You use this program to review, or adjust accrual promotion transactions and to issue Accounts Payable checks or Accounts Receivable credit notes for the values accrued to customers.

You can optionally include off invoice and free goods promotions in the review as well as zero balance accrual promotion transactions.

- Toolbar and menu

- Promotion Review Criteria

- Promotion Review

- Review Totals

- Adjust Accruals

- AP Invoice

- AR Credit

- Sales Order Credit Note

- Notes and warnings

| Field | Description |

|---|---|

| Start Review | Displays the promotions according to the Promotion Review Criteria selected. |

| Change Criteria | Enables you to change the Promotion Review Criteria. |

These criteria enable you to indicate the promotion transactions you want to view and optionally maintain.

| Field | Description | ||||

|---|---|---|---|---|---|

| Customers | |||||

| Customer selection | Indicate the customer(s) for whom you want to view promotion transactions. | ||||

| Salesperson | This displays the salesperson code defined against the customer (AR Customer Maintenance) entered in the Customer field. | ||||

| Area | This displays the geographic area code defined against the customer (AR Customer Maintenance) entered in the Customer field. | ||||

| Deductions | |||||

| Deduction selection | Indicate the deduction code(s) of the promotion you want to review. | ||||

| Accrual types | |||||

| Accrual type selection | Indicate the accrual type code(s) of the promotion you want to review. | ||||

| Promotions | |||||

| Promotion selection | Indicate the promotion code(s) for which you want to review transactions. | ||||

| Invoices | |||||

| Invoice selection | Indicate the invoice number(s) for which you want to

review transactions. You must enter a customer code in the Customer field before you can search for an invoice. |

||||

| Dates | |||||

| Date selection | Indicate the date(s) for which you want to review promotions. | ||||

| Include/exclude options | |||||

| Include off invoice and free goods | Enable this to include off invoice and free goods

promotions in the review. You can view transactions for these types of promotions, but only Accrual type promotions can be selected and adjusted. |

||||

| Include zero balance accruals | Enable this to include zero balance accrual promotions

in the review. Only accrued promotions with a balance are displayed when this option is not enabled. |

||||

| Set all accruals as selected | Enable this to initially set all rows in the

Promotion Review listview to

Selected for posting once the basic

criteria are applied.

|

||||

| Print requirements | |||||

| Print credit invoices | Select this use the Document Printprogram to

batch print the credit invoices generated from the

Post Detail Credit function. The invoices

can also be manually printed and reprinted using the Sales

Order Document Print process. This option is disabled when On-line printing is disabled for Invoices (Sales Order Setup) or if you are not allowed to print credit notes (Operator Maintenance). |

||||

| Format | Indicate the document format to use to print the invoices (S/O Document Formats). | ||||

| Format name | This displays the description of the selected Format. | ||||

The promotions are displayed in this listview when you select the Start Review function, according to the Promotions Review Criteria indicated.

To display details of transactions applicable to the promotion line, right click on the listview line and select the Transactions option (see Promotion Detail Transaction).

When the Credit accruals from invoices option is enabled (Trade Promotion Setup), credit notes created from invoices against which Trade Promotions accruals apply, reduce the value of the accrual promotion for the original invoice based on the quantity credited.

| Field | Description |

|---|---|

| Select | This option is only enabled when reviewing promotions

for a Single customer or if you highlight

a line in the listview and select the

Show - Single Line

option. You can use the checkbox in the Selected column to manually select and deselect individual lines. |

| Include All | Select this to set all rows in the listview to selected for posting once the basic criteria are applied. A tick is placed in the Selected checkbox for all lines in the listview. |

| Include Highlighted Lines | Select this to set all currently highlighted rows in the listview to selected for posting once the basic criteria are applied. A tick is placed in the Selected checkbox for these lines in the listview. |

| Exclude All | Select this to deselect all rows from being posted. The tick is removed from the Selected checkbox for all lines in the listview. |

| Exclude Highlighted Lines | Select this to deselect all currently highlighted rows in the listview from posting once the basic criteria are applied. The tick is removed from the Selected checkbox for these lines in the listview. |

| Show | |

| Single Line | Select this to display only the currently highlighted line in the listview. This enables you to maintain the line when viewing promotions for all customers. |

| All lines | Select this to display all lines in the listview according to the Promotion Review Criteria indicated. This disables maintenance of lines when viewing promotions for all customers. |

| Adjust | Select this to adjust the accrued balance for the transactions currently highlighted in the listview (see Adjust Accruals). You must enter a customer code in the Customer field or select the Show - Single line option before you can adjust promotion transactions. |

| Post AP Invoice | Select this to post an Accounts Payable invoice for an

accrued promotion value and subsequently issue the customer

with a check for the value of the invoice (see AP Invoice). You must enter a customer code in the Customer field or select the Show - Single line option before you can adjust promotion transactions. A customer/supplier link which is defined as having a TPM relationship must exist (AR Customer to Supplier Link). |

| Post AR Credit | Select this to process a credit note for all or part of

the accrued promotion balance (see AR Credit). You must enter a customer code in the Customer field or select the Show - Single line option before you can process a credit for promotion transactions. |

| Post Detail Credit | Select this to create a Sales order Credit note

containing a miscellaneous line for each accrual promotion

Selected for processing and to produce a

credit invoice from the credit note (see Sales Order Credit Note). You must enter a customer code in the Customer field or select the Show - Single line option before you can adjust promotion transactions. This option only applies in a SQL environment. |

| Date | This indicates the invoice date. |

| Original accrual amount | This indicates the original amount accrued. |

| Current accrual amount | This indicates the current amount accrued. |

| Outstanding invoice | This indicates the current balance against the invoice. |

| Selected | A tick indicates that the line is included for posting.

All lines are included by default if you selected the

Set all accruals as selected criteria.

This only applies to Accrual promotion

lines. This checkbox is only enabled when reviewing promotions for a Single customer or if you highlight a line in the listview and select the Show - Single Line option. Once the item has been processed, or you cancel out of the required action, the listview displays the information according to your original selection. |

| Totals | Totals are displayed at the bottom of the listview. The Balance column total indicates the total of the items Selected when viewing promotions for a single customer or when a single line is displayed. |

These totals relate to the lines displayed in the Promotion Review listview.

| Field | Description |

|---|---|

| Line count | This indicates the total number of lines in the listview. |

| Original accrual amount | This indicates the total original amounts accrued for the lines in the listview. |

| Current accrual amount | This indicates the total current amounts accrued for the lines in the listview. |

| Selected accrual amount | This indicates the total amount of the Selected lines in the listview. |

This is displayed when you select the Adjust function from the Promotion Review screen.

The options enable you to adjust the accrual balance for the selected customer.

Posting an adjustment has no effect on the Sales Analysis files/tables.

![[Note]](images/note.png)

|

|

|

The transaction journal is automatically created when you post an adjustment. The corresponding General Ledger journal is created and posted according to your selections for Accounts Receivable on the General Ledger tab of the General Ledger Integration program. Refer to Effect of automation level selected. Refer to Trade Promotions Integration for additional information on the journals created. |

|

| Field | Description |

|---|---|

| Post | Select this to apply the adjustment to the customer's

accrued balance. A positive adjustment generates an adjustment transaction and increases the customer's accrued balance and original balance. A negative adjustment reduces the accrued balance of orders in the listview on a first in first out basis (i.e. beginning with the first order that has an accrual balance). When posting negative adjustments, the Promotions Review listview is automatically refreshed. When an order is reduced to zero it is no longer displayed in the listview. You need to select the option: Include zero balance accruals to redisplay these orders if required. |

| Change Period | Select this to use the Change Posting Period program to change the ledger period to which the adjustment must be posted. |

| Accrual balance | This indicates the current value of all accrual promotions displayed in the review. |

| Adjustment amount | Enter the amount by which you want to adjust the

accrual balance. Enter a positive amount to increase the accrual balance and a negative amount to reduce the accrual balance. A negative amount entered cannot exceed the current accrual balance amount. When adjusting down, the amount is applied to the existing selected accruals until depleted. A positive adjustment amount (i.e. an upward adjustment) is treated as a new entry and an invoice is produced with an _TP001, rather than adjusting the balance. This invoice can be matched with a deduction if required. |

| Promotion | Enter the accrual promotion code to adjust for a positive adjustment. This is not required for a negative adjustment. |

| Reference | Enter a reference for the adjustment. This field is mandatory. |

| Accrual GL account | Enter the General Ledger code which must be credited with the adjustment. This defaults to the Accrual promotion account defined against the promotion code (Browse on Promotion Code), but may be changed. This only applies to positive adjustments. |

| Expense GL account | Enter the General Ledger account for the expense. For positive adjustments, this defaults to the promotion expense account defined against the promotion code (Browse on Promotion Code), but may be changed. For positive adjustments, this account is debited. For negative adjustments, this account is credited. |

| Deduction code | This defaults to the deduction code defined against the

promotion code, but can be changed. This is only required for

positive adjustments. The deduction code is used to identify the adjustment entry as available for offsetting when you use the Deduction Review program. |

| Period | This indicates the accounting period and year into which the adjustment will be posted. |

This is displayed when you select the Post AP Invoice function from the Promotion Review screen.

The options enable you to create an invoice for all or part of the total accrued promotion balance and subsequently to process a check for this amount to the customer.

Posting an AP invoice has no effect on the Sales Analysis files/tables.

![[Note]](images/note.png)

|

|

|

|

| Field | Description |

|---|---|

| Post |

Select this to post the invoice to the supplier account. The invoice transaction is automatically attached to the first accrual promotion line in the listview. |

| Accrual balance | This indicates the current accrued balance for the customer. |

| Invoice amount | Enter the amount for which the invoice must be

generated. The invoice amount may not exceed the value displayed in the Accrual balance field. The amount you enter here must be the full amount of the invoice including tax if tax is applicable. |

| Invoice number | Enter an invoice number for the invoice you are generating. |

| Supplier | This indicates the supplier code (which is linked to the customer code) for whom you are processing the invoice. |

| Tax code | Indicates the tax code used to calculate the

Tax amount for the invoice. This can be changed when the activity SO Change Trade Promotions AP tax in promotion review is allowed (Security Activities). |

| Tax amount | This indicates the taxable portion of the

Invoice amount. This is calculated when the customer is defined as taxable (AR Customer Maintenance) and you selected the setup option: Tax included in deductions and accruals (Trade Promotion Setup - Defaults tab). This can be changed when the activity SO Change Trade Promotions AP tax in promotion review is allowed (Security Activities). |

| Calculate | Select this to recalculate the Tax amount when you changed the Tax amount manually and thereafter changed the Tax code. |

| QST code | This indicates the tax code used to calculate the QST amount for the invoice. This can be changed when the activity SO Change Trade Promotions AP tax in promotion review is allowed (Security Activities). This applies when using the Canadian tax system. |

| QST amount | This indicates the QST tax portion of the

Invoice amount. This is calculated when the customer is defined as taxable (AR Customer Maintenance) and you selected the setup option: Tax included in deductions and accruals (Trade Promotion Setup - Defaults tab) This can be changed when the activity SO Change Trade Promotions AP tax in promotion review is allowed (Security Activities). This applies when using the Canadian tax system. |

| Calculate | Select this to recalculate the QST amount when you changed the QST amount and thereafter changed the QST code. |

This is displayed when you select the Post AR Credit function from the Promotion Review screen.

The options enable you to create a credit note for all or part of the total accrued promotion balance of the selected customer.

![[Note]](images/note.png)

|

|

|

|

| Field | Description |

|---|---|

| Post |

Select this to create the credit note and post it to the customer's account. The balance of the first accrual promotion line in the listview is automatically reduced by the value of the credit note. The original balance is not changed. |

| Accrual balance | This indicates the current accrued balance for the customer. |

| Credit amount |

Indicate the amount for which the credit note must be generated. The amount must be the full amount of the credit note including tax where applicable. |

| Product class | Indicate the product class to be used for the transaction. This field is mandatory. |

| Reference | Enter a reference for the credit note. This field is mandatory. |

| Customer branch | This indicates the branch defined against the customer (AR Customer Maintenance). |

| Invoice terms | This defaults to the invoice terms defined against the customer (AR Customer Maintenance). |

| Geographic area | This defaults to the geographic area defined against the customer (AR Customer Maintenance). |

| Salesperson | This defaults to the salesperson defined against the customer (AR Customer Maintenance). |

| Invoice number | |

| Tax code | Indicates the tax code used to calculate the

Tax amount for the credit. This can be set to blank if no tax is applicable. The Tax amount is automatically recalculated when the Tax code is changed providing the Tax amount field was not manually changed. If the Tax amount was manually changed and you subsequently change the Tax code, then you must use the Calculate button to recalculate the Tax amount. This can only be changed when the activity SO Change Trade Promotions AR tax in promotion review is allowed (Security Activities). |

| Tax amount | This indicates the taxable portion of the credit note.

This is calculated if the customer is defined as taxable

(AR Customer Maintenance) and you selected the setup option:

Tax included in deductions and accruals

(Trade Promotion Setup - Defaults tab). This can only be changed when the activity SO Change Trade Promotions AR tax in promotion review is allowed (Security Activities). |

| Calculate | Select this to recalculate the Tax amount when the Tax amount was manually changed and you then changed the Tax code. |

This is displayed when you select the Post Detail Credit function from the Promotion Review screen.

| Field | Description |

|---|---|

| Post | Select this to post the credit note. |

| Change Period | Select this to use the Change Posting Period program to indicate the period to which the credit note must be posted. |

| Accrual balance | This indicates the current accrual balance. |

| Credit amount | Enter the amount to credit. The message Credit amount invalid is displayed when this amount is more than the Accrual balance. |

| Product class | Indicate the product class to use for the credit note. |

| Customer purchase order | Enter the purchase order reference supplied by your customer. |

| Customer branch | Indicate the AR branch to use for the credit note. |

| Invoice terms | This default invoice terms held against the customer but can be changed. |

| Geographic area | This defaults to the geographic area applicable to the customer. |

| Salesperson | Indicate the code associated with the person in your company who was responsible for the sale. This defaults to the salesperson defined against the customer. |

| Sales order number | The order number is allocated according to the sales order numbering method defined on the Numbering tab of the Sales Order Setup program. You can only enter a sales order number when SO numbering is manual. |

| Reason code | Indicate the reason code for the credit note. |

| Credit note date | Indicate the date for the credit note. This defaults to the system date but can be changed. |

| Tax code | Indicate the tax code (and associated percentage) that you want to apply to the credit note. |

| Period | This displays the period to which the credit note will be posted. |

-

Promotion transactions are only displayed after a sales order has been invoiced.

-

If the GL analysis required option is enabled for a ledger account used in this program (General Ledger Codes or GL Structure Definition) then the GL Analysis program is displayed when you post the transaction, so that you can enter the analysis details.

The Ask Me Later function is only available when the option: Force GL Analysis - GL journal posting is enabled for the sub-module (General Ledger Integration - General Ledger tab).

General Ledger analysis entries are always distributed in the local currency, regardless of the currency in which the original transaction is processed.

Operator access to the following activities within this program can be restricted. You configure this using the Operator Maintenance program.

| Activity | Description |

|---|---|

| SO Print credit note | Controls whether an operator can print a Credit Note using the Sales Order Entry or Document Print programs. |

Inserting Application Help

You would typically follow this procedure to display help for the current program in a customized pane that can be pinned to the program window.

Information includes step-by-step instructions for the various functions available within the program, including a brief overview of what the program does, what setup options are required and how to personalize the program.

-

Open the program for which you want to insert application help into a customized pane.

This functionality is only available for a program that has panes.

-

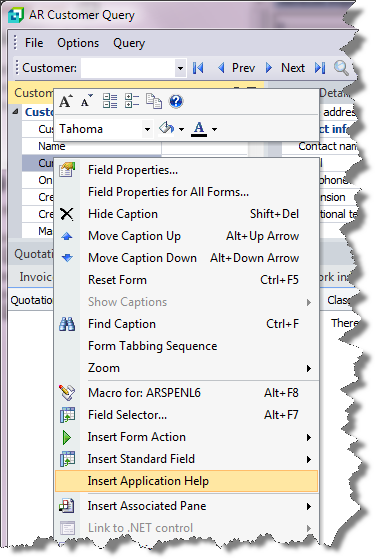

Right-click any form field.

You can also click the triangle menu icon that appears in the title area of a pane.

-

Select Insert Application Help from the context-sensitive menu.

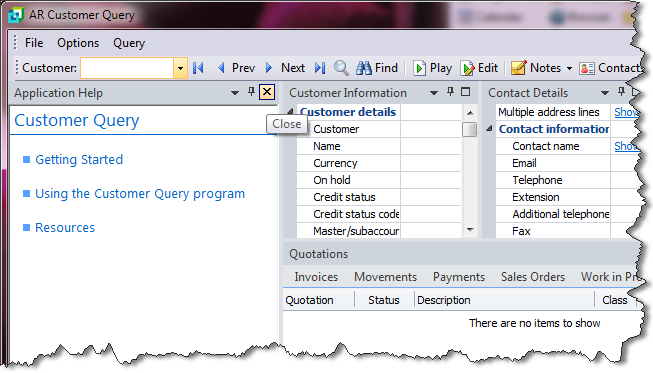

The application help appears in a pane within your program. You can reposition the pane using the docking stickers or pin it to the program window.

Removing the Application Help pane

If you no longer want to display application help in a pane for your current program, you can simply remove it.

-

Select the Close icon in the right-hand corner of the application help pane.

-

Confirm that you want to delete the pane.