You use this program to maintain the integrity of the data held in your Inventory module, to close the current month and open up a new month for processing your inventory transactions and to delete inventory information that is no longer required from the system.

This is achieved through the following functions:

- Balance

- Month end

- Year end

- Purge

- Reset in-process journal & GIT flags

- Balance lots (report only)

- Inventory Period End

- Information

- Report

- Warehouse Balance Report

- Inventory Balance Report

- GIT Balance Report

- Period End Reporting

- Balance

- Month End

- Year End

- Purge

- Notes and warnings

| Field | Description |

|---|---|

| Start Processing | Select this to begin processing the function you selected. |

| Select this to print the information currently displayed in the Report, Warehouse Balance Report, Inventory Balance Report and the GIT Balance Report output panes. | |

| Save Form Values | This option is only enabled in Design mode (see Automation Design). Your selections are saved and applied when the program is run in automated mode. |

| Field | Description | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Control details | |||||||||||||||||

| Current month number | This indicates the current month number of your Inventory module. | ||||||||||||||||

| Period end date | This indicates the period end date for the current month as defined on the Periods tab of the Inventory Setup program. | ||||||||||||||||

| Last period end date | This indicates the date on which the previous period end was processed. | ||||||||||||||||

| Processing options | |||||||||||||||||

| Function | This enables you to indicate the processing function you want to perform. | ||||||||||||||||

| Balance |

Select this to maintain the integrity of data held in your Inventory module. You use the Balance function to perform the following tasks:

|

||||||||||||||||

| Month end only | Select this to close the current month and open up a

new month for processing your inventory transactions.

|

||||||||||||||||

| Month end and purge | Select this to close the current month and open up a new month for processing your inventory transactions and delete inventory information that is no longer required from the system. | ||||||||||||||||

| Year end only |

Select this to perform the final month end of the year and start a new financial year in the Inventory module.

|

||||||||||||||||

| Year end and purge | Select this to perform the final month end of the year, start a new financial year in the Inventory module and delete inventory information that is no longer required from the system. | ||||||||||||||||

| Purge | Select this to delete inventory information that is no

longer required from the system.

|

||||||||||||||||

| Reset |

Select this to reset journal, GIT in transit and stock take confirmation flags. Refer to the Reset options section for details. |

||||||||||||||||

| Balance lots (report only) |

Select this to review lot quantity adjustments recommended by the system, before allowing the system to update your live system. Typically, when you run the Balance function and discrepancies are detected between quantities across lots, warehouses, multiple bins or FIFO buckets, the lot quantities are assumed to be correct and the other records are adjusted accordingly. This function, however, enables you to view a report of the proposed changes before actually implementing them. |

||||||||||||||||

| Reset options | These options are only enabled when you select to process a Balance or a Reset function. | ||||||||||||||||

| Reset lowest unprocessed journal |

Select this to locate the earliest Inventory and GRN journals that have not been posted. The Inventory GL Integration program creates and/or posts General Ledger journals from Inventory transaction journals according to your General Ledger Integration settings. The Inventory GL Integration program uses the lowest unprocessed Inventory journal number as a starting point to create/post these General Ledger journals. Similarly, the GRN GL Integration program creates and/or posts General Ledger journals from GRN transaction journals according to your General Ledger Integration settings. The GRN GL Integration program uses the lowest unprocessed GRN journal number as a starting point to create/post these General Ledger journals. Selecting this option therefore ensures that no Inventory and/or GRN journals are skipped when the General Ledger journals are created/posted for Inventory and GRNs. This option is only available when you select to process a Balance function.

|

||||||||||||||||

| Reset in-process journal |

Select this to restore in-process journals to a status that enables you to print them. You typically use this function if a power failure occurred during the processing of your inventory journals. This would cause the journals to be placed in an in-process status(*) and prevent you from printing them. The Reset in-process journals function effectively resets these in-process journals to a status of 0, allowing you to print them. This is automatically done as part of the Balance function and is therefore not available when you select to process a Balance function. |

||||||||||||||||

| Reset GIT details |

Select this to reset Goods in Transit flags. If the GIT Structure Change flag is set to 'P' (in process), then it is reset to 'Y' (structure validation required). If your inventory is shared (Company Maintenance - Options tab), then this flag is only checked when the Inventory Period End program is run from the company that owns the inventory table/files. This is automatically done as part of the Balance function and is therefore not available when you select to process a Balance function. |

||||||||||||||||

| Reset stock take confirmation | Select this to reset the stock take confirmation in

process flag on the warehouse control table/file. The stock take confirmation in process flag is set when the Stock Take Confirmation program is used to confirm a stock take for a warehouse. This prevents multiple operators simultaneously confirming a stock take for the same warehouse. If the Stock Take Confirmation program is not successfully completed, it is possible that this flag is not reset. This prevents various other stock take functions from being performed for the warehouse. This is automatically done as part of the Balance function and is therefore not available when you select to process a Balance function. |

||||||||||||||||

| Warehouses | |||||||||||||||||

| Warehouse selection |

|

||||||||||||||||

| Period end options | |||||||||||||||||

| FIFO valuation | Select this to value your inventory according to FIFO bins instead of the current unit cost. You can only select this option if you indicated that FIFO valuation is required (Inventory Setup or Browse on Warehouses). | ||||||||||||||||

| Recalc. current cost from FIFO buckets |

Select this to recalculate FIFO costs. The cost is recalculated by taking the total value of stock at FIFO value and dividing this by the total quantity. The result is used to update the Unit cost field on the stock warehouse record. This does not affect the General Ledger. Select this option only if you indicated that FIFO costing is required in at least one warehouse (Inventory Setup or Browse on Warehouses) and the option: Recalculate current cost from FIFO buckets (Inventory Setup) is selected. If you only selected the option: FIFO valuation (Inventory Setup), but no warehouse is set to use FIFO costing, then selecting this option does nothing.

This option only affects the value of the current cost field on the inventory warehouse record (UnitCost on InvWarehouse) for a warehouse with FIFO costing. The unit cost field on the warehouse where FIFO costing is in use is the average cost (i.e. it is calculated for a FIFO warehouse as if the warehouse was using average costing). It is recalculated each time a receipt is processed for an item, but not when the item is issued. The value of the inventory is based on the FIFO buckets, not the current unit cost held in the warehouse. If you want to get an indication of the value of the warehouse from the unit cost, then you need to select this option. This option allows you to recalculate the unit cost field on the warehouse based on the actual buckets you have in your FIFO warehouse. For example: Unit cost is calculated using the average costing method. Say you have the following quantities on hand at the unit costs shown: 1 at 10 = 10 2 at 15 = 30 3 at 16 = 48 Total FIFO cost is 88 and quantity 6. Therefore the average cost is 14.66667. You sell 2, so you now have: 1 at 15 = 15 3 at 16 = 48 Average cost is not recalculated on a sale or issue, so you now have a total cost of 63 for 4 items, with an average of 15.75. Therefore, your average cost in the warehouse does not reflect the average of the actual FIFO buckets you have. To adjust this, you select this option to recalculate your warehouse cost based on buckets. You cannot select this option if you are denied access to the activity: Inventory recalc current cost (FIFO) (Operator Maintenance). |

||||||||||||||||

| Recalc. actual cost from FIFO buckets |

Select this to recalculate the warehouse cost for each actual costing item by adding up all FIFO costs and dividing by the quantity on hand in the warehouse. The result is used to update the Unit cost field on the stock warehouse record. This does not affect the General Ledger. This option only applies if you are using Actual costing (Inventory Setup - General tab) and works in a similar fashion to the Recalc. current cost from FIFO buckets option. It therefore only affects the value of the current cost field on the inventory warehouse record (UnitCost on InvWarehouse) for a stock item which uses Actual costing. |

||||||||||||||||

| Recalc. actual cost original receipt qty | Select this to recalculate and adjust the actual cost bucket original receipt quantities for all Adjustment transactions previously processed in the Inventory Movements program. This option only applies when using Actual costing (Inventory Setup - General tab) and running the Balance function. |

||||||||||||||||

| Remove bins with zero quantity |

Select this to delete bins containing a zero quantity. A bin is only removed if the bin quantity was zero for the past three months. The warehouse default bins created by the system are never removed. You can only access this field if the option: Multiple bins in use is selected against the warehouse(s) selected (Browse on Warehouses). This option is never enabled when you select the Balance function. |

||||||||||||||||

| Delete temporary stock codes |

Select this to delete temporary stock codes that meet all criteria for deletion (see Purge). This option is only enabled when you select the Purge function. |

||||||||||||||||

| Balance goods in transit |

This option is available only if the full goods in transit system is installed (Inventory Setup and you are running a Balance function. This enables you to indicate whether to include the goods in transit details in the balancing routine. Selecting this resets GIT transactions which are flagged as being In process and ensures they are displayed in the Inventory Movements program. This is useful if an operator experienced a system problem whilst processing a GIT and the GIT is still flagged as being 'In process.' This option is selected automatically when running the month end or year end functions, but is deselected automatically if you also select the Ignore balance function option. |

||||||||||||||||

| Ignore balance function |

Select this to bypass the balance function that is normally run when performing a month end or year end. When you select this option, the Balance goods in transit option is deselected automatically.

|

||||||||||||||||

| Exclude warehouse totals from report |

This only applies if you selected the option: Ignore balance function. Select this to not calculate the inventory value and hash quantity for each warehouse you selected to process. Selecting this option reduces the time to process the month or year end, but the warehouse totals are not printed on the report. |

||||||||||||||||

| Warning messages | |||||||||||||||||

| Suppress warning messages | Select this to ignore error and warning messages when running the program in automation mode. Otherwise, messages will interrupt the program. | ||||||||||||||||

| After processing completed | These options are displayed within programs that can be automated. They enable you to indicate the action you want to perform once processing is complete (see Automation Design). | ||||||||||||||||

| Purge details | These fields are displayed for information purposes

when you process a Purge only,

Month end and purge or Year end

and purge function. Refer to Purge for additional information. |

||||||||||||||||

The results of the processing function you selected are displayed in this pane once processing is complete (unless you enabled the option to close the application from the After processing completed section). You use this section to print or email this information.

The results of the processing function you selected are displayed in this pane once processing is complete (unless you enabled the option to close the application from the After processing completed section). You use this section to print or email this information.

The Warehouse Balance Report is a summary of the total on-hand inventory values and hash quantities by warehouse.

The results of the Balance lots (report only) function are also displayed in this pane.

The error message 'Some stock codes were processed where the corresponding warehouse control did not exist' occurs when there is a record on the InvWarehouse file/table that does not have a corresponding record on the InvWhControl file/table. These warehouses will not have a description against them on the report produced by the Inventory Period End program. To rectify this, you will need to identify the stock items that belong to that warehouse and change the warehouse code. It is unlikely that this will be problematic, as the on hand quantity for items in that warehouse should be zero. The situation generally only arises when data has been converted from older versions of Encore / Award where all the records were not necessarily removed when a warehouse was deleted.

The results of the processing function you selected are displayed in this pane once processing is complete (unless you enabled the option to close the application from the After processing completed section). You use this section to print or email this information.

Errors encountered during the Balance function are displayed in this pane.

The results of the processing function you selected are displayed in this pane once processing is complete (unless you enabled the option to close the application from the After processing completed section). You use this section to print or email this information.

If you selected the Balance goods in transit option, then GIT errors encountered during the Balance function are displayed in this pane.

If you selected the setup option: Use full Goods in Transit transfers facility (Inventory Setup - General tab), then when you run the Balance function, the report produced may contain lines with a GIT reference number and the comment "Master updated." This occurs if the balance of the Master record for the GIT reference does not equal the total values of the Detail records for that GIT reference. The Master record balance is then updated.

You perform your Month end and Year end reporting after you have completed posting transactions for the previous month.

Under normal circumstances you will have already started processing information for the current month before you print your month end reports.

Transactions posted to the current month do not affect reports for previous months. To prevent transactions from being posted to previous months while printing your month end reports, you can set the previous month's status to closed (Inventory Setup) This does not stop you from reporting on the previous month. You can re-open and close previous months as often as required.

The system performs the following routine for a Balance:

-

If you selected the Aged inventory valuation option (Inventory Setup) then the total quantity of the aged valuation buckets is compared to the total on hand quantity for each warehouse. If these figures do not balance, the aged valuation buckets are adjusted to match the on hand quantity, commencing from the current year.

-

The on hand quantity and value for each warehouse is added to the totals printed at the end of the report.

-

If FIFO costing is installed:

- Any bucket with a zero on hand quantity in the current and previous two periods is deleted when the No of days to retain buckets with zero quantity is exceeded (Inventory Setup - History tab).

- Any bucket with a negative on hand quantity is set to zero.

- If you selected the FIFO valuation option, then the warehouse totals are updated by the value and quantity of the FIFO buckets, and not those of the warehouse.

- The FIFO buckets are renumbered

- If no FIFO buckets are held on file, a FIFO bucket is created with a bucket number of zero; the current on hand quantity and cost from the warehouse; and the current system date as the last receipt date.

- If the total on hand quantity of the FIFO buckets for a warehouse does not agree with the on hand quantity stored against the warehouse, an error line is printed showing the warehouse on hand quantity; the total FIFO buckets on hand quantity; and the difference between the two. The warehouse on hand quantity is updated to match the total of the FIFO buckets.

- If you selected to recalculate the current cost from FIFO buckets, then the total value and quantity of the FIFO buckets are accumulated and used to calculate a new unit cost for each inventory item.

-

If LIFO costing is installed:

- Any bucket with a zero on hand quantity is deleted.

- Any bucket with a negative on hand quantity, is set to zero.

- The warehouse totals are updated from the value and quantity of the LIFO buckets, and not those of the warehouse.

- The LIFO buckets are renumbered.

- If no LIFO buckets are held on file, a LIFO bucket is created with a bucket number of zero; the current on hand quantity and cost from the warehouse; and the current system date as the last receipt date.

- If the total on hand quantity of the LIFO buckets for a warehouse does not match the on hand quantity stored against the warehouse, an error line is printed showing the warehouse on hand quantity; the total LIFO buckets on hand quantity; and the difference between the two. The warehouse on hand quantity is updated to match the total of the LIFO buckets.

-

If Multiple bins is installed:

-

If no bins exist for a stock code, a default bin is created. The entire quantity on hand for the stock code/warehouse is allocated to the default bin and the current system date is set to the last receipt date.

If multiple bins are installed in the warehouse and a bin location is defined against the stock code's warehouse, then this bin location is used to generate the default bin. Otherwise, the warehouse code becomes the bin location.

-

If the total on hand quantity of the bins for a warehouse does not match the on hand quantity stored against the warehouse, then the bins are adjusted to equal the on hand quantity stored against the warehouse.

If multiple bins are installed in the warehouse, then an 'adjust' bin is created for the adjustment quantity. Otherwise, the adjustment is processed against the default bin.

Refer to Multiple bins for additional information.

-

-

If Multiple bins and Lot Traceability is installed:

-

If no bins exist for a stock code then a default bin is created. The entire quantity on hand for the stock code/warehouse is allocated to the default bin and the current system date is set to the last receipt date.

If a bin location is defined against the stock code's warehouse, then this bin location is used to generate the default bin. Otherwise, the warehouse code becomes the bin location.

-

If the total on hand quantity of lots for a warehouse matches the on hand quantity of the bins, but does not match the total on hand quantity stored against the warehouse, then the total on hand quantity for the warehouse is updated and an adjustment entry is posted to the journal file and movement file.

- If the total on hand quantity of lots for a warehouse does not match the total on hand quantity of either the bins or the total on hand quantity stored against the warehouse, then the quantity stored against the bins is set to zero and replaced by the lot quantity. The total on hand quantity for the warehouse is updated and an adjustment entry is posted to the journal file and movement file.

- You can run the Balance lots (report only) function to review lot quantity adjustments recommended by the system before updating your live system.

-

-

If Serial Number Tracking is installed

- If the Sales Order module is not installed then the quantity allocated field (held against each warehouse) is set to zero and recalculated from any serial numbers in stock that are on loan, in for a service, or at the service depot.

-

If Engineering Change Control (ECC) is used

-

An ECC item is treated in exactly the same manner as a lot traceable item, regardless of whether Lot Traceability (Lot Traceability Setup) is installed.

The LotDetail record is the only place that the stock level of a specific ECC revision/release is held. Therefore the report indicates an 'Out of balance lot adjustment', the adjustment is made from the LotDetail record when updating the warehouse(s) to the total of the individual revisions/releases.

-

-

Actual costing

If Actual costing for Lot traceable items is selected (Inventory Setup - General tab), then the balancing of lots is done by balancing to multiple bins if they exist. Bins are updated to match the lot total. Each lot is balanced to its FIFO buckets and if there is a variance, the FIFO buckets are updated and a FIFO journal is created. Adjustments are processed to the first or last FIFO bucket according to the FIFO/LIFO options selected (Inventory Setup - Options tab).

For each stock code, the lot total is checked against the warehouse total and the warehouse total is adjusted to match the lot total if a variance exists. If there are FIFO adjustments, then a normal journal is created indicating the total value of the FIFO adjustments and the quantity of the warehouse adjustment.

-

Goods in Transit detail lines are set to 'complete' if the full quantity transferred has been received and the GIT line was not set to 'complete' at the time of receipt.

-

The 'In process' flag against GITs are cleared if the option: Balance goods in transit is selected.

-

If you have NOT selected the setup option: Retain last 12 months' opening stock balances (Inventory Setup - History tab), then any opening balances and costs retained for the last months are deleted.

The system performs the following routine for a Month end:

-

For each warehouse, the number of months' usage is increased by 1 (the year-to-date usage is used to establish an items' ABC category). If the year-to-date usage value against each warehouse now represents 13 months, then the value is annualized to represent 12 months' usage. If the quantity sold or issued for the last 12 months does not exceed zero, then the usage value is set to zero.

-

The warehouse total quantities and values are updated as outlined in the balance function.

-

The monthly sales history buckets are rolled one month. The total month-to-date sales and/or issues are moved to the first history bucket, depending on your selection at the Sales history qty's to include field (Inventory Setup).

-

All month-to-date fields for each warehouse are set to zero.

-

The opening balance quantity for each warehouse is set to the current on hand quantity.

-

If you enabled the option: Retain last 12 months opening stock balances (Inventory Setup), then the monthly quantity and cost buckets are rolled 1 month. The first quantity bucket is set to the current on hand quantity for the warehouse, and the first cost bucket is set to the current cost for the warehouse. If you are using FIFO or LIFO costing, the first cost bucket is calculated as the total value in the buckets divided by the on hand quantity for the warehouse.

-

If you are using multiple bins and you select the Remove bins with zero quantity option, then bins with a zero on hand quantity and zero sales order quantity to ship are deleted. The default bin created by the system is never removed.

-

If you selected to process a specific warehouse, then the current financial month for the selected warehouse is incremented by one. You will be unable to select a specific warehouse if you have disallowed the selection of a single warehouse for processing during a period end (Inventory Setup).

-

If you selected to process all warehouses, then the inventory control record is updated as follows:

- If you enabled the option: Close previous month automatically (Company Maintenance) then the current month is set to a status of closed. Otherwise the second previous month is set to a status of closed.

- The current system date is moved to the month end date for the current financial month.

- The current financial month number is incremented by one.

- The current financial month is set to a status of open.

- The current financial month and year for all warehouses are set to the current financial month and year on the inventory control record.

The system performs the following routine for a Year end:

-

All the steps outlined in the Month end function are processed.

-

If you selected the Aged inventory valuation option (Inventory Setup) then the aged valuation buckets are rolled.

-

The year-to-date sales value is moved to the previous year-to-date sales value.

-

The total year-to-date quantity sold and/or issued are moved to the previous year-to-date quantity sold, depending on your selection at the Sales history qty's to include field (Inventory Setup).

-

All year-to-date fields for each warehouse are set to zero.

-

The inventory control record is updated as follows:

- The current financial month number is reset to 1.

- The current financial year is incremented by 1.

- The current year's next journal number; month end dates; and open/closed flags are moved to the previous year.

- The next journal number for the current year is set to 1.

- The current year's month end dates are all set to zero.

- The first month of the year (which is now the current month) is set to a status of open.

- The last three year end dates are rolled.

- The current system date is moved to the first year end date.

- If multiple companies are sharing the same inventory files (Company Maintenance) all journal numbers for the shared companies are reset as part of the year end function in the company that is being shared.

A purge can be run together with either a month end or year end, or as a separate process.

The system performs the following routine when doing a Purge:

-

If Inventory is linked to General Ledger in summary or detail (General Ledger Integration), then inventory and GRN distribution entries are deleted if:

- the General Ledger journals for the transactions have been created (Inventory GL Integration)

- they have been posted to the General Ledger (GL Journal Entry)

- the ledger year and period against the distribution entry is earlier than the calculated cut-off month and year, which is based on your entry at the Number of months to retain - Inventory journals field (Inventory Setup - History tab).

If Inventory is not linked to the General Ledger, then all inventory and GRN distribution entries that have been printed are deleted.

-

If the Full goods in transit facility is in use (Inventory Setup - General tab), then completed goods in transit detail lines are deleted if the period and year in which the transfer was completed is earlier than the calculated cut-off month and year, which is based on your entry at the Number of G/L periods to retain - Goods in transit entries (Inventory Setup - History tab).

-

If the Inventory Period End option: Delete temporary stock codes is selected, then temporary stock codes are deleted when all of the following conditions are met:

- the stock code is not on full or partial hold (Stock Code Maintenance)

- the stock code is on full or partial hold, but the option: Define Delete Options - On partial or full hold (Inventory Setup - Options tab) is selected

- no Blanket purchase order contracts exist for the stock code

- the stock code is defined as a kit type S or K item and no sales orders exist against it

- no Bill of Landed Costs exists for the stock code

- Bill of Landed Costs exist for the stock code, but the option: Define Delete Options - Part of a bill of Landed cost tracking (Inventory Setup - Options tab) is selected

- no components exist against the stock code

- no operations exist against the stock code

- the stock code is not in use in a Bill of Materials

- no build schedules exist for the stock code

- no forecasts exist for the stock code

- the stock code is a co-product, but is not used in a Bill of Materials or a job

- the stock code is a notional part, but no co-products are attached to it

- no customer/stock code cross-references exist against the stock code

- customer/stock code cross-references exist against the stock code, but the option: Define Delete Options - Customer/stock code cross reference (Inventory Setup - Options tab) is selected

- no supplier/stock code cross-references exist against the stock code

- supplier/stock code cross-references exist against the stock code, but the option: Define Delete Options - Supplier/stock code cross reference (Inventory Setup - Options tab) is selected

- no movement has occurred during the current period, previous period 1 or previous period 2 in a warehouse in which the stock code is stocked

- the stock code has not been used in a configuration

- the stock has been used in a configuration, but the option: Define Delete Options - Used in a configuration (Inventory Setup - Options tab) is selected

- the stock is not used in a sales order or purchase order

- the stock is used in a sales order or purchase order, but the option: Define Delete Options - Temporary stock code has sales order details and/or purchase order details (Inventory Setup - Options tab) is selected, provided there is no outstanding quantity against the order.

-

the following quantities are zero against all warehouses in which the item is stocked:

- On order quantity

- On hand quantity

- Quantity allocated to sales orders

- Backorder quantity

- Quantity allocated to Work in Progress

- Quantity in transit

- Quantity in inspection

- Quantity dispatched but not invoiced

- the opening balance in Previous period 1 and Previous period 2 is zero against all warehouses in which the item is stocked

- no stock take is in progress against a warehouse in which the item is stocked

-

Inventory movements are deleted according to the number of records you are retaining (or the age of records) for each stock code/warehouse combination.

If you select to retain records by date (Inventory Setup - History tab), then the number of days between the current company date and the transaction date against each movement is compared to the maximum number of days you are retaining records. If a movement record is older than the maximum number of days, it is removed.

If you select to retain records by number (Inventory Setup - History tab), then the number of movement records is counted for each stock code/warehouse combination. If the number of records exceeds the maximum number of records you are retaining, then the excess records (starting from the oldest) are deleted.

-

Inventory inspection records are deleted when all of the following conditions are met:

- the record is not for a traceable stock code.

- there is zero quantity off-site.

- the quantity counted is complete.

- the quantity counted is equal to the total of the quantity accepted and scrapped.

-

Inventory journals that meet all of the following conditions are deleted:

- the General Ledger journals for the transactions have been created (Inventory GL Integration)

- The journal was posted in a financial month and year prior to the cut-off month and year (GL Journal Entry).

- If the Interface module is installed and you selected the Exports required option (Interface System Setup), then the journal must either have been exported, or the age of the journal (compared to the current company date) must exceed the number of days that you are retaining records before automatic deletion (Interface System Setup)

-

Printed inventory documents are deleted if the transaction posting year and month is earlier than the calculated cut-off month and year (see Inventory Setup - History tab).

-

Price history is deleted if the date of the price change is earlier than the calculated cut-off date. The cut-off date is calculated as the current company date less the number of days or months to Retain history of price changes (Inventory Setup - History tab).

-

A report containing a summary of the following for each file processed:

- the number of ledger distribution entries deleted

- the number of movements deleted

- the number of inspection items deleted

- the number of inventory document transaction items deleted

- the number of inventory journals deleted

- the number of goods in transit entries deleted

- the number of inventory price history items deleted

- the number of temporary stock codes deleted

-

It is strongly recommended that you take a backup of your data before processing a Month end, a Year end or a Purge.

-

Only the Processing options to which you are granted access are available. You cannot run this program if you are denied access to all the Processing options.

-

If the Work in Progress module is installed, then you cannot process the following transactions if the Inventory and Work in Progress modules are not in the same month and year:

- Job Receipts (Job Receipts)

- Backflushing in Inventory movements (Inventory Movements)

- Job/Kit Issues (Job Issues)

- WIP issue floor stock allocations (WIP Issue Floor Stock Allocations)

- WIP Inspection - Accept into stock (WIP Inspection Maintenance)

- WIP Inspection - Scrap (WIP Inspection Maintenance)

- WIP Inspection - Rework (WIP Inspection Maintenance)

-

You cannot process invoices for customers using the following programs if the Inventory module is in an earlier period than the Accounts Receivable module, or the current period of the Inventory and Accounts Receivable modules differ by more than one month:

Electronic Signatures provide security access, transaction logging and event triggering. This enables you to increase control over your system changes.

Access to the following eSignature transactions within this program can be restricted at Operator, Group, Role or Company level. You configure this using the Electronic Signatures program.

| eSignature Transaction | Description |

|---|---|

| Inv Period End |

Controls access to the Month end only and Year end only processing functions of the Inventory Period End program. |

| Inv Period End and Purge |

Controls access to the Month end and purge and Year end and purge processing functions of the Inventory Period End program. |

| Inv Purge |

Controls access to the Purge only processing function of the Inventory Period End program. |

| Inv Balance |

Controls access to the Balance processing function of the Inventory Period End program. |

| Inv Reset |

Controls access to the Reset processing function of the Inventory Period End program. |

| Inv Balance Lots |

Controls access to the Balance lots (report only) processing function of the Inventory Period End program. |

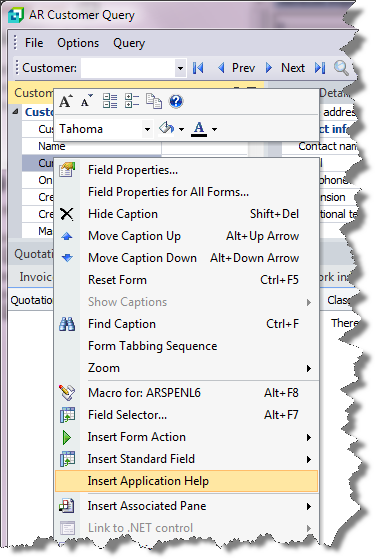

Inserting Application Help

You would typically follow this procedure to display help for the current program in a customized pane that can be pinned to the program window.

Information includes step-by-step instructions for the various functions available within the program, including a brief overview of what the program does, what setup options are required and how to personalize the program.

-

Open the program for which you want to insert application help into a customized pane.

This functionality is only available for a program that has panes.

-

Right-click any form field.

You can also click the triangle menu icon that appears in the title area of a pane.

-

Select Insert Application Help from the context-sensitive menu.

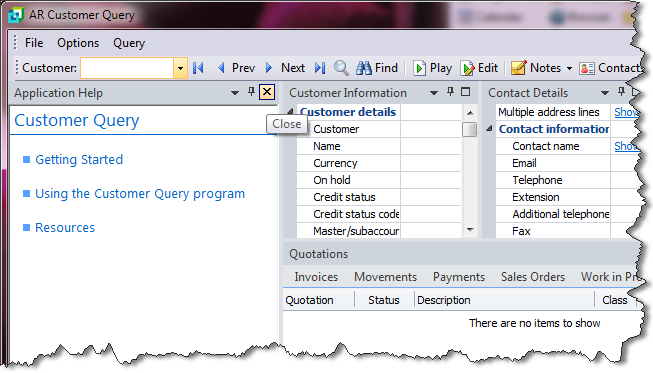

The application help appears in a pane within your program. You can reposition the pane using the docking stickers or pin it to the program window.

Removing the Application Help pane

If you no longer want to display application help in a pane for your current program, you can simply remove it.

-

Select the Close icon in the right-hand corner of the application help pane.

-

Confirm that you want to delete the pane.

![[Note]](images/note.png)

![[Warning]](images/warning.png)