You use this program to view the month-to-date totals of your Accounts Receivable module for the current and previous two months (i.e. the totals that are recorded against the AR control record).

The Branch Information menu function enables you to view month-to-date totals of Accounts Receivable information by branch (AR at a Glance by Branch).

Access to this program should only be given to operators who have access to all branches. Any access levels defined for operators are ignored (see Access and Access Control).

| Field | Description |

|---|---|

| Current AR period | The current financial period and year of your Accounts Receivable module. |

| Current GL period | The current financial period and year of your General Ledger module. |

| Next document numbers | If you selected By company at the Invoice numbering setup option (Accounts Receivable Setup) then the next document numbers to be used by the system are displayed in the fields below. |

| Invoices | The next number that will be allocated to the next invoice you process. |

| Credit notes | The next number that will be allocated to the next credit note you process. |

| Debit notes | The next number that will be allocated to the next debit note you process. |

| Next cash journals | |

| Previous year | The next journal number that will be allocated to payment transactions if you process them into the previous year. |

| Current year | The next journal number that will be allocated to payment transactions processed for the current year. |

| Next invoice register | |

| Previous year | The next invoice register number that will be allocated to invoicing transactions if you process them into the previous year. |

| Current year | The next invoice register number to be allocated to invoicing transactions processed for the current year. |

| Field | Description | ||||

|---|---|---|---|---|---|

| Opening balance | The opening balance for the Accounts Receivable module

as of the beginning of the month you selected to view.

It should be equal to the closing balance of the previous month. The value at the Balance forward field includes invoices captured using the AR Initial Invoice Capture program. It is updated automatically with invoices captured using this program. The opening balance for a branch is calculated as the closing balance less the sum of all the transactions for the period for the branch. |

||||

| MTD sales | The total value to date of sales processed against customer accounts for the month you selected to view. This value is taken from the sales transaction invoice summary table/file. This value excludes permanent entries, balance take-ons and IBT sales and tax. | ||||

| MTD IBTs | The total value to date of inter-branch transfers processed using the Sales Order Entry program for the month you selected to view. This value excludes tax. | ||||

| MTD tax | The total value to date of tax processed against customer accounts for the month you selected to view. This includes the tax portion on sales, adjustments, debit notes and credit notes. This value excludes tax. | ||||

| MTD adjustments |

This indicates the total value to date of:

This value excludes tax. |

||||

| MTD debit notes |

The total value to date of debit notes processed using the AR Invoice Posting program for the month you selected to view. This value excludes tax. |

||||

| MTD credit notes |

The total value to date of credit notes processed using the AR Invoice Posting program for the month you selected to view. This value excludes tax. |

||||

| MTD payments |

The total value to date of payments processed using the Payments and Adjustments program for the month you selected to view. Counter sales deposit refunds, payments from counter sales and deposits applied as payments to customer accounts processed through the Counter Sales program are included. Cash taken in, cash paid out and unapplied deposits taken are excluded. If you are using withholding tax (Tax Options), then withholding tax values are included in the MTD payment amount. |

||||

| MTD revaluation |

The difference in the value of foreign currency invoices which were revalued using the AR Exchange Rate Revaluation program for the month you selected to view. It includes revaluations on all outstanding invoices, debit and credit notes, including finance charge invoices. The revaluation program creates entries with a transaction type = V and a reference of Reval. |

||||

| MTD discounts | The total value to date of settlement discounts processed against customer accounts for the month you selected to view (Payments and Adjustments). | ||||

| MTD bal correction |

The total value of any balance corrections made by the system when you select the Balance function of the AR Period End program.

The following is performed by the Balance function of the AR Period End program:

|

||||

| Closing balance |

The current Accounts Receivable balance to date for the month you selected to view. You can view the details of this total by printing the AR Trial Balance, Summary Credit Management or Credit Management reports for all customers for the relevant month. If the Current AR balance does not equal the total of any of these reports (for all customers), then you need to run the Balance function of the AR Period End program to enable the system to correct the discrepancy. Additionally, if Accounts Receivable is integrated to the General Ledger either in summary or detail (General Ledger Integration) and all Accounts Receivable journals have been posted to the General Ledger, then this total must equal the total of the Accounts Receivable control account(s) in the General Ledger. You also need to ensure that no journals were posted to the Accounts Receivable control account(s) in the General Ledger using the GL Journal Entry program. |

||||

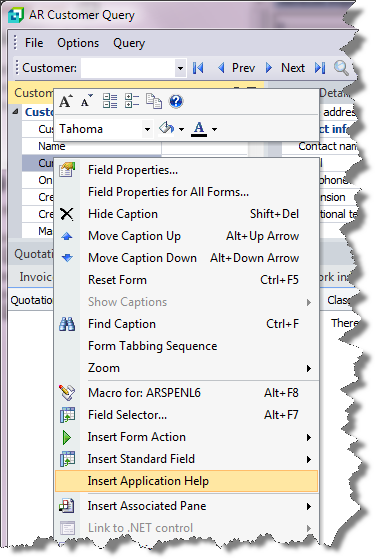

Inserting Application Help

You would typically follow this procedure to display help for the current program in a customized pane that can be pinned to the program window.

Information includes step-by-step instructions for the various functions available within the program, including a brief overview of what the program does, what setup options are required and how to personalize the program.

-

Open the program for which you want to insert application help into a customized pane.

This functionality is only available for a program that has panes.

-

Right-click any form field.

You can also click the triangle menu icon that appears in the title area of a pane.

-

Select Insert Application Help from the context-sensitive menu.

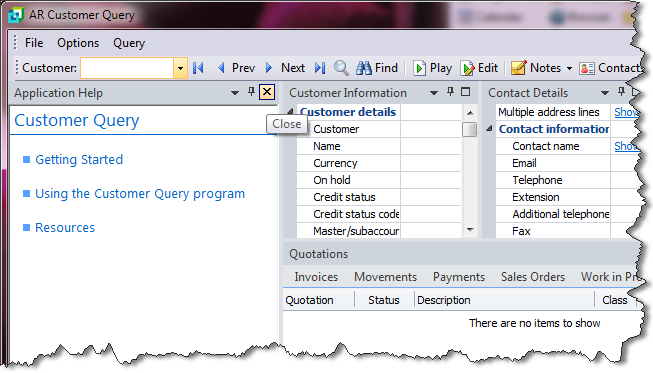

The application help appears in a pane within your program. You can reposition the pane using the docking stickers or pin it to the program window.

Removing the Application Help pane

If you no longer want to display application help in a pane for your current program, you can simply remove it.

-

Select the Close icon in the right-hand corner of the application help pane.

-

Confirm that you want to delete the pane.

![[Note]](images/note.png)