You use this program to capture and maintain details of stock items required within the system.

- Toolbar and menu

- Stock Code Details

- Replenishment

- Production Details

- Sales Details

- Foreign Text

- Tracking

- Additional Fields

- Other

- Notes and warnings

- Hints and tips

| Field | Description | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Options | |||||||||||||||||

| Preferences | This assigns preferences that you want to apply to all new

stock codes added to the system. For each preference selected, the appropriate program is loaded when you save the details for the new stock item. You then have the option of entering the details at that point, or later if required. If you do not select a preference, you can still use the appropriate program to enter the required details later.

|

||||||||||||||||

| Defaults | |||||||||||||||||

| Use Product Class Defaults | This uses the default entries defined against the product

class when adding a stock item. If you do not select this option then the entries defined using the Maintain Global Defaults option are used when adding a stock item.

|

||||||||||||||||

| Change Product Class | If you selected Use Product Class Defaults, then this allows you to select a different default product class to use when adding stock items. | ||||||||||||||||

| Maintain Product Class Defaults | This assigns default entries to fields according to the

product class to which the stock item belongs. When capturing a stock item that belongs to a specific product class, you can then elect to use the default entries which you assigned to the product class. |

||||||||||||||||

| Maintain Global Defaults | This assigns entries to fields that you want to use by default whenever you capture a stock item. | ||||||||||||||||

| Warehouse Defaults | This loads the Warehouses for Stock Code program to define

the default entries required for warehouses to which you are

adding the stock item. This option is only enabled if you selected either the Maintain Global Defaults or Maintain Product Class Defaults option from the Defaults menu. If you selected to maintain product class defaults, then you must enter a product class before you can define the warehouse defaults. |

||||||||||||||||

| Stock code | Enter the code of the item you want to add or maintain. The

number of characters you can enter depends on the key type you

have configured for stock codes (Company Maintenance). You can only access this field if your stock code numbering method is set to manual (Inventory Setup). If set to numeric or automatic, then the next stock code number is displayed here automatically. A stock code that already exists can only be created as a non-stocked code in the Quotations module (Non-Stocked Maintenance) if the Allow stock code to exist in non-stocked table setup option (Inventory Setup) is enabled. |

||||||||||||||||

| Product class | When maintaining product class defaults, this field is used to enter the product class for which you want to maintain the default entries. When adding a stock item that belongs to a specific product class, you can elect to use the default entries that you assigned to the product class. | ||||||||||||||||

| Notes | Select this to view and maintain various text notations

against the stock item. A tick indicates that text is assigned

to the item.

|

If you change the unit of measure of a stock item for which bill of materials exist, then you can use the BOM Update Unit of Measure program to change the unit of measure for the item against all your bills.

| Field | Description | ||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stock code information | |||||||||||||||||||||||||||||||||

| Stock code | This indicates the code of the stock item you are currently adding or maintaining. | ||||||||||||||||||||||||||||||||

| Stock code (scripted) |

This field is only enabled if you indicated that the Stock code numbering method is Scripted (Inventory Setup). You use the VBScript Editor to build a unique stock code for each new stock item added. The scripted stock code can be constructed using values from other entered fields to update the StockCodeDetails.CodeObject.StockCodescripted field. |

||||||||||||||||||||||||||||||||

| Description | This describes the stock code and is displayed throughout the system whenever the stock code is entered. You can use it to verify that the correct item has been entered. | ||||||||||||||||||||||||||||||||

| Long description | This is an additional description assigned to a stock code which is viewable from within the Inventory Query program and which can be printed on reports and inventory documents. | ||||||||||||||||||||||||||||||||

| Warehouse to use |

This indicates the warehouse that must be used to extract the quantities of stock required by the Bill of Materials module when performing functions such as a cost implosion and creating material allocations. It is also the default warehouse used for the parent when adding a job and is used to calculated the new landed cost of an item. The Purchase Orders module does not use the Warehouse to use as the default warehouse when adding a purchase order.

|

||||||||||||||||||||||||||||||||

| Warehouse to use description | This indicates the description held against the warehouse to use you selected. | ||||||||||||||||||||||||||||||||

| Drawing number | This field is for documentary purposes and is printed on

reports and factory documentation. This field is only enabled if the ECC (Engineering Change Control) module is installed. |

||||||||||||||||||||||||||||||||

| Part category |

|

||||||||||||||||||||||||||||||||

| Product class | This indicates the category to which the item is assigned.

It is used for reporting purposes (Sales Analysis) and as a method

of defining your integration to the General Ledger

module. You must enter a valid product class if you enabled the Validate product class setup option (Inventory Setup). When you enter a valid product class, the description for the product class is displayed. If you did not select to validate product classes, then, although a product class must be assigned to a stock item, your entry is validated only at the time of generating a sales order (see Sales Order Entry). You cannot access this field if you selected the Use Product Class Defaults option (Defaults function). The product class you entered on the Use Product Class Defaults screen is automatically entered in this field. To change the default product class, select the Change Product Class option from the Defaults function. |

||||||||||||||||||||||||||||||||

| Product class description | This indicates the description for the product class you selected. | ||||||||||||||||||||||||||||||||

| Stocking unit metrics | |||||||||||||||||||||||||||||||||

| Stocking unit of measure | This indicates the unit of measure in which the stock item

is held on file. A stocking unit of measure entry must be assigned

to a stock item. If you enabled the Unit of measure conversion factors are theoretical setup option (Sales Order Setup) then you enter the theoretical unit of measure here. For example: You sell boxes of fruit that you stock in kilograms, but sell by the box. If there are theoretically 10kg in one box, then kilograms is the theoretical unit of measure because only at the time of selling the fruit do you know the exact number of kilograms sold. |

||||||||||||||||||||||||||||||||

| Mass per stocking unit | This indicates the weight of a single unit of the stock

item in the stocking unit of measure. It is used for reporting

purposes (Inventory and Sales Analysis) and can be printed on

inventory and sales documents. If you enabled the EC VAT system required setup option (Tax Options) then the mass per stocking unit is required for the Supplementary Declarations report. When creating a parent item from Product Configurator (Product Configurator Wizard) the mass of the item is the sum of the masses of the components used to create the parent item. |

||||||||||||||||||||||||||||||||

| Volume per stocking unit | This indicates the volume of a single unit of the stock

item in the stocking unit of measure. It is used for reporting and

query purposes. In addition, the stock unit volume, the order line

volume and total volume can be printed on delivery notes and

invoices. When creating a parent item from Product Configurator (see Product Configurator Wizard), the volume of the item is the sum of the volumes of the components used to create the parent item. |

||||||||||||||||||||||||||||||||

| Specific gravity |

This indicates the value that must be used to convert volume measurements to weight measurements (e.g. conversion between kilograms and liters, or vice versa). This field is used if you indicated that the stock item is required in a batch bill of materials. |

||||||||||||||||||||||||||||||||

| Alternate unit of measure | If you want to be able to hold inventory costs in a unit of measure other than the stocking unit of measure, you need to enable the Inventory cost to be held in a unit of measure other than stocked setup option (Inventory Setup). | ||||||||||||||||||||||||||||||||

| Alternate uom unit | This indicates the description for the alternative unit of measure for the sale or purchase quantity of an item and the pricing. | ||||||||||||||||||||||||||||||||

| Alternate uom factor | The conversion factor enables you to convert the Alternate

unit of measure into the Stocking unit of measure.

The field is used by the Sales Order module if you indicated that the unit of measure must be requested for order quantities (Sales Order Setup). It is also used by the Purchase Order module if you indicated that the Alternate unit of measure must be used for order quantities (Purchase Orders Setup). For example: If your item is stocked as each and sold or ordered in dozens, then you would set up the alternate unit of measure table conversion as follows:

If you enabled the Unit of measure conversion factors are theoretical setup option (Sales Order Setup) then you enter the absolute unit of measure in this field. For example: You sell boxes of fruit that you stock in kilograms, but sell by the box. The box is the absolute unit of measure. If there are theoretically 10kg in one box, then kilograms is the theoretical unit of measure. |

||||||||||||||||||||||||||||||||

| Alternate uom method | You use this field to indicate whether the Stocking unit of measure must be multiplied or divided to give the alternate unit of measure. | ||||||||||||||||||||||||||||||||

| Alternate uom conversion | This displays the result of converting from the stocking unit of measure to the alternate unit of measure or vice versa. You can select the Test option from the Alternate uom unit field to view the same results in a separate screen. | ||||||||||||||||||||||||||||||||

| Other unit of measure | If you want to be able to hold inventory costs in a unit of measure other than the stocking unit of measure, you need to enable the Inventory cost to be held in a unit of measure other than stocked setup option (Inventory Setup). | ||||||||||||||||||||||||||||||||

| Other uom unit | This indicates the description for the other unit of measure for the sales ordering quantity of an item and the pricing. | ||||||||||||||||||||||||||||||||

| Other uom factor | A conversion factor enables you to convert the Other unit of measure into the Stocking unit of measure.

The field is used by the Sales Order module if you have indicated that the unit of measure must be requested for order quantities (Sales Order Setup). For example: If your item is stocked as Each and sold in Dozens or Boxes (5 per box), then you would set up the other unit of measure table conversion as follows:

|

||||||||||||||||||||||||||||||||

| Other uom method | You use this field to indicate whether the Stocking unit of measure must be multiplied or divided to give the Other unit of measure. | ||||||||||||||||||||||||||||||||

| Other uom conversion | This displays the result of converting from the Stocking unit of measure to the Other unit of measure or vice versa. You can select the Test option from the Other uom unit field to view the same results in a separate screen. | ||||||||||||||||||||||||||||||||

| Manufacturing unit of measure | Defining a manufacturing unit of measure enables you to

view and report on the unit of measure you entered to manufacture

the item. This provides you with an additional unit of measure over and above the stocking, alternate and other units of measure.

|

||||||||||||||||||||||||||||||||

| Manufacturing uom unit | Indicate the description for the manufacturing unit of measure. | ||||||||||||||||||||||||||||||||

| Manufacturing uom factor | A conversion factor enables you to convert the Manufacturing unit of measure into the Stocking unit of measure. | ||||||||||||||||||||||||||||||||

| Manufacturing uom method | Indicate whether the Stocking unit of measure must be multiplied or divided to give the Manufacturing unit of measure. | ||||||||||||||||||||||||||||||||

| Manufacturing uom conversion | This displays the result of converting from the Stocking unit of measure to the Manufacturing unit of measure or vice versa. You can select the Test option from the Manufacturing uom unit field to view the same results in a separate screen. | ||||||||||||||||||||||||||||||||

| Other options | |||||||||||||||||||||||||||||||||

| Cost unit of measure | This indicates the unit of measure to be used for the

inventory cost of the item. You define cost units of measure using

the Unit of Measure Maintenance program.

|

||||||||||||||||||||||||||||||||

| Maximum number of decimals |

This indicates the number of decimals to which you want to store and print stock quantities. When converting between the different units of measure defined for the stock item, quantities are always rounded to the number of decimals defined here when the option: Round converted quantities to stock code no. of decimals is enabled (Inventory Setup). Stock code related quantities are displayed in list views to the number of decimals you define here, providing you enabled the Edit quantities using decimals associated with item setup option (Company Maintenance). The maximum number of decimals defined here should equal the Maximum no. of decimals allowed in quantities if that is defined. Refer to the example against the Maximum no. of decimals allowed in quantities option (Inventory Setup). |

||||||||||||||||||||||||||||||||

| Unit quantity processing |

Enable this to handle and display quantities of the stock code as units of the stocking and alternate unit of measure, rather than as units and decimal places. For example: If an item is stocked in cases with an alternate unit of measure of 12 bottles per case, then a quantity of 2.5 is presented as 2/06, or entered as two fields - one for 2 and one for 6 (i.e. no decimal places are allowed on either the stocking or alternate unit of measure). When entering this type of stock code during sales order entry, the system requests the entry of quantities in two separate fields - the primary quantity is always in the stocking unit of measure, followed by the equivalent alternate unit of measure where decimal places would previously have been entered. The same procedure applies to Stock Takes, Inventory Movements, Purchase Orders and Dispatch Notes. It is not possible to enter a job for anything other than units of the stocking quantity.

|

||||||||||||||||||||||||||||||||

| Alternate key 1 | This indicates additional information assigned to the stock

item which can be used as a selection criterion when browsing on

stock codes. It can also be used to change the sequence in which items are displayed when browsing on stock codes. You can change the wording displayed for this field to suit your own requirements (Inventory Setup). |

||||||||||||||||||||||||||||||||

| Alternate key 2 | This indicates additional information assigned to the stock

item which can be used as a selection criterion when browsing on

stock codes. It can also be used to change the sequence in which items are displayed when browsing on stock codes. You can change the wording displayed for this field to suit your own requirements (Inventory Setup). |

||||||||||||||||||||||||||||||||

| Retain stock movements | Select Yes if you want to store on

file all transaction movements processed against the stock

item. If you enabled the Record movements for bin transfers setup option (Inventory Setup) then details of bin transfers within the same warehouse are retained. A listing of stock movements can be printed using the Inventory Movement and Kardex Report programs. |

||||||||||||||||||||||||||||||||

| Stock code status | This enables you to define the status of the stock

item.

|

||||||||||||||||||||||||||||||||

| Additional items | |||||||||||||||||||||||||||||||||

| Warehouses | This enables you to assign the stock item to a warehouse and to define the warehouse information for the highlighted stock item using the Warehouse Maintenance for Stock Code program. | ||||||||||||||||||||||||||||||||

| Pricing | This enables you to define the pricing information for the highlighted stock item using the Browse on Stock Code Pricing program. | ||||||||||||||||||||||||||||||||

| Foreign purchase prices | This enables you to define the foreign purchase pricing information for the highlighted stock item using the Foreign Purchase Prices program. | ||||||||||||||||||||||||||||||||

| Alternate stock codes | This enables you to define the alternate stock code information for the highlighted stock item using the Alternate Stock Codes program. | ||||||||||||||||||||||||||||||||

| Alternate suppliers | This enables you to define the alternate supplier information for the highlighted stock item using the Alternate Suppliers program. | ||||||||||||||||||||||||||||||||

| Field | Description | ||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Purchasing | |||||||||||||||||||||||||||||||||||||||||

| Supplier | This indicates the code of the primary supplier from whom you usually purchase this stock item and is validated only if the Accounts Payable or Purchase Order modules is installed. | ||||||||||||||||||||||||||||||||||||||||

| Supplier name | This indicates the name of the selected supplier. | ||||||||||||||||||||||||||||||||||||||||

| Buyer | This indicates the code of the person responsible for

purchasing the stock item. It is used as a selection criterion for stock codes printed on various Requirements Planning reports. |

||||||||||||||||||||||||||||||||||||||||

| Buyer name | This indicates the name of the selected buyer. | ||||||||||||||||||||||||||||||||||||||||

| Tariff code | This is used in the Landed Cost Tracking system to

determine the duty rate applicable to an imported item. It is also used in the EC VAT system and is an important data field on the Supplementary Declarations report - identifying goods that are the subject of a dispatch or arrival. |

||||||||||||||||||||||||||||||||||||||||

| Tariff code description | This indicates the description for the selected tariff code (see Tariff Code Maintenance). | ||||||||||||||||||||||||||||||||||||||||

| Supplementary units | This indicates that supplementary units are required for

the tariff code. A number of tariff codes require the declaration of a supplementary unit (e.g. the number of pieces, liters or cubic meters). A supplementary unit is generally required when it is a more appropriate measure of particular goods than the net mass and allows a greater degree of comparison and analysis. When adding a sales order line for a stock item that requires supplementary units, the supplementary unit code is passed to the order line from the stock code. A factor can then be added for calculating the supplementary unit quantity. When invoicing, the supplementary unit information is saved and made available for printing on the EC Sales reports. When receipting a purchase order, the supplementary unit information is requested, saved and made available for printing on the EC Declaration of Arrivals report. |

||||||||||||||||||||||||||||||||||||||||

| Supplementary code | This indicates the supplementary code to use for the stock

item. The field can be blank, but if entered must be a valid supplementary code (see Browse on Intrastat Supplementary Units). |

||||||||||||||||||||||||||||||||||||||||

| Supplementary code description | This indicates the description defined against the supplementary code selected (see Intrastat Supplementary Units). | ||||||||||||||||||||||||||||||||||||||||

| Landed cost tracking required |

This indicates that the stock item is required in the Landed Cost Tracking system. It can only be selected for bought-out items. |

||||||||||||||||||||||||||||||||||||||||

| Lead time (days) | This indicates the number of days in which to either buy

out or manufacture the stock item (see Lead time). For bought-out items, you enter the number of days it takes the supplier to deliver the item from the date the order is placed. This must be manually buffered for non-working days (e.g. if your supplier takes 3 days from date of order to delivery, this represents 3 working days. You will therefore need to buffer the lead time to account for weekends). For made-in items, you use the Lead Time Calculation program to calculate and update the lead time. The program calculates a ratio of working to non-working days and applies this when calculating the lead time for an item (i.e. you do not need to buffer the lead time for made-in items if you are using the Lead Time Calculation program to update this field). The lead time is used in the calculation performed by the Minimum Quantity Calculation program to establish the minimum quantity required for each stock code and warehouse. It is also used in the Requirements Planning and Bill of Materials modules. |

||||||||||||||||||||||||||||||||||||||||

| Replenishment details | |||||||||||||||||||||||||||||||||||||||||

| Dock to stock (days) | This indicates the number of days that a bought-out or

made-in stock item must be in stock prior to usage. This enables

you to calculate an earlier due date for jobs or purchase orders

and, from these, an earlier start date. Non-working days per the factory calendar are taken into account when the delivery date is calculated to add to the ship date. |

||||||||||||||||||||||||||||||||||||||||

| Batching rule |

Enter the required batching rule for the item. This is used to calculate an order quantity for the item when shortages are encountered. Batching rules are applied to MPS items when producing the Master Production Schedule, unless you enabled the Include build schedule in requirements calculation setup option (Requirements Planning Setup). They are applied to non-MPS items when running the Requirements Calculation program.

If you are using Inventory Optimization then the following batching rules are used in Requirements Planning in relation to the maximum level:

|

||||||||||||||||||||||||||||||||||||||||

| Economic batch quantity | The economic batch quantity is used to determine the

costing of a bill of materials. It is also used within the

Requirements Planning module together with batching rules B, G, I,

K, M and O.

|

||||||||||||||||||||||||||||||||||||||||

| Pan size | This can be likened to a container size. Within the Bill of

Materials module you can indicate whether the elapsed time against

work centers or cost centers is based on the pan size or the

economic batch quantity.

|

||||||||||||||||||||||||||||||||||||||||

| Fixed time period (days) | This indicates the number of working days that represents a

fixed time period. For example: A fixed time period of 1 day indicates that if a shortage is encountered, then the total shortage for today and the next working day is used as if the shortage falls today. The entry made here is used for all time-based buying rules (i.e. C, K, L, M and N) within the Requirements Planning module.

|

||||||||||||||||||||||||||||||||||||||||

| Date of supersession | This indicates the date on which the stock item should no

longer be sold. It is used by the Superseded Clearing Stock report as a criterion according to which stock items are selected for printing. |

||||||||||||||||||||||||||||||||||||||||

| Quantity cycle count | You use this field to indicate the number of times that you

want to count the stock item during the year. When you use the Stock Take Selection program to select stock items for a stock take, you can indicate that you only want to include items with a specific quantity cycle count in a stock take. It can also be used as a selection criterion for reporting purposes. |

||||||||||||||||||||||||||||||||||||||||

| ABC analysis required | Select this to indicate that you want to include the stock

item in the calculations performed by the ABC Analysis

program (the program prints a list of stock items in descending

order of usage value, based on the cost value of stock used -

issued and/or sold - over the last 12 months). The report indicates which are your most used and least used items, enabling you to determine what quantities of selected stock items should be included in your inventory. |

||||||||||||||||||||||||||||||||||||||||

| Field | Description | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Master production schedule |

|

||||||||||||||||||||

| Gross requirement rule | This is used by the Master Production Schedule

(Requirements Planning) to indicate how you want to calculate the

demand for a component prior to netting off on hand inventory and

scheduled receipts. It is used to calculate the projected

available stock and the suggested build

schedule.

|

||||||||||||||||||||

| Percent yield | This indicates the percentage of an item that is lost in

the manufacturing process so that a shortfall in actual production

does not cause an unexpected inability to meet demand on time.

This field applies only to MPS items and is used in the MPS Review program to calculate the gross requirement. For example: If a stock code has a percent yield of 50 and in the MPS Review program there is a net requirement of 10, the MPS Review program uses the yield percentage to calculate a gross requirement of 20 in order to meet the demand of 10. |

||||||||||||||||||||

| Manufacturing options | |||||||||||||||||||||

| Manufacturing quantity basis | This indicates the basis of the elapsed time calculated against work centers or cost centers. | ||||||||||||||||||||

| Economic batch quantity | This uses the economic batch quantity as the manufacturing quantity basis. | ||||||||||||||||||||

| Pan size | This uses the pan size as the manufacturing quantity basis. | ||||||||||||||||||||

| Floorstock | This indicates whether the stock item relates to an

inexpensive production part held in the factory from which

production workers can draw without requisitions. Floorstock items must be stocked in the warehouse defined as the floorstock warehouse (WIP Setup).

|

||||||||||||||||||||

| Include in relationship validation | Select this to include the stock item in the processing performed by the Relationship Validation program. | ||||||||||||||||||||

| Soft phantom | If you select this option and the item is attached to a

bill of materials as a component, then it will act similar to a

phantom part (i.e. the item itself is not attached to the job as a

material allocation, but it explodes through and brings its

components in as allocations). You can, however, create a job for

the item, stock it and sell it. When a soft phantom item is used as an allocation, it is exploded into its component parts, but its labor costs are not inherited by the parent part. In addition, sub jobs are not allowed for the soft phantom component. When used as a parent part, the soft phantom item is treated as a normal stock item with the following exceptions:

Soft phantoms can only have a Part category of Made-in, Bought-out or Subcontracted. |

||||||||||||||||||||

| Batch bill of material | Select this if a parent part has components by percentage

instead of quantity (i.e. the wet weight percentage of the parent

must be used instead of the quantity per for the components). The

specific gravity of the parent and component part(s) must be

specified.

|

||||||||||||||||||||

| Manufacture lead time |

This indicates the number of days it takes to manufacture a made-in stock item, assuming that all the raw materials are available. It is the longest cumulative manufacturing time, established from the sum of the elapsed time and inter-operation movement time for all levels of the bill of materials (i.e. the manufacturing lead time is calculated according to the operation times). For make-to-order items, the manufacturing lead time is the total time between the release of an order to the production process and shipment to the customer. For make-to-stock items, it is the length of time between the release of an order to the production process and receipt into inventory. For made-in items, you use the Lead Time Calculation program to calculate and update the lead time. The program calculates a ratio of working to non-working days and applies this when calculating the lead time for an item. This means that you do not need to buffer the lead time for made in items if you are using the Lead Time Calculation program to update this field. |

||||||||||||||||||||

| Planner | This indicates the person in a company responsible for

planning the manufacture of made-in stock items. You can use the planner as a selection criterion in various Requirements Planning reports. |

||||||||||||||||||||

| Planner name | This indicates the name of the selected planner. | ||||||||||||||||||||

| Resource | This indicates the parent of a resource structure of

critical resources for the stock code. It is the default resource

parent which can be changed within the Build Schedule Maintenance

program. This resource parent is applied only to new build schedules; existing build schedules must be maintained to reflect the resource parent. The resource code is used by the Resource Planning system and is validated only if the Requirements Planning module is installed. |

||||||||||||||||||||

| Resource description | This indicates the description for the resource code selected. | ||||||||||||||||||||

| WIP ledger control account |

This indicates the default account to which you want to post the value of work in progress when a job is created for this stock item. If not defined against the stock item, then the WIP ledger control account (General Ledger Integration) is used as the default instead. However, at the time of creating the job the ledger code entered at the WIP ledger code field overrides these defaults. This field is validated if Inventory is linked to General Ledger. |

||||||||||||||||||||

| WIP ledger control description | This indicates the description for the WIP ledger code selected. | ||||||||||||||||||||

| Default job classification | This indicates the default job classification assigned to

the job. Job classifications enable you to group your jobs according to similar characteristics. In addition, you can optionally specify that job numbering must take place according to the job classification (WIP Setup). You can also configure security access settings by job classification, to restrict the unauthorized processing of jobs and allocations (i.e. viewing, adding, changing, importing, canceling and posting). |

||||||||||||||||||||

| Default job classification description | This indicates the description for the job classification code selected. | ||||||||||||||||||||

| Field | Description | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Pricing | |||||||||||||

| Pricing category | (Extended pricing only) This establishes the price or discount code applicable to the stock code (depending on the pricing method) by locating the corresponding entry in the customer's price category/code table. For example: When defining a pricing category of E against a stock code, the price/discount code entered against E on the customer's price category/code table is the code that is applied when selling items with that pricing category to the customer. |

||||||||||||

| Pricing method |

(See also: Pricing and Discounts). |

||||||||||||

| List price |

This indicates the list price for the item. Discounts for the stock code can be based on this price during sales order entry processing.

|

||||||||||||

| List price basis | This indicates the unit of measure on which the first selling price of the stock item is based. | ||||||||||||

| Commission code |

This indicates the percentage of commission you want to apply against a sale of the stock item, if the commission is based on the price for the stock item (Sales Order Setup). An entry of 0 indicates that you do not want to calculate commission. |

||||||||||||

| Currency | |||||||||||||

| List price code | This indicates the standard price code for the stock item

on which discounts can be based during sales order entry

processing. This can be blank if you enabled the Allow blank list price codes setup option (Inventory Setup). The List price code basis applies the discount percentage to the list price held against the stock item only if the stock code Pricing method is set to Discounted. The stock code must exist before the price code can be captured, so this field is only enabled when maintaining a stock code. |

||||||||||||

| Minimum % above cost | This indicates the minimum percentage by which the price of

stocked order lines must exceed the cost of the item. If defined

as zero against the stock item, then the minimum price percentage

above cost defined within the Sales Order Setup program is

used. The minimum percentage above cost defined against the item is used only if you indicated that the stock code margin (instead of the company margin) must be used (Sales Order Setup). You can indicate whether the margin check is based on the gross or net value and you can override this margin if you have indicated that this override is allowed (Sales Order Setup). |

||||||||||||

| Tax codes | |||||||||||||

| Tax code | This is the default tax code used for sales orders,

purchase orders and requisitions created for the item. Tax codes are maintained using the Tax Codes Setup program. The Descriptive tax code must be used if defined (Descriptive Tax Codes). If the customer is defined as taxable, then the rate for the tax code entered in this field is applied by the Sales Order Entry program when the item is sold to that customer. If the customer is defined as non-taxable (AR Customer Maintenance) then this tax code is ignored and the customer is not charged tax on the item.

|

||||||||||||

| Tax code description | This indicates the description for the tax code selected and is displayed for information purposes. | ||||||||||||

| Tax code rate | This indicates the rate defined against the tax code selected and is displayed for information purposes. | ||||||||||||

| Other tax code | This indicates an alternative tax code for the stock item

which is used only if the stock item is sold to a customer against

whom you indicated that the Other tax code

must be used (AR Customer Maintenance). The Descriptive tax code must be used if defined (Descriptive Tax Codes). This enables you to define different rates of tax for this item and then apply these rates to different customers when using the Sales Order Entry program. You need to select the option: Other tax code against those customers for whom you want to apply the Other tax code rate (AR Customer Maintenance). For example:

Assume that only selected customers purchase the item with inclusive tax.

When processing sales orders for the item:

When processing requisitions and purchase orders for the item, the default tax code or all suppliers will be Tax code C - 14% exclusive. |

||||||||||||

| Other tax code rate | This indicates the rate defined against the other tax code selected and is displayed for information purposes. | ||||||||||||

| Other tax code description | This indicates the description for the other tax code selected and is displayed for information purposes. | ||||||||||||

| Sales options | |||||||||||||

| Kit type | This indicates whether the stock code is used in a single

level bill of materials. Sales order entry always uses route 0. To sell Kit type items, therefore, route 0 must be used for the bill of materials.

|

||||||||||||

| Demand time fence | This indicates the number of days from the time an order is

placed until it can be fulfilled. It is used in the calculations performed by the Master Production Schedule. An entry of 0 means the field is ignored, or the stock code is not a make-to-order item. |

||||||||||||

| Country of origin | (EC VAT purposes) This is required for reporting supplementary declarations. The entry here is used as the default unless a nationality code is defined against the warehouse (in which case that will be used as the default country of origin). |

||||||||||||

| Country of origin description | This indicates the description for the country of origin entered. | ||||||||||||

| Distribution warehouse |

This is used as a possible source of supply when importing orders into SYSPRO (using the Post to a Sales Order business object) if no warehouse is specified against individual stock lines, or on the order header. If left blank, then the warehouse specified at the Warehouse to use field is used as the default. You can also indicate that this warehouse must be used as the default warehouse for displaying quantities when browsing on stock items (Inventory Setup). |

||||||||||||

| Distribution warehouse description | This indicates the description for the distribution warehouse selected. | ||||||||||||

| Make to order item | This indicates that the stock code is only manufactured if

a sales order has been placed for the item. Otherwise the item is

manufactured according to the gross requirements rule, regardless

of whether a sales order exists.

|

||||||||||||

| Returnable item | This is an item usually sold together with a stock item and

typically returned for credit (e.g. a re-usable container, crate

or pallet). When a returnable item is sold, the warehouse quantity is reduced and a journal is created. If you enabled the Multiple bins setup option (Inventory Setup) then stock of a returnable item is always depleted from the bin that has the same name as the warehouse. Stock must be transferred into this bin manually. You define the warehouse from which returnable items are depleted at the Returnable item setup option (Sales Order Setup). If you select this option, then the Maximum number of decimals for the returnable item must be set to zero. A returnable item cannot be a kit part, traceable, serialized, ECC-controlled, or defined with unit quantity processing.

|

||||||||||||

| Sales weight analysis |

|

||||||||||||

| Canadian GST | (CAN only)

|

||||||||||||

| GST code | This code determines the GST percentage assigned to the stock item (Browse on Tax Codes). | ||||||||||||

| GST code rate |

This indicates the rate defined against the GST code and is displayed for information purposes. |

||||||||||||

| GST code description |

This indicates the description for the GST code and is displayed for information purposes. |

||||||||||||

| GST included in price |

This indicates whether the calculated tax amount must be included in the price of the item during sales order processing. |

||||||||||||

| Trade promotion pricing |

Trade promotion prices can be applied to specific stock items, product classes, product groups or departments. This means that different prices can be defined for a single stock item. The options on this tab enable you to select the trade promotions price that must apply to this specific stock item. For example: You used the Browse on Prices program to define the following three trade promotion price breaks for stock item A100:

Stock item A100 belongs to product group Bicycles and to product class BA, so all these prices apply to stock item A100. You use the Price type and Price basis options against the stock item to select which price you want to apply for stock item A100. Therefore, if you wanted to apply price break 1, then you select Price type = Product group and Price basis = Quantity. Similarly, if you wanted to apply price break 2, then you select Price type = Stock code and Price basis = Mass.

|

||||||||||||

| Product group | You use this field to link the stock item to a specific product group. Product groups provide a facility to group items together in a more specific or general manner than product classes. Product groups are maintained using the Product Group Maintenance program. | ||||||||||||

| Price type | You use this field to indicate the basis of your trade

promotions price breaks.

|

||||||||||||

| Price basis | You use this field to indicate the unit of measure on which

the price break is based.

|

||||||||||||

| Alternate stock codes | Alternate stock codes can be used to substitute stock items when the required item is out of stock. | ||||||||||||

| Automatic apply | This automatically replaces an item on a sales order with alternate stock (defined in Alternate Stock Codes) when the stock for the original item is unavailable. | ||||||||||||

| Deplete oldest first | If FIFO valuation is enabled, then you can select this to

consume the oldest alternate stock codes first. The priority

defined against the alternate stock codes (Alternate Stock Codes) determines the sequence of the

substitution. If two stock codes have the same priority then they will be consumed alphabetically. This will continue until either the order quantity is depleted or the substitution quantity is depleted. If you are not able to fulfill all order quantities after using all the alternate stock codes, then the order quantity is reduced to the quantity available (line-cut). |

||||||||||||

| Reduce order quantity | This reduces the order quantity to the alternate stock code

quantity available (i.e. the order quantity is reduced so that the

order can be fulfilled). The conversion factor defined against the

alternate stock code (Alternate Stock Codes) is used to

determine the quantity of alternate stock to use. If the original order quantity is not fulfilled, then the order quantity on the original sales order line is reduced. |

||||||||||||

If you have enabled the Multi-language for document printing setup option (System Setup) then you can use this pane to add descriptions and long descriptions for the stock item in different languages.

| Field | Description |

|---|---|

| Language | Select the language in which you want to capture text for the Description or Long Description fields. |

| Text type | Indicate whether the text is for the Description or Long Description. |

| Text | Enter the foreign text required for the stock description or long description. |

| Field | Description | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Serial tracking | |||||||||||||||||||||

| Serial tracking method |

|

||||||||||||||||||||

| Record serial numbers | Indicate the point at which you want to capture serial

numbers.

|

||||||||||||||||||||

| Lot traceability control | |||||||||||||||||||||

| Lot traceability |

|

||||||||||||||||||||

| Traceable | These options are only enabled if you selected the

Lot traceability - Traceable

option.

|

||||||||||||||||||||

| Allow issues from multiple lots | Select this to be able to issue this stock item from more than one lot during sales order entry and issues to jobs. | ||||||||||||||||||||

| Lot shelf life (days) | This indicates the number of days before the expiry of a traceable item. This is used when performing a two-stage receipt of the item into stock. | ||||||||||||||||||||

| Engineering change control | |||||||||||||||||||||

| ECC controlled | This indicates that the stock item is regulated by the

Engineering Change Control system. Any changes to the item within a bill of materials can only be made by means of an engineering change order. You cannot set a stock item to be ECC-controlled if it is in transit between warehouses or currently forms part of a stock take to be ECC-controlled. Engineering change control tracking information (revisions/releases) for an item is only retained from the time the item is set to be ECC-controlled. You can use the Set ECC Control for Stock Code program to set multiple stock items to be ECC-controlled. |

||||||||||||||||||||

| Responsible ECC user | This indicates the engineering user assigned to the stock

item. This enables you to notify the appropriate person(s) of changes to the status of stock codes under their control. If this field is left blank, then the default ECC user configured within the Bill of Materials Setup program is used. |

||||||||||||||||||||

| Revision | Enter the current revision for the stock item. The revision is used to indicate design changes made to the stock item. The format can be defined as Alpha or Numeric at the Release numbering setup option (Bill of Materials Setup).

|

||||||||||||||||||||

| Release | Enter the current release for the stock item. The release is used to indicate minor design changes to the stock item. The format can be defined as Alpha or Numeric at the Release numbering setup option (Bill of Materials Setup).

|

||||||||||||||||||||

| Manual serial numbers | These options are only available if your serial tracking

method above is defined as manual and you selected the

By stock code option at the Manual

serial number tracking setup option (Inventory Setup). Tracking manual serial numbers at stock code level enables you to create sequential ranges of manual serial numbers for each serialized stock item. Ranges of serial numbers are created according to the Prefix and Next suffix defined against each individual serialized stock item. For example:

Creating a range of three manual serial numbers will be generated as: 22001, 22002 and 22003. The next range of manual serials numbers created would begin with 22004.

|

||||||||||||||||||||

| Manual serial prefix | Enter the character(s) that must form the start of manual serial numbers generated for the stock item. | ||||||||||||||||||||

| Manual serial next suffix | Enter the number to append to the prefix, to form the next

serial number in a range of manual serial numbers for this stock

item. The system updates the Next suffix whenever a new serial number is created using the prefix.

|

||||||||||||||||||||

This pane displays any custom form data defined against the key field (see Custom Form Entry).

| Field | Description |

|---|---|

| Add Fields to this Form | Opens the Field Selector for Form window

enabling you to add custom fields, master fields or scripted fields

to the form. This option is not displayed once you have added a field to the form, but can be accessed using the Field Selector function from the context menu (Alt+F7). |

| Field | Description |

|---|---|

| Costing | These fields are disabled if you enabled the

Apply warehouse BOM costs setup option

(Inventory Setup). You enter BOM costs against the warehouse using the Costing function of the Warehouses for Stock Code program. |

| BOM operations cost | This indicates the total cost of all operations for items included in the stock item's structure. It is updated for all parent parts by the Cost Implosion program, unless you selected the Manualcost option. |

| BOM material cost |

This indicates the total cost of all materials for items included in the stock item's structure. It is updated for all parent parts by the Cost Implosion program, unless you selected the Manualcost option. |

| BOM fixed overhead |

This indicates the total cost of all fixed overheads for items included in the stock item's structure. It is updated for all parent parts by the Cost Implosion program, unless you selected the Manualcost option. |

| BOM variable overhead |

This indicates the total cost of all variable overheads for items included in the stock item's structure. It is updated for all parent parts by the Cost Implosion program, unless you selected the Manualcost option. |

| BOM subcontract cost |

This indicates the total cost of all subcontract operations for items included in the stock item's structure. It is updated for all parent parts by the Cost Implosion program, unless you selected the Manualcost option. This field is only enabled if you selected the Split subcontract operation costs from material costs setup option (Bill of Materials Setup). |

| Activity based costing required | This enables you to more accurately accumulate overhead

costs to specific products by applying these costs at the

points of transition in the procurement, manufacturing and

sales cycle. This cannot be applied to co-products or notional parts. The Activity based costing system required setup option must be enabled (Bill of Materials Setup). (See also: Activity Based Costing Introduction). |

| Manual cost | You cannot access this field if you enabled the

Apply warehouse BOM costs setup option

(Inventory Setup). Select this to updated costs manually as required (i.e. the Cost Implosion program will not be used to update the BOM costs defined against this stock item). |

| User defined | |

| User defined 1-5 |

You use these fields to indicate extra information you want to assign to the item. You can specify your own wording for these fields using the Inventory Setup program. |

Electronic Signatures provide security access, transaction logging and event triggering. This enables you to increase control over your system changes.

Access to the following eSignature transactions within this program can be restricted at Operator, Group, Role or Company level. You configure this using the Electronic Signatures program.

| eSignature Transaction | Description |

|---|---|

| Inv Stock code added |

Controls access to the Add or New function in the Browse on Stock Codes, Product Configurator Wizard, Copy Stock Code, Stock Code Maintenance, Quotation Entry, Estimates, Copy to Estimate and Quotation Stock Part Creation programs. |

| Inv Stock code changed |

Controls access to the Change function in the Browse on Stock Codes, Maintain Hold Status, Stock Code Maintenance, Quotation Entry, Estimates, Copy to Estimate and Quotation Stock Part Creation programs. |

| Inv Stock code deleted |

Controls access to the Delete function in the Inventory Stock Codes, Inventory Stock Code Delete, Inventory Stock Code Maintenance, Quotation Entry, Quotation Estimates, Quotation Copy to Estimates and Quotation Stock Part and Str Creation programs. |

-

The stock code can be defined as alphanumeric or numeric. If defined as numeric, data is right-aligned with preceding zeros and the size of the entry field is 15 characters. If defined as alphanumeric, data is left-aligned with trailing blanks and the size of the entry field is 30 characters.

You should not change stock codes once you have started using them, as this could compromise the access to your data.

For example: If you capture stock codes using an alpha key and then change the key to be numeric, then you will be unable to access any stock codes that were captured with the alpha key. If you change your key from numeric to alphanumeric, then you can only access any previously-entered numeric codes by entering the code with leading zeros.

-

Changing any of the stock code's units of measure (or factors associated with a uom) after the stock code has been used in any transactions can lead to unpredictable results in the system.

-

You cannot maintain an ECC stock item if it has been put on hold in the Change Orders program (i.e. If the Hold stock maintenance checkbox is ticked in the Affected Items listview of the Change Orders program).

The message: 'Stock code xxxx held by engineering change control' is displayed, where xxxx is the actual code.

-

If stock code deletion options are not defined in the Inventory Setup program, then you cannot delete a stock code if the item:

- is used in a configuration;

- is attached to a customer/stock code or supplier/stock code cross reference;

-

has a valid ECC drawing number;

-

is attached to an LCT bill;

-

is a temporary stock code with sales and/or purchase order details; or

-

is either on a full or partial hold.

![[Note]](images/note.png)

If you configured the options against which a stock code may be deleted, then some of the these checks can be bypassed and the codes deleted.

-

Regardless of stock code deletion options being defined, you cannot delete a stock code if:

- operations are held against the stock item;

- the stock item is a parent or component part in a bill of materials structure;

- there are outstanding jobs, purchase orders or sales orders for the stock item;

- there is an on hand quantity of the stock item in any warehouse;

- movements exist for the item in the current or two prior periods;

- warehouse records exist for the item;

- the stock item is a notional part to which a structure/routing or co-product is attached;

- a stock take is in progress affecting any warehouse to which the stock item has been assigned; or

-

the stock item is defined as traceable.

![[Note]](images/note.png)

Business rules dictate that lot traceable items must remain in the system indefinitely. If lots exist against a traceable item, it can never be deleted, regardless of whether these lots are archived.

To prevent transactions from being processed against an item, you can place the item on full hold.

-

If you select to delete a stock code which has one or more of the above mentioned restrictions, then the Inventory Stock Code Delete screen is displayed with a list applicable error messages.

-

If you delete a stock item, then all movement records associated with the item are removed.

-

The maximum number of decimals for manual serial items can only be zero

This is displayed when an item has a Serial tracking method of Manual serial and the Maximum number of decimals is not set to zero.

With a manual serial, the serial number is unique to a specific item (e.g. a watch) unlike a batch serialised item, where the serial can exist for any quantity of an item (e.g. a roll of wire).

Operator access to the following activities within this program can be restricted. You configure this using the Operator Maintenance program.

| Activity | Description |

|---|---|

| Inv Add stock code | Controls whether an operator can add (or copy) a stock code using the Stock Code Maintenance or Browse on Stock Codes programs. |

| Inv Stock code on hold | Controls whether an operator can change the hold status of a stock item within the Browse on Stock Codes program. |

| Inv Change stock code | Controls whether an operator can change stock code details (including notes) within the Stock Code Maintenance program. |

Operator access to the following fields within this program can be restricted. You configure this using the Security Fields function of the Operator Maintenance program.

| Field | Description |

|---|---|

| INV Text technical spec | Controls whether an operator can edit technical specification text against a stock item. |

| INV Text sales order | Controls whether an operator can edit sales order text against a stock item. |

| INV Text purchase order | Controls whether an operator can edit purchase order text against a stock item. |

| INV Text job narrations | Controls whether an operator can edit job narration text against a stock item. |

| INV Text inspections | Controls whether an operator can edit inspection text against a stock item. |

| INV Text dangerous goods | Controls whether an operator can edit dangerous goods text against a stock item. |

-

You can generate a report of stock items added, deleted or changed if you enable the Amendment journals required setup option (Inventory Setup).

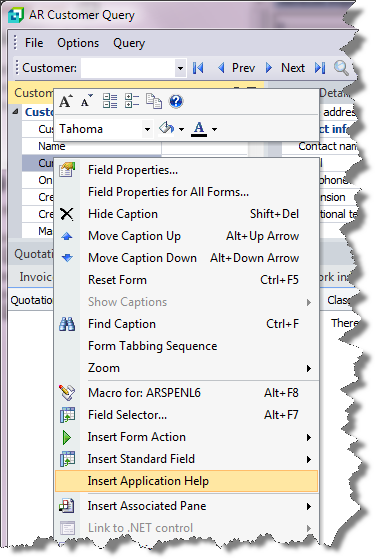

Inserting Application Help

You would typically follow this procedure to display help for the current program in a customized pane that can be pinned to the program window.

Information includes step-by-step instructions for the various functions available within the program, including a brief overview of what the program does, what setup options are required and how to personalize the program.

-

Open the program for which you want to insert application help into a customized pane.

This functionality is only available for a program that has panes.

-

Right-click any form field.

You can also click the triangle menu icon that appears in the title area of a pane.

-

Select Insert Application Help from the context-sensitive menu.

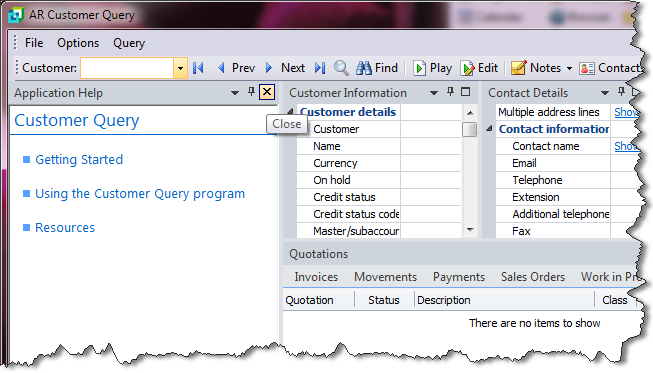

The application help appears in a pane within your program. You can reposition the pane using the docking stickers or pin it to the program window.

Removing the Application Help pane

If you no longer want to display application help in a pane for your current program, you can simply remove it.

-

Select the Close icon in the right-hand corner of the application help pane.

-

Confirm that you want to delete the pane.

![[Warning]](images/warning.png)