You use this program to evaluate and resolve customer deductions recorded at the time of processing customer payments and receipts using the Payments and Adjustments program.

- Toolbar and menu

- Deductions Review Criteria

- Payment Customer Details

- Deductions Review

- Resolve

- Reclassify

- Automatic Write Off

- Reinstate Deduction

- Transaction Results

- Notes and warnings

| Field | Description |

|---|---|

| Start Review | Select this to display the deductions you selected for review. |

| Change Criteria | Select this to reset the selections in the Deductions Review Criteria pane enabling you to indicate new criteria according to which you want to review deductions. |

| Field | Description |

|---|---|

| Payment customer options | |

| Payment customer selection | Indicate the payment customer(s) you want to include in

the review. Payment customers are the customers against whom the payment deductions were recorded using the Payments and Adjustments program. |

| Payment customer | Enter the code of the payment customer for whom you

want to review deductions. This only applies when you select to review deductions for a single customer. |

| Include in selection | |

| Deduction customers | Indicate the deduction customers you want to include in

the review. Deduction customers are the customers who initiated the deduction and can vary from payment customers. This typically occurs when the head office of a company pays all accounts on behalf of their branches or a single corporate payment is made for multiple SYSPRO customers. |

| Deduction codes | Indicate the deduction code(s) to include in the review. |

| Deduction amounts | Indicate the deduction amount(s) to include in the review. |

| Follow up dates | Indicate the follow up date(s) for which to include deductions in the review. The follow up date is the date specified against a deduction by an operator when the deduction was last reviewed. This may be the date for next review or action. |

| Payment dates | Indicate the payment date(s) for which to include deductions in the review. |

| Status selection | |

| Select 'Open' status | Select this to review deductions in an open status. |

| Select 'Closed' status | Select this to review deductions in a closed status. |

| Currency selection | |

| Currency | Enter the currency for which you want to review deductions. |

This displays details of the payment customer.

| Field | Description |

|---|---|

| Payment customer | This indicates the payment customer for which you are reviewing the deductions. This is only displayed if you selected to review deductions for a single payment customer. |

| Phone | This indicates the telephone number defined against the payment customer displayed in the Payment customer field. |

| This indicates the email address defined against the payment customer displayed in the Payment customer field. | |

| Area | This indicates the geographic area defined against the payment customer displayed in the Payment customer field. |

| Salesperson | This indicates the salesperson defined against the payment customer displayed in the Payment customer field. |

This displays the deductions according to your selections in the Deductions Review Criteria pane.

| Field | Description |

|---|---|

| Resolve | Select this to resolve the currently highlighted deduction by either resolving it, writing it off or matching it against promotions. |

| Reclassify | Select this to allocate the currently highlighted deduction to one or more different deduction codes. Trade Promotion journals are created. |

| Notes | Select this to use the Text Editor program to attach free format comments to the currently highlighted deduction line. In addition, you can define a follow up date on which the deduction must next be reviewed. |

| Auto Write-off | Select this to write off all deductions below a specific deduction amount. |

| Reinstate AR | Select this to reinstate the deduction by creating a

debit note to the customer's account. You would select this

option when you want to recharge the customer for the

deduction amount as you do not agree that the deduction was

valid. The Product Class entered during the reinstatement process determines the GL Accounts Receivable and Sales Revenue accounts to use when the Debit Note is processed in the SYSPRO AR Invoice Register. Note that two GL Journal entries are made to record the movement of the unauthorized Deduction amount back into Accounts Receivable for the customer; one to reduce the original sale to reflect the deduction and one to record the reinstated sale. To achieve this, a Deduction Code for use with the Reinstate AR function needs to be set up. A suggested Deduction Code for use only with Reinstated AR would have a GL account for the desired Reinstated AR in the Deduction GL Account field, and a Contra Sales account in the Resolution GL Account field. If the deduction was originally recorded under a different Deduction Code, the deduction will need to be reclassified before Reinstating. The AR Reinstatement Journal entry created by TPM debits the AR account set up to track Payment Deductions and credits the Sales Contra account. This can be setup to directly reduce the Sales account if desired by entering the Sales GL account in the Resolution field of the Deduction Code. The Debit Note GL Journal entry created by TPM debits the AR account and credits the Sales account from the Product Code entered during the Reinstate Deduction process. |

This screen is displayed when you select the Resolve function from the Deductions Review pane, allowing you to resolve, write off or to offset deductions against promotions.

Resolving a deduction has no effect on the Sales Analysis files/tables.

![[Note]](images/note.png)

|

|

|

Once you have processed a resolution, a write-off or a promotion accrual offset, the transaction journal is automatically created. The corresponding General Ledger journal is created and posted according to your selections for Accounts Receivable on the General Ledger tab of the General Ledger Integration program. Refer to Effect of automation level selected. Refer to Trade Promotions Integration for additional information on the journals created. |

|

| Field | Description |

|---|---|

| Post | Select this to process the resolution, write-off or promotion offset. |

| Deduction resolution details | |

| Payment customer | This indicates the payment customer for the deduction you are resolving. This is the customer from whom you received the payment that included the deduction. |

| Deduction customer | This indicates the deduction customer for the deduction you are resolving. This is the customer who took the deduction. This may or may not be the same customer from whom you received the payment (i.e. the payment customer). |

| Deduction code | This indicates the deduction code for the deduction you are resolving. |

| Receivable | This indicates the General Ledger account code defined in the Deductions field of the deduction code (Browse on Deduction Codes) at the time the customer payment was processed. This is typically the Accounts Receivable Deduction Control Account. |

| Reference | Enter a notation for the deduction resolution. |

| Follow up date | This indicates the date on which the deduction must be reviewed or followed up on. This is defined using the Notes function. |

| Notes | Select this to use the Text Editor program to attach free format comments to the currently highlighted deduction line. In addition, you can define a follow up date on which the deduction must next be reviewed. |

| Amount | This indicates the current undistributed amount for the deduction. This value decreases as you resolve, write-off or offset amounts against promotions. |

| Remaining amount | |

| Posting information | |

| Period | This indicates the accounting period and year into which the transaction will be posted. |

| Change Period | Select this to use the Change Posting Period program to change the ledger period to which the transaction must be posted. |

| Field | Description |

|---|---|

| Resolution Details | |

| Type | These options enable you to resolve or write off part

or all of a deduction. Essentially, resolving a deduction is the same as writing it off. The deduction amount for a resolved deduction is typically more significant than the amount for a write-off and the reasons for resolution will typically be more varied than for a write-off. You can define different deduction codes for resolved deductions, enabling you to process them to different ledger codes. In addition, you can define different resolution codes for resolved deductions, enabling you to analyse them in greater detail. You would typically write deductions off for insignificant amounts and in depth analysis would not be required. You could, therefore use a single deduction code and a single resolution code for write-offs. These options enable you to offset part or all of the deduction against a promotion. |

| Deduction code | This indicates the deduction code that must be used. This determines the General Ledger accounts to which the amount must be debited/to which the write-off must be posted/offset the promotion. |

| Amount | Enter the amount. This amount cannot exceed the amount displayed in the Undistributed field, or the accrued amount available against the promotion. |

| Resolution code | This indicates the resolution code to use. This is used for reporting purposes and is mandatory. |

| Promotion code | Enter the code of the promotion against which you want to offset the deduction. |

| Accrual type | You use this field to enter the accrual type against which you want to offset the deduction. |

This screen is displayed when you select the Reclassify function from the Deductions Review pane.

Reclassifying a deduction has no effect on the Sales Analysis files/tables.

The options enable you to reclassify all or part of a deduction.

You typically reclassify a deduction if it was incorrectly recorded in the Payments and Adjustments process.

A journal is created to reduce the balance in the ledger code defined against the original deduction code and to increase the balance in the ledger account defined against the new deduction code. Refer to Trade Promotions Integration for additional information on the journals created.

The transaction journal is automatically created. The corresponding General Ledger journal is created and posted according to your selections for Accounts Receivable on the General Ledger tab of the General Ledger Integration program. Refer to Effect of automation level selected.

| Field | Description |

|---|---|

| Post | Select this to reclassify the deduction code according to the entries listed. |

| Reclassification details | |

| Payment customer | This indicates the payment customer for the deduction you are reclassifying. This is the customer from whom you received the payment that included the deduction. |

| Deduction customer | This indicates the deduction customer for the deduction you are reclassifying. This is the customer who took the deduction. This may or may not be the same customer from whom you received the payment (i.e. the payment customer). |

| Deduction code | This indicates the current deduction code for the

deduction you are reclassifying. The balance in the General Ledger code defined against this deduction code is reduced by the amount specified in the Amount field when you select the OK function. |

| Amount | This indicates the total deduction amount for the selected line in the Deduction Review listview. |

| Remaining amount | This indicates the amount which is available for

reclassifying. This value is reduced each time you select the Add function to add a reclassification line to the list of reclassifications. |

| Field | Description |

|---|---|

| Customer | This defaults to the customer who took the deduction.

This may or may not be the same customer from whom you

received the payment (i.e. the payment customer). For

example, the payment customer may have been a master

account, but the deduction customer was a sub

account. This field is only enabled if the customer is a master or sub account or you have access to the activity: SO Change Trade promotions deduction customer in review (Operator Maintenance - Security tab). For master and sub accounts, this field can be changed to the master account or any sub account in the grouping even if the above activity is denied. |

| Deduction code | You use this field to enter the deduction code to

which you want to reclassify the deduction. You can reclassify a deduction to the same deduction code and use the Amount field to split the deduction amount into smaller parts. The balance in the General Ledger code defined against this deduction code is increased by the amount specified in the Amount field when you select the OK function. |

| Amount | You use this field to indicate the amount of the

deduction you want to reclassify. This amount cannot be negative and cannot exceed the value in the Remaining amount field. All or part of the deduction can be reclassified. |

| Reference | You use this field to enter a notation for the reclassification. |

| Follow up date | This indicates the date on which the deduction must be reviewed or followed up on. |

| Copy notes | Select this to copy any notes defined against the original deduction code to the new deduction code. |

This screen is displayed when you select the Auto Write Off function from the Deductions Review pane.

The options enable you to automatically write off deduction amounts below a specified value for all open deductions on file.

Writing off a deduction has no effect on the Sales Analysis files/tables.

![[Note]](images/note.png)

|

|

|

Once you have processed an automatic write-off, the transaction journal is automatically created. The corresponding General Ledger journal is created and posted according to your selections for Accounts Receivable on the General Ledger tab of the General Ledger Integration program. Refer to Effect of automation level selected. Refer to Trade Promotions Integration for additional information on the journals created. |

|

| Field | Description | ||||

|---|---|---|---|---|---|

| Post | Select this to write all deductions off that have an

amount less than the amount entered in the Write off

deduction less than field.

|

||||

| Automatic write off details | |||||

| Deductions less than | You use this field to enter the amount below which

deductions can be written off.

|

||||

| Resolution code | You use this field to enter the resolution code for the

write offs. This field is mandatory. This defaults to the entry in the Deduction resolution code - Write off field (Trade Promotion Setup - Defaults tab), but can be changed. |

||||

| Posting information | |||||

| Posting period | This indicates the financial period and year in which the write-offs will be processed. | ||||

| Change Period | Select this to use the Change Posting Period program to change the period to which the write-offs must be posted. | ||||

This screen is displayed when you select the Reinstate AR function from the Deductions Review pane.

The options on this screen enable you to reverse the deduction by processing a debit note to the customer's account. You would typically reinstate a deduction when you have established that the deduction was incorrectly taken by the customer. When you reinstate the deduction you can disallow all or part of the deduction taken by the customer.

![[Note]](images/note.png)

|

|

|

|

| Field | Description |

|---|---|

| Post | Select this to create the debit note according to the

information you entered. Two sets of journals are created to record the movement of the unauthorized deduction amount back into Accounts Receivable against the customer, reduce the original sale to reflect the deduction and to record the reinstated sale. |

| Deduction details | |

| Customer | This indicates the customer against whom you are reinstating the deduction. |

| Branch | This indicates the branch defined against the customer (Browse on Customers). |

| Deduction code | This indicates the deduction code assigned to the deduction. |

| Receivable | This indicates the General Ledger account code defined in the Deductions field of the deduction code (Browse on Deduction Codes) at the time the customer payment was processed. This is typically be the Accounts Receivable Deduction Control Account. |

| Resolution | This indicates the General Ledger account code defined in the Resolution field of the deduction code (Browse on Deduction Codes) at the time the customer payment was processed. This is the General Ledger expense account to charge when a deduction is resolved for a reason other than a match to a corresponding accrual promotion account. |

| Amount | This indicates the current balance of the deduction. |

| Reinstate details | |

| Document amount | Enter the deduction amount you want to reinstate. This is the total amount (including tax if applicable) at which the debit note will be created. |

| Document date | Enter the date for the debit note which will be created by this transaction. |

| Reference | Enter a notation for the deduction reinstatement. |

| Product class | Enter the product class to use for the transaction. The product class determines the Accounts Receivable and Sales revenue accounts to be used when the debit note is processed using the AR Invoice GL Integration program. |

| Invoice terms | This indicates the invoice terms defined against the customer (Browse on Customers). |

| Geographic area | This indicates the geographic area code defined against the customer (Browse on Customers). |

| Salesperson | This indicates the salesperson code defined against the customer (Browse on Customers). |

| Resolution | This indicates the resolution code to use. This is used for reporting purposes. |

| Tax amount | This indicates the taxable portion of the debit note. This is only calculated if the original order was taxable, the customer is defined as taxable (Browse on Customers) and you selected the setup option: Tax included in deductions and accruals (Trade Promotion Setup - Defaults tab). |

-

If the GL analysis required option is enabled for a ledger account used in this program (General Ledger Codes or GL Structure Definition) then the GL Analysis program is displayed when you post the transaction, so that you can enter the analysis details.

The Ask Me Later function is only available when the option: Force GL Analysis - GL journal posting is enabled for the sub-module (General Ledger Integration - General Ledger tab).

General Ledger analysis entries are always distributed in the local currency, regardless of the currency in which the original transaction is processed.

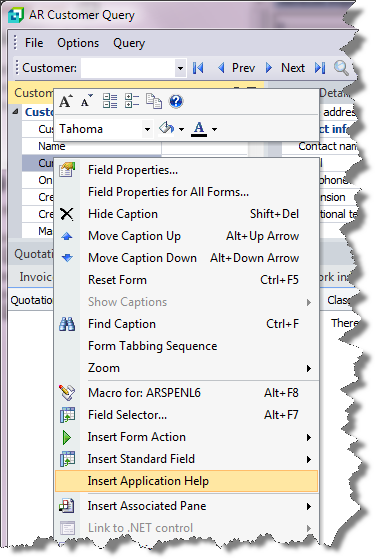

Inserting Application Help

You would typically follow this procedure to display help for the current program in a customized pane that can be pinned to the program window.

Information includes step-by-step instructions for the various functions available within the program, including a brief overview of what the program does, what setup options are required and how to personalize the program.

-

Open the program for which you want to insert application help into a customized pane.

This functionality is only available for a program that has panes.

-

Right-click any form field.

You can also click the triangle menu icon that appears in the title area of a pane.

-

Select Insert Application Help from the context-sensitive menu.

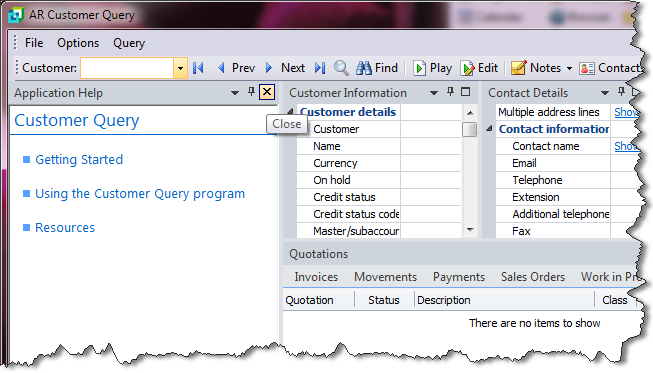

The application help appears in a pane within your program. You can reposition the pane using the docking stickers or pin it to the program window.

Removing the Application Help pane

If you no longer want to display application help in a pane for your current program, you can simply remove it.

-

Select the Close icon in the right-hand corner of the application help pane.

-

Confirm that you want to delete the pane.