You use this program to re-cost stock items from raw material level through to the finished product.

The program also checks for more than 15 levels in a product's structure to identify inadmissible parent/component/parent loops.

- Toolbar and menu

- Information

- Report

- Calculations

- Error and warning messages

- Hints and tips

- Notes and warnings

| Field | Description | ||||||

|---|---|---|---|---|---|---|---|

| Start Processing | Begins the cost implosion process. Structure on/off dates are validated against the current run date.

|

||||||

| Prints the information currently displayed in the Report pane. | |||||||

| Save Form Values | This option is only enabled in Design mode (see Automation Design). Your selections are saved and applied when the program is run in automated mode. |

| Field | Description | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Processing options | |||||||||||||||||

| Cost based on | Since the implosion begins at the lowest level (i.e.

raw materials) you must decide on the basis of the costs to be

used for each of the raw materials and the rate to charge for

labour and overheads.

|

||||||||||||||||

| Costs to update |

|

||||||||||||||||

| Routing | Indicate the specific routing that must be used for the

implosion. If you select a route other than Route 0, then you are prompted to indicate whether you want to use the costs of the components and operations from Route 0 if no components or operations exist on the route you selected.

|

||||||||||||||||

| Update unit run times | Select this to recalculate and update the

BOMOPS file with the calculated run time

for Block and Rate

type work centers based on the time taken and quantity

fields. If this option is not selected, then rounding differences between the values displayed in the various costing programs such as Cost Analysis for Stock Code, Costing Query and Costing Report could occur. |

||||||||||||||||

| Stock code selection | Indicate a selective range of stock items that must be included in the cost implosion. | ||||||||||||||||

| Warehouse selection | Indicate a selective range of warehouses that must be included in the cost implosion. This option is only available if you are using Costing by warehouse and you enabled the Apply warehouse BOM costs setup option (Inventory Setup). |

||||||||||||||||

| Options | |||||||||||||||||

| Update non-current Revision/Release | Applies the rolled-up costs to non-current and archived

revisions/releases. Although the actual non-current and archived revisions/releases are not changed, the updated costs are saved in the ECC cost file. These saved costs are then used when a job is created using a non-current or archived bill of material.

|

||||||||||||||||

| Accumulate mass to parent | Accumulates the mass against each component up to the

parent item to calculate the mass of the parent

item. Scrap percentages/values defined against components are ignored. Therefore the mass for the parent item is calculated based on the quantity per parent part and excludes any scrap percentage or quantity defined against the components. |

||||||||||||||||

| Accumulate volume to parent | Accumulates the volume against each component up to the

parent item to calculate the volume of the parent

item. Scrap percentages/values defined against components are ignored. Therefore the volume for the parent item is calculated based on the quantity per parent part and excludes any scrap percentage or quantity defined against the components. |

||||||||||||||||

| Product classes | Indicate a selective range of product classes according to which items will be selected for inclusion in the cost implosion. | ||||||||||||||||

| Suppliers | Indicate a selective range of suppliers according to which items will be selected for inclusion in the cost implosion. | ||||||||||||||||

| Buyers | Indicate a selective range of buyers according to which items will be selected for inclusion in the cost implosion. | ||||||||||||||||

| Planners | Indicate a selective range of planners according to which items will be selected for inclusion in the cost implosion. | ||||||||||||||||

| Job classifications | Indicate a selective range of job classifications according to which items will be selected for inclusion in the cost implosion. | ||||||||||||||||

| After processing completed | These options are displayed within programs that can be automated. They enable you to indicate the action you want to perform once processing is complete (see Automation Design). | ||||||||||||||||

The results of the processing function you selected are displayed in this pane, unless you selected to close the application after processing is completed.

The Level column (which can be added to the listview using the Field Chooser option) indicates whether the error encountered was a warning (processing continued) or an error (processing was aborted).

The implosion starts from the lowest level upwards, therefore, you should only use the Stock Code Maintenance program to change bill of material labor and material costs for low level parts.

For subcontract operations, the subcontract unit value is accumulated as a material cost onto the parent, provided you have not enabled the Split subcontract operation costs from material costs setup option (Bill of Materials Setup).

If a made-in parent item includes a by-product that is defined as a negative material allocation, then the by-product's cost is deducted from the parent's total material cost.

If you have enabled the Apply warehouse BOM costs setup option (Inventory Setup) then the warehouse defined against the component is used to obtain the component cost when Inventory or Last cost is used. If the option is not enabled, then the warehouse against the component is ignored and the inventory or last cost is always obtained from the warehouse to use for bought out items (i.e. the inventory or last cost for a bought out item is always obtained from the warehouse to use when BOM costs are not held at warehouse level).

The Cost Implosion program uses all 6 decimal places in calculating mass and volume accumulated to the parent. However, for co-products, the unit mass and volume of the co-products is worked out using the quantity per field for co-products which is only 3 decimals.

The mass and volume for the parent item is calculated based on the quantity per parent part and excludes any scrap percentage or quantity defined against the components.

Example 1:

Assume you have the following:

| Parent item |

|

||||||||||

| Component 1 |

|

||||||||||

| Total per (including scrap) |

((Qty per + (Qty per * Scrap percentage)) +

(Scrap quantity / Parent EBQ)

((10 + (10 *0.10) + (2 / 10) = 10.1 + 0.2 = 11.2 |

||||||||||

| Mass |

Component Qty per * Component

Mass

10 * 2 = 20 |

||||||||||

| Volume |

Component Qty per * Component

Volume

10 * 1 = 10 |

The cost held against the stock item (Stock Code Maintenance) is used, unless you have enabled the Apply warehouse BOM costs setup option and selected Costing by warehouse (Inventory Setup) in which case the costs held against the warehouse (Warehouses for Stock Code) are used.

Example 2:

Assume you have the following:

| Parent item |

|

||||||

| Component 1 |

|

||||||

| Operation 1 |

|

||||||

| Create a job for 10 Parent items |

|

||||||

|

However, to make 10 (net) of the parent, you require 13.333 (gross) of the parent. Therefore, you need 13.333 * 12.5 = 166.6625 total components for the job. Taking 166.6625 divided by 10 = 16.66625 (rounded to 16.663) gives the quantity required of the component to make a single parent item. |

Material costs are established by accumulating the results of the following calculations:

- The quantity per is increased by the scrap percentage factor, and by the result of dividing the scrap quantity by the economic batch.

- Multiply the cost of each first level component by its recalculated per and add the costs of all the operations on the part. If the economic batch quantity is zero the program automatically assumes a quantity of 1.

Operation costs are established by accumulating the results of the following calculations:

If the economic batch quantity or productive units are zero (or between zero and 1) the startup value, setup value, teardown value, fixed overhead value and variable overhead value will always assume 1 if less than 1 when calculating a unit value.

If the economic batch quantity is less than the startup quantity x productive units, then the startup quantity x productive units is used as the economic batch quantity.

-

Run value {run time x run rate x [EBQ - (startup quantity x productive units)]} divided by EBQ

-

Setup (setup rate x setup time x productive units) divided by EBQ

-

Startup (startup rate x startup time x productive units) divided by EBQ

-

Teardown (teardown rate x teardown time x productive units) divided by EBQ

-

Fixed overhead (fixed overhead rate x ((run time x (EBQ - (startup quantity x productive units))) + (setup time x productive units) + startup time x productive units) + (teardown time x productive units))) divided by EBQ

-

Variable overhead (variable overhead rate x ((run time x (EBQ - (startup quantity x productive units))) + (setup time x productive units) + startup time x productive units) + (teardown time x productive units))) divided by EBQ

-

Operation costs of soft phantom components (Inventory Setup) are not included in the cost of the parent.

The following example indicates the effect of holding BOM costs by warehouse:

Assume you have two manufacturing warehouses:

-

JO – Located in Johannesburg

This warehouse can handle 50 000 liters per job.

-

DU – Located in Durban

This warehouse can only handle 15 000 liters per job.

Therefore:

- the EBQ required for each site is different

-

the manufacturing time for different quantities may still be the same.

For example, setup costs will be the same, as they both take the same time to set up the machines even though different quantities are being manufactured. In this example, the processing cost in Durban is higher than in Johannesburg.

In addition, assume that some of the materials required for the job are imported through Durban harbour, reducing the transport costs for Durban. Johannesburg, however must carry the cost of the transport from Durban to Johannesburg, which increases the material costs for Johannesburg.

The following two options in Inventory Setup enable you to cater for this scenario:

- Costing by warehouse - when selected enables you to set the costing method by individual warehouse.

-

Apply warehouse BOM costs - when selected will calculate and store the Bill of Materials costs per stock code/warehouse combination.

![[Note]](images/note.png)

If this option is not selected, then the Cost Implosion calculates and stores the BOM costs against the item itself on Route 0.

If this option is selected then:

- the Re-order quantity defined against the stock code/warehouse (Warehouse Maintenance for Stock Code) is used as the Economic Batch Quantity (EBQ).

- the Cost Implosion applies the Route (if alternate routing is required) and the component warehouse to use defined for the warehouse (Warehouse Maintenance - Options for cost implosion and suggested).

Returning to the example, assume we have:

| Warehouse | Route to Use | Component Warehouse | EBQ (Re-order quantity) |

|---|---|---|---|

| JO (Johannesburg) | 0 | J1 | 50 000 |

| DU (Durban) | 1 | D1 | 15 000 |

The structure to manufacture Part A on both Route 0 and Route 1 is as follows:

| Component | Quantity | Warehouse R1 | Warehouse R2 |

|---|---|---|---|

| X | 2 | 10.00 | 8.00 |

| Y | 10 (Fixed) | 10.00 | 10.00 |

| Z | 1 | 10.00 | 12.00 |

The routing and rate on Route 0 and on Route 1 is the same and has a single operation - Op1:

| Setup Time | Setup Rate | Runtime | Runtime Rate |

|---|---|---|---|

| 10.00 | 200.00 | 1.00 | 50.00 |

The Cost Implosion results are as follows:

-

JO (Johannesburg)

Components:

Component Calculation Result X 2 * 10.00 20.00 Y 10 * 10/50 000 (remember this is fixed) 0.002 Z 1 * 10.00 10.00 The total material cost is 30.002

Operation:

Op1 = (10 * 200.00 / 50 000) + 50 = 50.04

-

DU (Durban)

Components:

Component Calculation Result X 2 * 8.00 16.00 Y 10 * 10/15 000 (remember this is fixed) 0.006667 Z 1 * 12.00 12.00 The total material cost is 28.006667

Operation:

Op1 = (10 * 200.00 / 15 000) + 50 = 50.133333

Other areas where costs will be different are rate and block operations as well as fixed and variable overheads.

Co-products manufactured via a notional part can be defined multiple times against a notional part, so the quantities and percentages against the co-product are accumulated.

For example:

A notional part has the following co-products:

| Stock code (co-product) | Quantity | Material % | Labor % | Subcontract % |

|---|---|---|---|---|

| A | 4 | 25 | 25 | 25 |

| B | 1 | 25 | 40 | 0 |

| C | 3 | 0 | 35 | 50 |

| A | 1 | 50 | 0 | 25 |

The program checks the notional part to obtain its EBQ (economic batch quantity).

Using the notional part, the operations and components are extracted and the unit costs for the notional part are calculated. Each of these costs is multiplied by the relevant percentages.

![[Note]](images/note.png)

|

|

|

The material percentage apportionment is applied to labor, subcontract and overheads attached to a component. The labor and subcontract percentages are only applied to labor attached to the notional part. |

|

The cost rollup takes the apportionment defined in maintenance and calculates the costs of the co-products according to the cost method defined against the notional part and route (simple or detail). See BOM Co-products.

![[Note]](images/note.png)

|

|

|

The EBQ, etc for cost rollup and lead time calculation is associated against the notional part. The cost is then apportioned according to the percentages and then divided by the quantity to get a unit cost. |

|

Simple Costing

Example:

The following bill of materials was created:

-

Notional part N (qty per 1) with three co-products attached: co-product A - qty per of 1, co-product B - qty per of 1 and co-product C - qty per of 2.

- Operation Op 1 (6 hours)

- Operation Op 2 (4 hours)

-

Component C1 (qty per 3)

-

Component C2 (qty per 1)

-

Component C3 (qty per 6)

-

By product Z (qty per -1)

If simple cost is in use then, using this example, the following percentages of cost are allocated:

| Co-product | Qty per of N | Material Apportionment % | Labor Apportionment % | Subcontract Apportionment % |

|---|---|---|---|---|

| A | 1 | 33.334 | 33.334 | 33.334 |

| B | 1 | 33.333 | 33.333 | 33.333 |

| C | 2 | 33.333 | 33.333 | 33.333 |

Note that because of the requirement that the percentage must equal 100% for all the elements the first entry is rounded up.

This is much simpler to maintain than the current method of maintaining proportional bills against the negative allocations.

The program rolls the costs up to the notional part (as is done currently) and then applies the apportionment percentages and updates the co-products costs.

Detail Costing

Detail costing enables you to apportion costs to the co-products by individual materials and labor.

For example:

In the plastic injection molding industry it is not uncommon for a number of similar items to be produced sequentially (one after the other) to cater for different colors. Whilst this is a single job, the costs of materials and labor need to be apportioned. Example of detail costing: A plastic injection mould manufactures 4 co-products ‘CLEAR, WHITE, RED, BLACK’. These are set up as follows:

| Co-product | Qty | Offset | Material % | Labor % | Subcontract % |

|---|---|---|---|---|---|

| CLEAR | 1 | 1 | 20.000 | 25.000 | 25.000 |

| WHITE | 1 | 2 | 20.000 | 25.000 | 25.000 |

| RED | 2 | 3 | 30.000 | 25.000 | 25.000 |

| BLACK | 1 | 4 | 30.000 | 25.000 | 25.000 |

The materials attached to he notional part are:

| Component | Qty per | Offset Operation | Cost per Unit | Total |

|---|---|---|---|---|

| PLASTIC | 4 | 2 | 10.00 | 40.00 |

| WHITEDYE | 1 | 3 | 20.00 | 20.00 |

| REDDYE | 1 | 4 | 15.00 | 15.00 |

| BLACKDYE | 1 | 5 | 10.00 | 10.00 |

| TOTAL: | 85.00 |

The cost of the material ‘PLASTIC’ is apportioned evenly with all the co-products. The dyes (WHITEDYE, REDDYE, etc.) are associated with individual co-products.

The operations attached to the notional part are:

| Operation Number | Operation | Time | Cost per Unit | Total |

|---|---|---|---|---|

| 1 | SETUP | 2 | 20.00 | 40.00 |

| 2 | CLEARRUN | 1 | 10.00 | 10.00 |

| 3 | WHITERUN | 1 | 10.00 | 10.00 |

| 4 | REDRUN | 1 | 10.00 | 10.00 |

| 5 | BLACKRUN | 1 | 10.00 | 10.00 |

| 6 | CLEANUP | 2 | 10.00 | 20.00 |

| TOTAL | 100.00 |

As with the materials operations, 1 (SETUP) and 6 (CLEARUP) are equally apportioned against all the co-products but operations 2 through 4 (WHITERUN etc.) are associated with individual co-products.

The new detail costing files would contain the following information (excluding notional part and route) and are populated when the job is created:

| Co-product | Type | Comp/Op | Percentage |

|---|---|---|---|

| CLEAR | M | PLASTIC | 25.00 |

| WHITE | M | PLASTIC | 25.00 |

| RED | M | PLASTIC | 25.00 |

| BLACK | M | PLASTIC | 25.00 |

| WHITE | M | WHITEDYE | 100.00 |

| RED | M | REDDYE | 100.00 |

| BLACK | M | BLACKDYE | 100.00 |

| CLEAR | O | 1 (SETUP) | 25.00 |

| WHITE | O | 1 (SETUP) | 25.00 |

| RED | O | 1 (SETUP) | 25.00 |

| BLACK | O | 1 (SETUP) | 25.00 |

| CLEAR | O | 2 (CLEARRUN) | 100.00 |

| WHITE | O | 3 (WHITERUN) | 100.00 |

| RED | O | 4 (REDRUN) | 100.00 |

| BLACK | O | 5 (BLACKRUN) | 100.00 |

| CLEAR | O | 1 (CLEANUP) | 25.00 |

| WHITE | O | 1 (CLEANUP) | 25.00 |

| RED | O | 1 (CLEANUP) | 25.00 |

| BLACK | O | 1 (CLEANUP) | 25.00 |

![[Note]](images/note.png)

|

|

|

If no detail cost entries are defined for a material or operation, then the system applies the 'simple' cost apportionment percentages defined against each co-product entry. For example: If the PLASTIC material does not have apportionment records defined then the program splits the costs 20% to CLEAR, 20 % to WHITE, 30 % to RED and 30 % to BLACK. |

|

The resultant costs for the co-products are as follows:

| CLEAR - Total cost = 35.00: |

|

||||

| WHITE - Total cost = 60.00 |

|

||||

| RED - Total cost = 60.00 |

|

||||

| BLACK - Total cost = 60.00 |

|

-

* Missing warehouse record for stock code : %1 Warehouse : %2

If you enabled the Apply warehouse BOM Costs setup option (Inventory Setup) then this is an error and BOM costs are not updated. If you did not enable the option, then this is merely a warning and BOM costs will be updated for bought out stock items not stocked in the warehouse to use.

-

*Missing warehouse record for notional part: XXXXXX Warehouse: XX

This warning is displayed if a notional part is not defined against the same warehouse as its co-product (i.e. you have co-products defined against warehouses in which the notional part was not defined).

-

* Missing warehouse record for co-product: xxxx Warehouse: XX

This warning is displayed if not all co-products are stocked in the same warehouse. For example: You may have defined a notional part in warehouse AA and attached three co-products, but only defined one of these co-products as being stocked in warehouse AA.

-

An error is given where stock items do not exist in warehouses. The reason is that unless you define a specific component warehouse to use against the parent warehouse, or define a warehouse to use on the BOM itself, then the cost implosion assumes that the component to use for the cost implosion exists in the parent warehouse.

-

Amendment journals are created if these are required for Inventory (Inventory Setup).

Electronic Signatures provide security access, transaction logging and event triggering. This enables you to increase control over your system changes.

Access to the following eSignature transactions within this program can be restricted at Operator, Group, Role or Company level. You configure this using the Electronic Signatures program.

| eSignature Transaction | Description |

|---|---|

| BOM Cost implosion |

Controls access to the Start Processing function in the Cost Implosion program. |

-

Enabling the option: Allow cosmetic changes (Bill of Materials Setup) determines whether you are prompted to change the revision/release of affected items.

If you select to change the release, then the BOM is updated without changing the revision.

-

For automatic control, components added and deleted are considered significant changes, as are changes to the following fields:

-

Revision (Component)

-

Release (Component)

-

Unit of Measure

-

Quantity per

-

Fixed quantity flag

-

Parent per fixed quantity

-

Structure on date

-

Structure off date

-

Include from job number

-

Include to job number

-

Scrap percentage

-

Scrap quantity

-

Warehouse to use

If a structure or routing is not found when checking for cosmetic changes, the item is assumed to be a component and its revision/release is changed.

When saving cosmetic changes for an affected parent item, if a component against the BOM of the parent is also an affected item, then this component revision/release is not applied to the parent, as this constitutes a major change. This applies even if the component revision/release is changed at the time of applying BOM changes.

-

-

You cannot run the Transfer BOM Costs to Wh Costs program unless you run the Cost Implosion for all stock codes.

If a range of stock codes were updated on one cost implosion run and another range of stock codes were updated on a different run, then the Implosion numbers in the Inventory Master table will differ, resulting in you not being able to do the costs transfer.

-

If you enabled Activity based costing (Bill of Materials Setup) then you need to run the Cost Implosion program as part of implementing activity based costs (see Activity Based Costing Introduction for additional information).

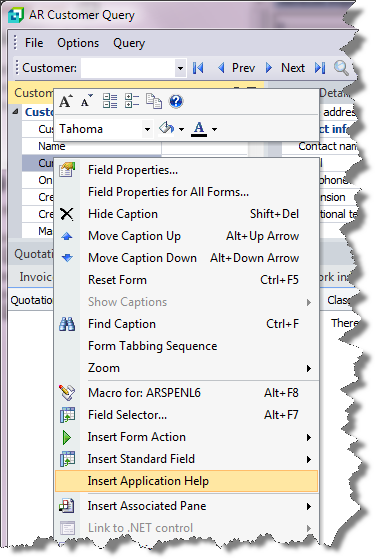

Inserting Application Help

You would typically follow this procedure to display help for the current program in a customized pane that can be pinned to the program window.

Information includes step-by-step instructions for the various functions available within the program, including a brief overview of what the program does, what setup options are required and how to personalize the program.

-

Open the program for which you want to insert application help into a customized pane.

This functionality is only available for a program that has panes.

-

Right-click any form field.

You can also click the triangle menu icon that appears in the title area of a pane.

-

Select Insert Application Help from the context-sensitive menu.

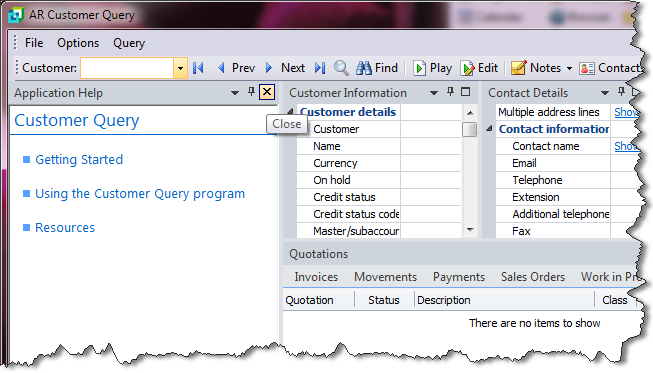

The application help appears in a pane within your program. You can reposition the pane using the docking stickers or pin it to the program window.

Removing the Application Help pane

If you no longer want to display application help in a pane for your current program, you can simply remove it.

-

Select the Close icon in the right-hand corner of the application help pane.

-

Confirm that you want to delete the pane.

![[Warning]](images/warning.png)