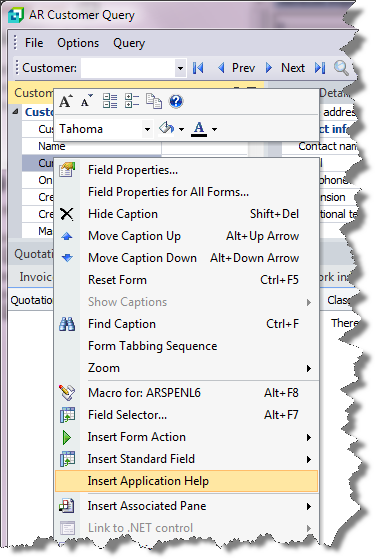

Inserting Application Help

You would typically follow this procedure to display help for the current program in a customized pane that can be pinned to the program window.

Information includes step-by-step instructions for the various functions available within the program, including a brief overview of what the program does, what setup options are required and how to personalize the program.

-

Open the program for which you want to insert application help into a customized pane.

This functionality is only available for a program that has panes.

-

Right-click any form field.

You can also click the triangle menu icon that appears in the title area of a pane.

-

Select Insert Application Help from the context-sensitive menu.

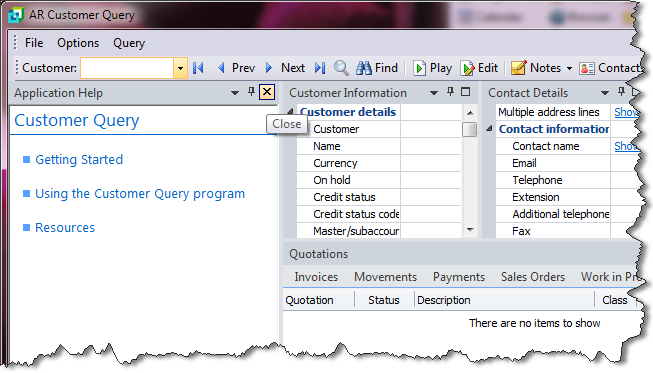

The application help appears in a pane within your program. You can reposition the pane using the docking stickers or pin it to the program window.

Removing the Application Help pane

If you no longer want to display application help in a pane for your current program, you can simply remove it.

-

Select the Close icon in the right-hand corner of the application help pane.

-

Confirm that you want to delete the pane.